Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

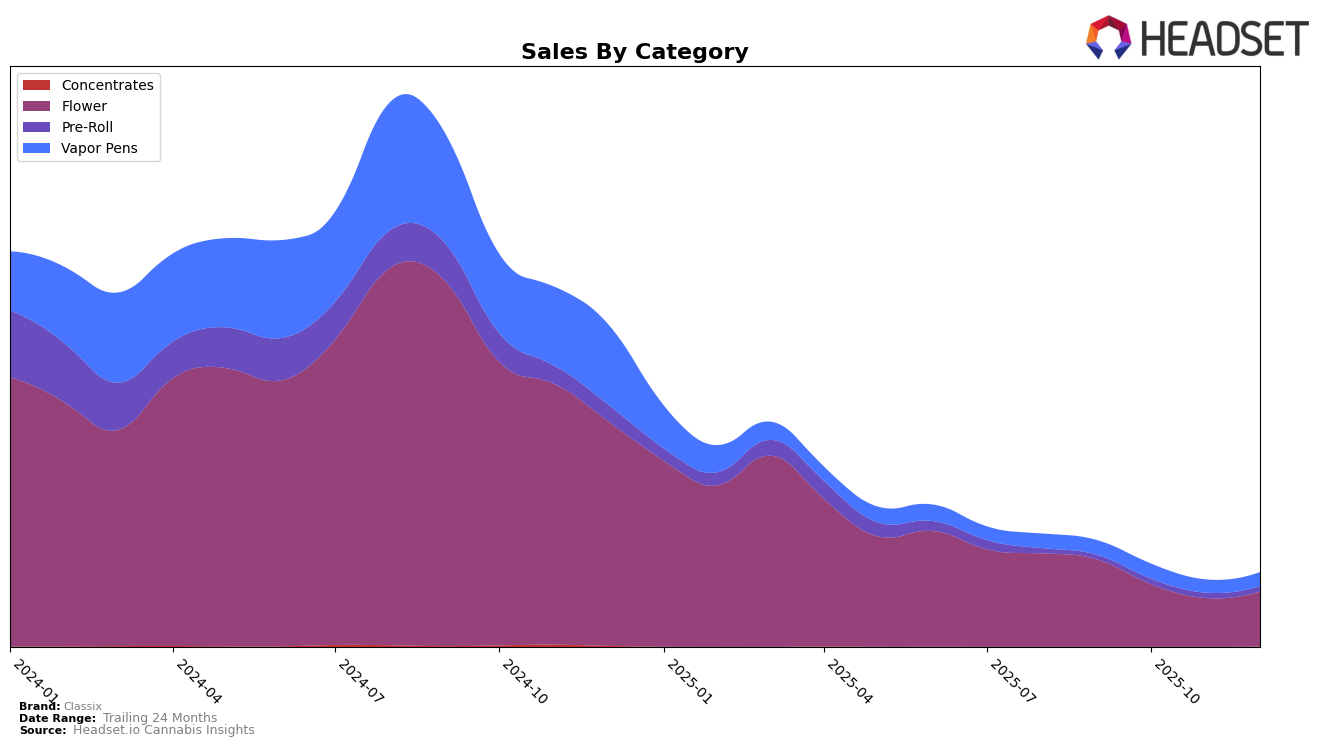

Classix has shown varied performance across different states and product categories, with notable movements in their rankings. In the Colorado market, Classix's Flower category experienced a significant drop from 6th place in September to 13th place by December 2025, indicating a decline in sales momentum. However, the Pre-Roll category in Colorado showed a positive trajectory, climbing from a rank of 48 in September to 40 by December, suggesting a growing preference among consumers for this product format. In contrast, the Illinois market saw Classix's Pre-Roll category enter the rankings at 66th place in November, which, while not in the top 30, marks their entry into the competitive landscape of that state.

In Illinois, the Vapor Pens category for Classix experienced a slight decline in rank from 44th in September to 48th in December, reflecting a contraction in sales, although the sales figures showed a recovery in December. Meanwhile, in Maryland, Classix's Vapor Pens category saw some volatility, with rankings fluctuating between 42 and 49, but ultimately ending the year at 47th place. This suggests a somewhat stable yet competitive environment for Vapor Pens in Maryland. The New Jersey market tells a different story for the Flower category, where Classix improved its position from 75th to 65th by December, indicating a positive reception in that state. On the other hand, Ohio saw a decline in the Flower category's rank from 35th in September to 48th in December, highlighting challenges in maintaining market share in that region.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Classix has experienced notable fluctuations in its market position from September to December 2025. Initially ranked 6th in September, Classix saw a decline to 13th in October, maintaining this position through November and December. This decline in rank coincides with a decrease in sales, which dropped from September to October but showed a slight recovery by December. In contrast, Silver Lake maintained a strong presence, starting at 5th place in September and only dropping to 15th by December, despite a significant sales drop. Meanwhile, Old Pal and Dro both demonstrated resilience, with Old Pal rebounding to 12th place by December and Dro climbing to 11th, indicating potential threats to Classix's market share. Artsy Cannabis Co remained relatively stable, hovering around the 12th to 14th positions, suggesting a consistent performance. These dynamics highlight the competitive pressures Classix faces, emphasizing the need for strategic adjustments to regain its earlier market standing.

Notable Products

In December 2025, Classix's top-performing product was Molotov Cocktail Pre-Roll (0.5g) in the Pre-Roll category, which secured the number one rank with sales of 4097 units. Super Starfruit (14g) in the Flower category followed closely, ranking second. Snowberry Pre-Roll (0.5g), which was the top product in November, dropped to third place in December with sales of 3685 units. Jungle Tartz (14g) in the Flower category maintained a steady presence, moving up from third in October and November to fourth in December. Apricot Scone Pre-Roll (0.5g) entered the rankings at fifth place, indicating a strong performance in the Pre-Roll category for Classix.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.