Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

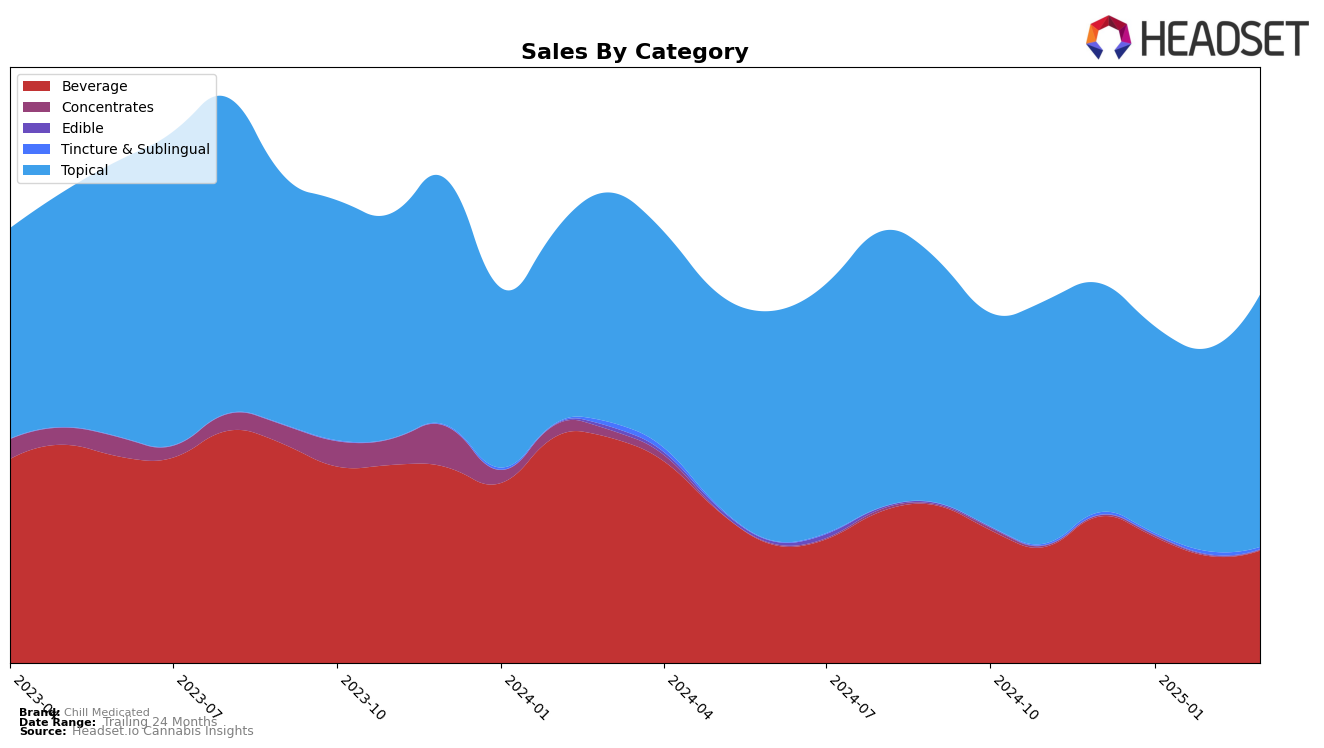

Chill Medicated has shown a varied performance across different states and product categories in early 2025. In Massachusetts, the brand has maintained a strong presence in the Topical category, consistently holding the 2nd position from December 2024 through March 2025. This stability indicates a strong foothold and customer loyalty in this category. However, in the Beverage category, Chill Medicated experienced a slight decline, dropping from 3rd place in December 2024 to 5th place in January and February 2025, before improving to 4th place in March. This fluctuation suggests some competitive pressure or market dynamics affecting their Beverage sales in the state.

In Michigan, Chill Medicated has demonstrated dominance in the Topical category, consistently ranking 1st from December 2024 to March 2025, showcasing their strong market leadership and consumer preference in this segment. The Beverage category in Michigan presents a different story, with the brand moving from 5th place in December to 3rd in January, only to settle back to 4th place by February and March. Despite these shifts, the brand's sales in the Beverage category saw a notable increase in March 2025, indicating potential growth opportunities or successful marketing strategies that could be further explored. The absence of Chill Medicated from the top 30 in any category would be a significant concern, but this is not the case here, reflecting their consistent market presence.

Competitive Landscape

In the Michigan Topical category, Chill Medicated has consistently maintained its top position from December 2024 through March 2025, demonstrating strong brand loyalty and market presence. Despite a slight dip in sales from December to February, Chill Medicated experienced a significant rebound in March 2025, suggesting effective marketing strategies or product innovations that resonated with consumers. In contrast, Mary's Medicinals held steady in the second position throughout the same period, but with a noticeable decline in sales, indicating potential challenges in maintaining consumer interest. Meanwhile, Rise (MI) consistently ranked third, with relatively stable sales figures, suggesting a loyal but smaller customer base compared to the leading brands. The consistent top ranking of Chill Medicated highlights its competitive edge in the Michigan market, driven by its ability to adapt and appeal to consumer preferences more effectively than its competitors.

Notable Products

In March 2025, the top-performing product from Chill Medicated was CBD/THC 1:1 Extreme X Body Rub (2000mg CBD, 2000mg THC, 2.5oz), maintaining its first-place rank from previous months with notable sales of 2753 units. Strawberry Syrup (200mg) held steady at the second rank, demonstrating consistent popularity. Blue Raspberry Syrup (200mg THC, 4oz) showed significant improvement, climbing to third place from fifth in February, with a sales increase to 1265 units. Cherry Syrup (200mg THC, 4floz) remained at fourth place, showing a slight sales recovery from February. Maxx - CBD/THC 1:1 Medicated Body Rub (1000mg CBD, 1000mg THC) slipped to fifth place, despite a minor sales increase compared to the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.