Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

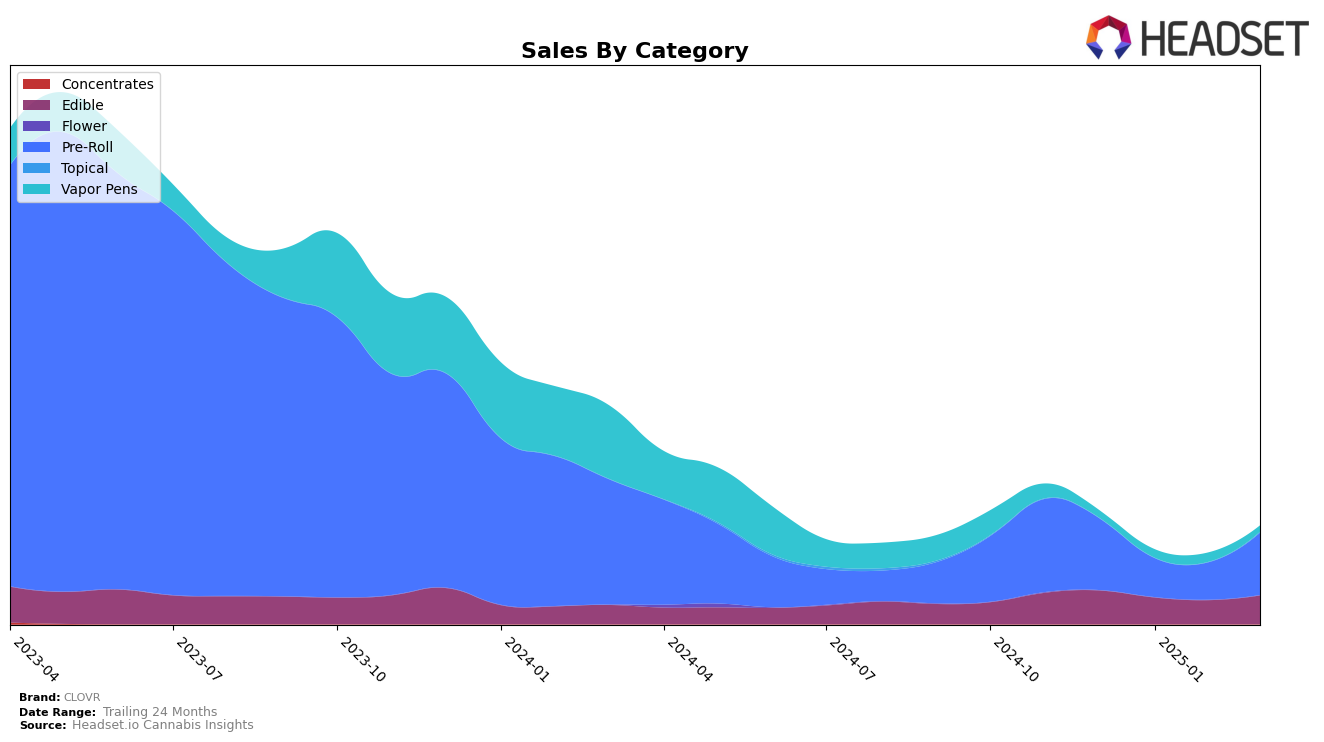

In the state of Missouri, CLOVR's performance across various cannabis categories presents a mixed picture. In the Edible category, CLOVR's ranking fluctuated slightly, dropping out of the top 30 in January and February 2025, before stabilizing at the 31st position in March 2025. This indicates a challenge in maintaining a competitive edge in the Edible market, although there was a slight recovery in sales by March. On the other hand, the Pre-Roll category showed a more promising trend. CLOVR improved its ranking from 24th in January to 19th by March 2025, demonstrating a positive movement that suggests a strengthening presence in this particular segment. Their sales in Pre-Rolls also reflect a significant upward trajectory, which could be a focal point for further growth.

However, CLOVR's performance in the Vapor Pens category in Missouri tells a different story. Consistently ranked outside the top 60, with a decline to 71st place by March 2025, this category appears to be an area where CLOVR struggles to gain traction. Despite a slight increase in sales in January and February, the overall trend suggests a need for strategic reassessment to improve market positioning. The Vapor Pens category represents a challenging market for CLOVR, and it remains to be seen how the brand will address these challenges moving forward. This diverse performance across categories highlights the varying levels of competition and consumer preference in the Missouri cannabis market.

Competitive Landscape

In the competitive landscape of the Missouri pre-roll category, CLOVR has experienced notable fluctuations in its market position over the past few months. Starting from a rank of 17 in December 2024, CLOVR saw a decline to 24th and 25th positions in January and February 2025, respectively, before recovering to 19th place in March 2025. This recovery coincides with a significant increase in sales, suggesting a positive response to strategic adjustments. In contrast, TWAX has shown a steady improvement, climbing from outside the top 20 to 20th place by January 2025 and maintaining its position through March. Meanwhile, Packs Cannabis (MO) and Daybreak Cannabis have consistently outperformed CLOVR, though both experienced slight declines in rank by March. The competitive dynamics indicate that while CLOVR faces strong competition, its recent sales surge and rank improvement highlight its potential to regain a stronger foothold in the Missouri pre-roll market.

Notable Products

In March 2025, the top-performing product for CLOVR was Lemon Cookie OG Pre-Roll 2-Pack (1g) in the Pre-Roll category, climbing to the number one spot with sales of 1338 units. Following closely, Clovr x Nuthera - Grape Cream Cake Pre-Roll (1g) secured the second position, having risen from the first rank in February. Clovr x Nuthera - Sour GMO Cookies Pre-Roll (1g) held the third position, showing a slight drop from its fourth-place ranking in December 2024. Clovr x Nuthera - Buttermilk Biscuits Pre-Roll (1g) improved its standing, moving up to fourth place from fifth in February. Lastly, Clovr x Nuthera - MAC V2 Pre-Roll (1g) entered the rankings at fifth place, marking its debut in the top five for March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.