Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

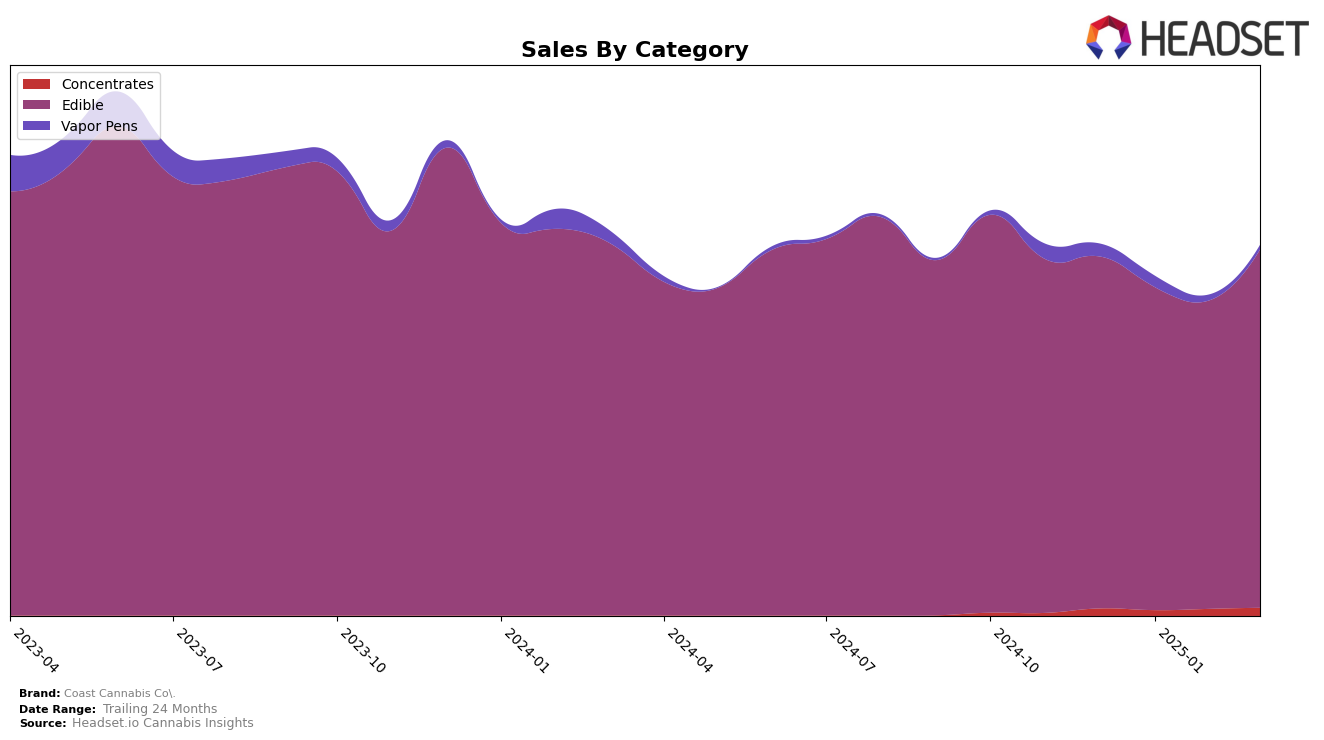

Coast Cannabis Co. has shown varied performance across different product categories and states. In Massachusetts, the brand has maintained a strong presence in the Edible category, consistently ranking 5th from December 2024 through March 2025. This stability suggests a loyal customer base and effective brand positioning in the Edibles market. However, the brand's performance in the Concentrates category has been more volatile, with a notable absence from the top 30 rankings in the early months of 2025, only to reappear at the 34th position by March. Such fluctuations could indicate challenges in maintaining consistent market share or changes in consumer preferences.

In contrast, Coast Cannabis Co.'s presence in the Vapor Pens category in Massachusetts has been less prominent, with rankings outside the top 30 in the early months of 2025. Despite this, there was a slight improvement in the Concentrates category, moving from a non-ranking position to 34th by March 2025. While sales figures in the Edibles category have shown a recovery in March after a dip, the brand's overall performance indicates areas for potential growth and strategic improvement, particularly in the less dominant categories like Vapor Pens and Concentrates.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Massachusetts, Coast Cannabis Co. consistently held the 5th rank from December 2024 to March 2025, indicating a stable position amidst fluctuating market dynamics. Despite this stability, Coast Cannabis Co. faces stiff competition from brands like Kanha / Sunderstorm, which maintained a higher rank at 2nd and 3rd positions during the same period, reflecting their strong market presence. Additionally, Betty's Eddies consistently ranked 4th, just ahead of Coast Cannabis Co., suggesting a close competitive race. While Incredibles improved their rank from 7th to 6th by March 2025, Choice experienced a decline, dropping from 6th to 7th, which could potentially benefit Coast Cannabis Co. if they capitalize on this shift. Overall, Coast Cannabis Co.'s sales trajectory, with a notable increase in March 2025, positions them well to potentially climb the ranks if they leverage strategic marketing and product differentiation.

Notable Products

In March 2025, the top-performing product for Coast Cannabis Co. was the CBD:CBN:THC 1:1:1 Cranberry Pomegranate Gummies 20-Pack, maintaining its first-place rank from previous months and achieving sales of 6,317 units. The CBD/CBG/THC 1:1:1 Tangerine Full Spectrum Gummies 20-Pack consistently held the second position, showing steady performance. Notably, the CBN/THC 5:1 Goodnight Grape Gummies 20-Pack climbed to third place from fifth, indicating a significant increase in popularity. The CBD/THC/THCV 1:1:1 Raspberry Lime Gummies 20-Pack slightly dropped to fourth place, while the Restore - THC/CBD/CBC 1:4:1 Boysenberry Gummies 20-Pack remained stable in fifth. This month showed a dynamic shift in rankings, with the Goodnight Grape Gummies gaining traction among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.