Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

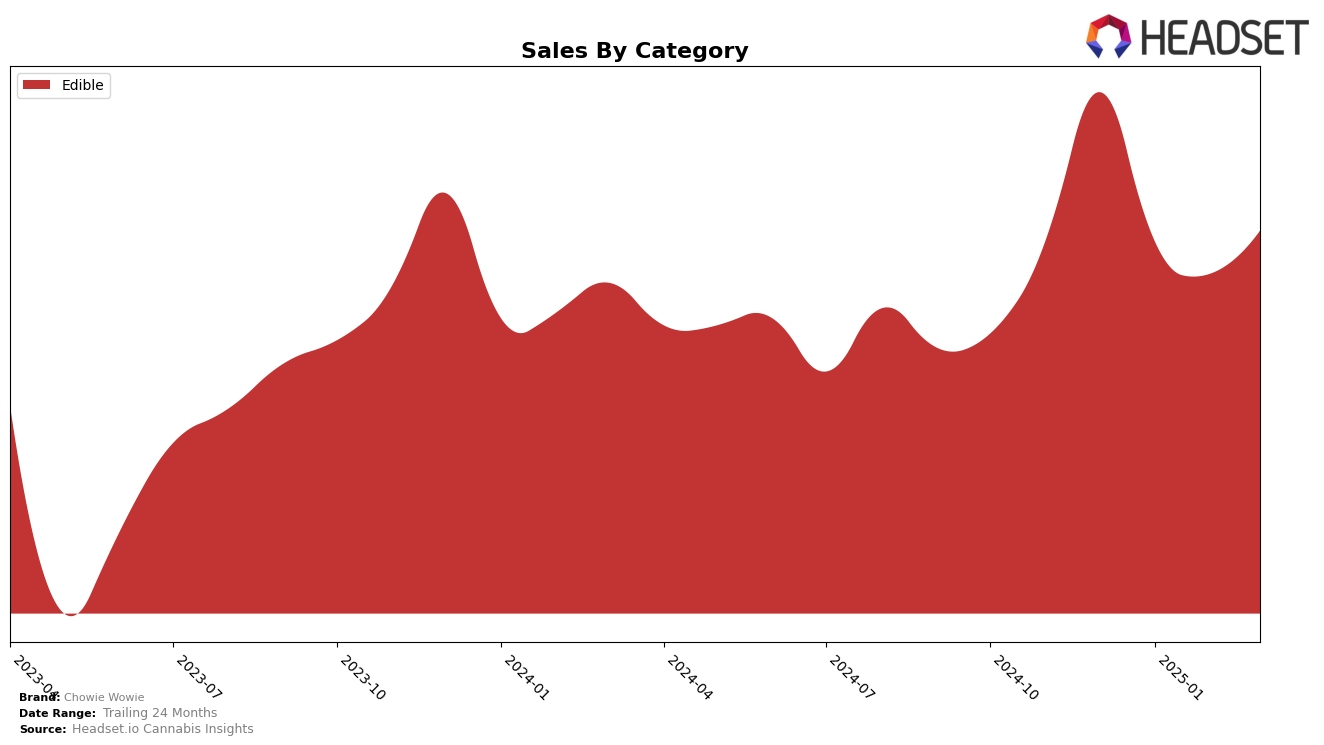

Chowie Wowie has maintained a steady presence in the Edible category across several Canadian provinces, demonstrating consistent performance in the rankings. In Alberta, the brand held a strong position, consistently ranking sixth from January to March 2025, after a slight drop from seventh place in December 2024. This stability is mirrored in Ontario, where Chowie Wowie consistently ranked eighth throughout the same period. Meanwhile, in Saskatchewan, the brand showed resilience by bouncing back from seventh place in February 2025 to sixth in March, matching its January ranking. However, it’s worth noting that in British Columbia, the brand experienced a slight dip in February, falling to eleventh place before regaining its tenth position in March.

Sales figures for Chowie Wowie reveal interesting trends that align with their ranking performance. In Alberta, despite a drop in sales from December 2024 to January 2025, the brand managed to increase its sales again by March 2025, reflecting a positive trend. Similarly, in British Columbia, sales increased from January to March, despite the temporary dip in rankings, suggesting a recovery in consumer demand. Ontario's sales, however, showed a significant decline from December 2024 to February 2025, with only a slight recovery in March, indicating potential challenges in maintaining market share. Saskatchewan's sales followed a similar trajectory, with a notable decrease in February but a subsequent rise in March, aligning with the brand's improved ranking in that month. These movements suggest that while Chowie Wowie faces competitive pressures, it remains a resilient player in the Canadian edibles market.

Competitive Landscape

In the Ontario edibles market, Chowie Wowie consistently held the 8th rank from December 2024 through March 2025, indicating a stable position amidst a competitive landscape. Despite maintaining its rank, Chowie Wowie experienced a slight decline in sales over this period, contrasting with competitors like Foray, which consistently ranked 7th and showed more stable sales figures. Meanwhile, Monjour maintained a higher rank at 5th and 6th, with significantly higher sales, suggesting a stronger market presence. Bhang and Olli trailed behind Chowie Wowie in rank, with Bhang showing a slight improvement over the months, while Olli gradually climbed from 14th to 11th. These dynamics highlight the competitive pressures Chowie Wowie faces, particularly from brands like Monjour and Foray, which may influence strategic adjustments to bolster its market share and sales performance.

Notable Products

In March 2025, Chowie Wowie's top-performing product was the CBD/THC 1:1 Solid Milk Chocolate Bar 2-Pack with a consistent rank of 1 since December 2024, achieving sales of 43,125 units. The THC Solid Milk Chocolate Bar maintained its position at rank 2, showing a slight increase in sales compared to February 2025. The CBD/THC1:1 Soft Caramel Milk Chocolate held steady at rank 3, with stable sales figures over the months. The CBD/THC 1:1 Peanut Butter Balanced Milk Chocolate remained at rank 4, while the CBD/THC 1:1 Cookies N' Cream Balanced White Chocolate consistently ranked 5 since its introduction in January 2025. Overall, the rankings have shown remarkable stability, with no changes in the top five products since December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.