Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

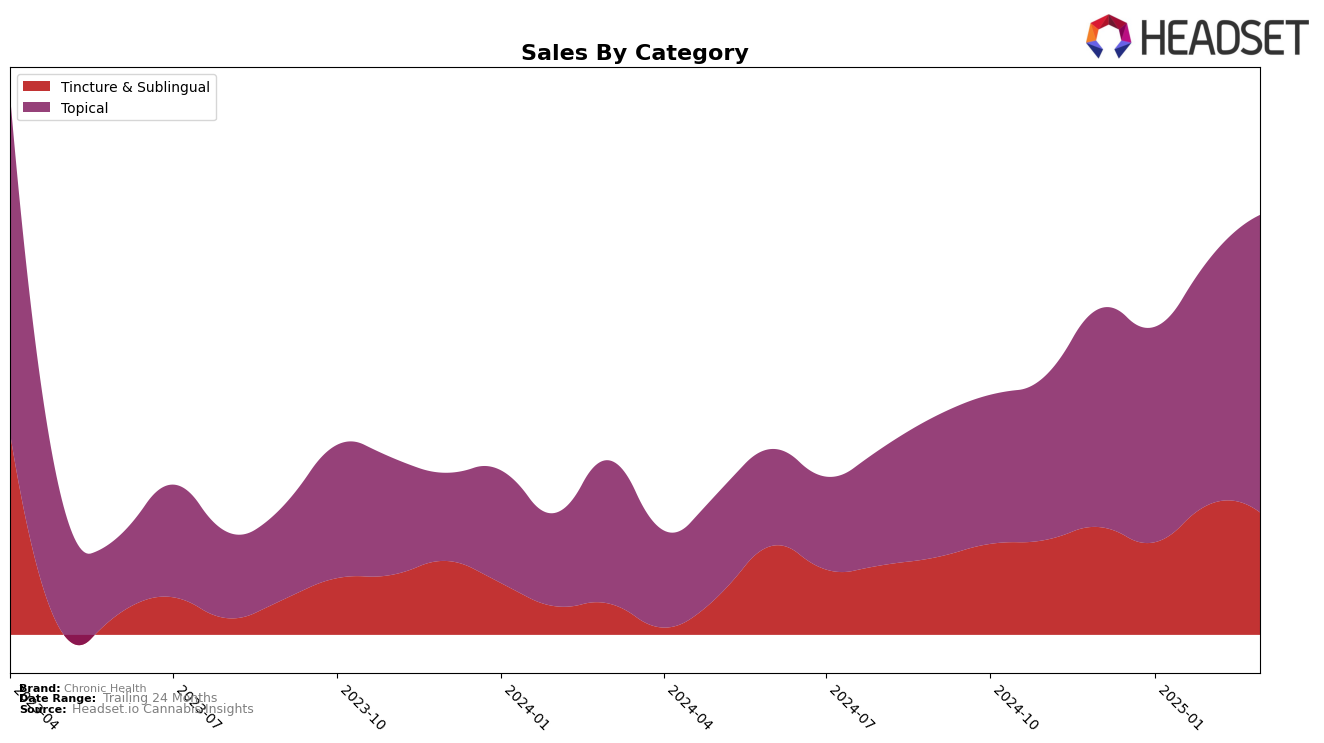

Chronic Health has demonstrated a strong performance in the Arizona market, particularly in the Tincture & Sublingual category where it consistently held the second position from December 2024 through March 2025. Despite a slight dip in sales in January, the brand recovered with a notable increase in February, maintaining its rank. This stability in ranking suggests a solid consumer base and effective market strategies in this category. However, it is important to note that the brand did not appear in the top 30 for other categories in Arizona, which could indicate potential areas for growth or a focus on specific product lines.

In the Topical category in Arizona, Chronic Health has shown impressive progress, climbing from the second position in December and January to securing the top spot in February and March 2025. This upward movement is accompanied by a significant increase in sales, especially in March, which highlights the brand's growing popularity and effectiveness in this category. The absence of rankings in other states or provinces suggests that the brand's focus and success are currently concentrated in the Arizona market, providing a strategic advantage but also highlighting opportunities for expansion. The brand's ability to maintain and improve its standing in these categories is a testament to its competitive edge in the Arizona cannabis market.

Competitive Landscape

In the competitive landscape of the topical cannabis category in Arizona, Chronic Health has demonstrated a remarkable ascent, securing the top rank in both February and March 2025. This rise to prominence is particularly notable given its consistent second-place position in December 2024 and January 2025. The brand's upward trajectory in rank is mirrored by its sales performance, which has consistently increased, culminating in a significant sales lead over competitors by March 2025. Meanwhile, Drip Oils + Extracts, which held the top spot in December 2024 and January 2025, experienced a decline to third place by February 2025, indicating a potential shift in consumer preference or market dynamics. Similarly, Tru Infusion maintained a steady climb, reaching the second position by February 2025, but still trails behind Chronic Health's leading sales figures. This competitive analysis highlights Chronic Health's strategic positioning and market dominance in the Arizona topical cannabis sector.

Notable Products

In March 2025, the Indica THC Glycerin Tincture (100mg THC, 1oz) emerged as the top-performing product for Chronic Health, climbing from the second position in February to first, with sales reaching 793 units. The CBD/THC 1:1 Sleep Well Tincture (100mg CBD, 100mg THC, 1oz) maintained its strong performance, holding the second spot after briefly topping the charts in February. The CBD/THC 1:1 Glycerin Tincture (100mg CBD, 100mg THC, 1oz) showed improvement, rising to third place from fourth in February. Meanwhile, the CBD/THC 1:1 Pain Relief Ointment (175mg CBD, 175mg THC, 2oz) remained consistently in fourth place, gradually increasing its sales each month. A new entry, THC Pain Relief Lotion (100mg), debuted in fifth place, indicating potential growth in the topical category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.