Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

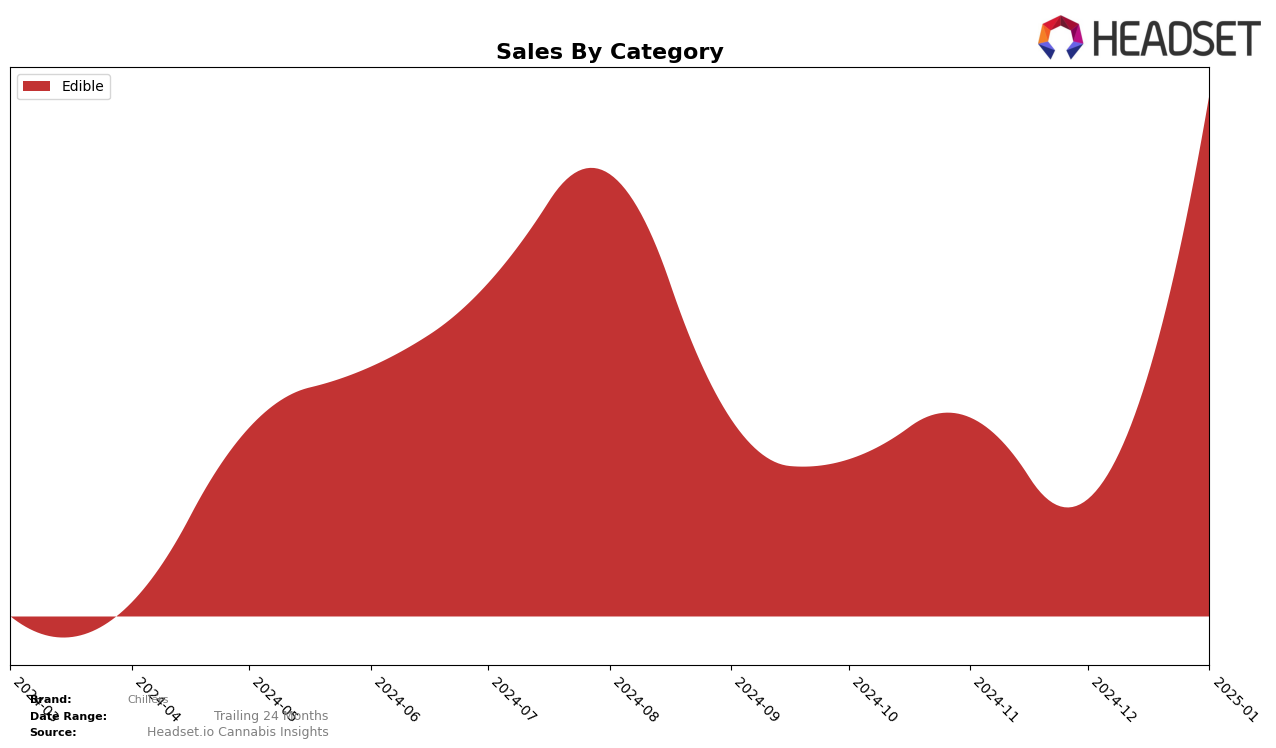

Chillers, a notable player in the cannabis industry, has shown some intriguing movements in the Edible category across various states. In Nevada, Chillers made a notable entry into the top 30 rankings in January 2025, securing the 26th position. This marks a significant achievement for the brand, as it had not been ranked in the top 30 in the preceding months. The sales figures for January suggest a positive trajectory, indicating a growing consumer interest in their products. However, the absence of Chillers from the top 30 in previous months suggests that there is still room for growth and improvement in brand visibility and market penetration in Nevada.

While Nevada shows promising signs of growth for Chillers, it's important to note that their presence in other states and categories remains to be seen. The lack of rankings in states outside Nevada or in categories other than Edibles might suggest either a strategic focus on specific markets or a need for expansion efforts to capture a broader audience. The performance in Nevada could serve as a benchmark for Chillers to explore similar strategies in other regions. Tracking their progress in the coming months will be essential to understanding their market strategy and potential for expansion. For now, the brand's ability to break into the Nevada market is an encouraging sign of their potential to replicate this success elsewhere.

Competitive Landscape

In the competitive landscape of the Nevada edible cannabis market, Chillers has shown a notable entry in January 2025, securing the 26th rank, which marks its emergence into the top 20 brands for the first time in this category. This is a significant development, especially when compared to competitors like Cheeba Chews, which fluctuated in rankings from 28th in October 2024 to 25th in January 2025, and Evergreen Organix, which saw a decline from 18th to 24th over the same period. Meanwhile, Vert and Hippies have also experienced varying ranks, with Vert missing from the top 20 in October 2024 and January 2025, and Hippies dropping to 27th in January 2025. These shifts suggest that Chillers is gaining traction and potentially capturing market share from these established brands, as evidenced by its strong sales performance in January 2025, which positions it competitively against its peers.

Notable Products

In January 2025, Tropical Paradise Live Resin Gummies 20-Pack (100mg) emerged as the top-performing product for Chillers, climbing from a second-place rank in December 2024 to first, with notable sales of 519 units. Indica Apple Sangria Gummies 20-Pack (100mg) followed closely, maintaining a strong presence by moving up from third in December to second in January, with 415 units sold. Strawberry Mimosa Live Resin Gummies 20-Pack (100mg) ranked third, having previously held the top spot in November 2024. Cherry Amaretto Live Resin Gummies 20-Pack (100mg) debuted in the rankings, securing the fourth position in January. Strawberry Mimosa Live Resin Gummies 10-Pack (100mg) saw a decline, dropping to fifth place in January from its consistent second-place ranking in October and November 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.