Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

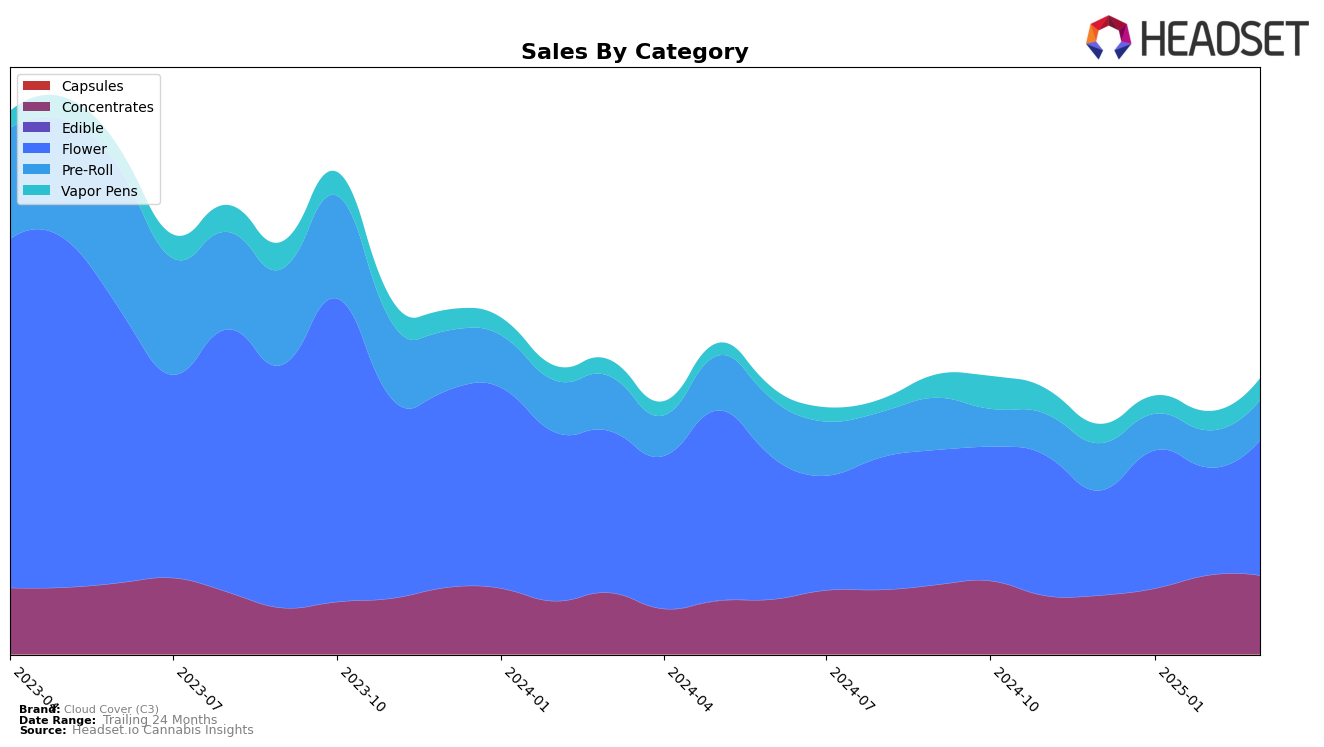

Cloud Cover (C3) has shown varied performance across different states and product categories. In Massachusetts, the brand's Concentrates category saw a consistent presence in the top 15, peaking at rank 8 in January and February 2025, although it slipped back to 11 by March. Meanwhile, their Flower category experienced significant fluctuations, climbing from rank 33 in December 2024 to 19 in January 2025, but not maintaining this momentum consistently. Pre-Rolls in Massachusetts have struggled, with a noticeable drop out of the top 30 in January and a further decline to rank 40 by March, indicating a challenging market environment or competitive pressure in this segment.

In Michigan, Cloud Cover (C3) has shown positive trends in the Pre-Roll category, moving from outside the top 30 in December 2024 to rank 56 by March 2025, suggesting a growing acceptance or market penetration. The Flower category also demonstrated a positive trajectory, climbing steadily from rank 81 in December 2024 to 50 by March 2025. However, in Missouri, while the Concentrates category has been strong, maintaining a top 10 position throughout the months, the Flower and Pre-Roll categories have faced challenges, with rankings fluctuating and showing a downward trend by March. These movements highlight the brand's varying competitive positioning and market dynamics across different states and product categories.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Cloud Cover (C3) has demonstrated a notable upward trajectory in its rankings and sales from December 2024 to March 2025. Starting at rank 81 in December 2024, Cloud Cover (C3) climbed to rank 50 by March 2025, showcasing a consistent improvement in market position. This ascent is particularly impressive when compared to competitors like North Cannabis Co., which experienced a decline from rank 41 to 48 in the same period, and Cheech & Chong's, which fluctuated significantly, dropping from rank 36 in December to 58 in March. Meanwhile, Crude Boys and Muha Meds also saw varied performances, with Crude Boys ending March at rank 45 and Muha Meds at 61. The steady increase in Cloud Cover (C3)'s sales figures, culminating in a significant rise by March 2025, highlights its growing consumer appeal and effective market strategies, positioning it as a formidable player in the Michigan flower market.

Notable Products

For March 2025, the top-performing product from Cloud Cover (C3) was Pina Grande (3.5g) in the Flower category, maintaining its number one rank from the previous months with a sales figure of 4,386 units. MAC Truck (3.5g), also in the Flower category, entered the rankings at the second position, showcasing a strong debut. Fruit Loops (3.5g), another Flower product, held steady in the third position, consistent with its February ranking. Banana Split Cured Terp Sugar (1g) in the Concentrates category was ranked fourth, marking its first appearance in the rankings. Lastly, Dirty Dozen (Bulk) in the Flower category secured the fifth position, adding a new entry to the list for March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.