Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

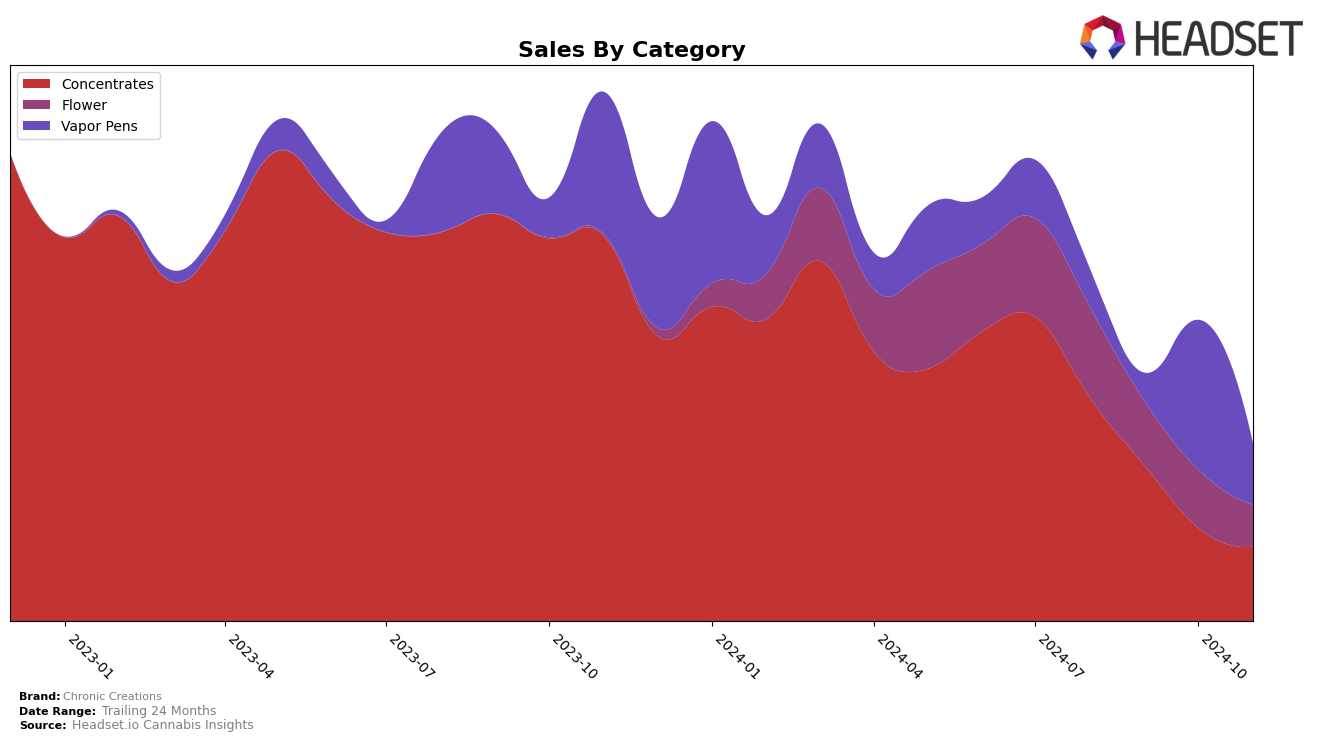

Chronic Creations has shown a dynamic performance across various categories in Colorado over the past few months. In the Concentrates category, the brand experienced a decline in rankings from 10th in August to 25th by November, indicating a downward trend in their market presence. This movement suggests increased competition or possibly a shift in consumer preferences. The Flower category, however, presents a different scenario, where Chronic Creations did not manage to break into the top 30, maintaining a steady decline from 51st position in August to 73rd in November. This could be seen as a challenge for the brand, as it struggles to gain traction in this particular segment.

Interestingly, the Vapor Pens category paints a more positive picture for Chronic Creations. The brand made a significant leap from 74th in August to 41st in October, before settling at 57th in November. This suggests a potential area of growth and opportunity for Chronic Creations, as they managed to break into the top 50 at one point. Despite the fluctuations, the brand's ability to improve its ranking in this category highlights a promising avenue for future focus. Overall, while there are areas that require strategic attention, particularly in the Flower segment, the performance in Vapor Pens could provide a foundation for building a stronger market presence in Colorado.

Competitive Landscape

In the competitive landscape of Colorado's concentrates category, Chronic Creations has experienced a notable decline in rank and sales over the past few months. From August to November 2024, Chronic Creations dropped from the 10th to the 25th position, indicating a significant shift in market dynamics. This downward trend contrasts with the performance of competitors such as Spherex, which, despite not being in the top 20 initially, improved its rank to 27th by November. Similarly, Newt Brothers Artisanal showed resilience, maintaining a relatively stable rank around the low 20s, while Green Treets made a notable leap from 41st to 24th place. Meanwhile, The Greenery Hash Factory saw fluctuations but ended up at 26th, just behind Chronic Creations. These shifts suggest that Chronic Creations may need to reassess its market strategies to regain its competitive edge in the concentrates market.

Notable Products

In November 2024, Ky Jealousy (1g) emerged as the top-performing product for Chronic Creations, climbing from the fifth position in October to secure the number one spot with impressive sales of 3,464 units. Han Solo Burger (1g) maintained a strong presence, ranking second, although it dropped from its previous top position in September. Orange Blossom Fizz (1g) saw a slight decline, moving from first place in October to third in November. Bananas N Melons Wax (1g) entered the rankings at fourth place, indicating a promising performance in the concentrates category. Chronic Creations Shatter (1g) also made its mark, debuting at fifth place, showcasing a growing interest in concentrates.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.