Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

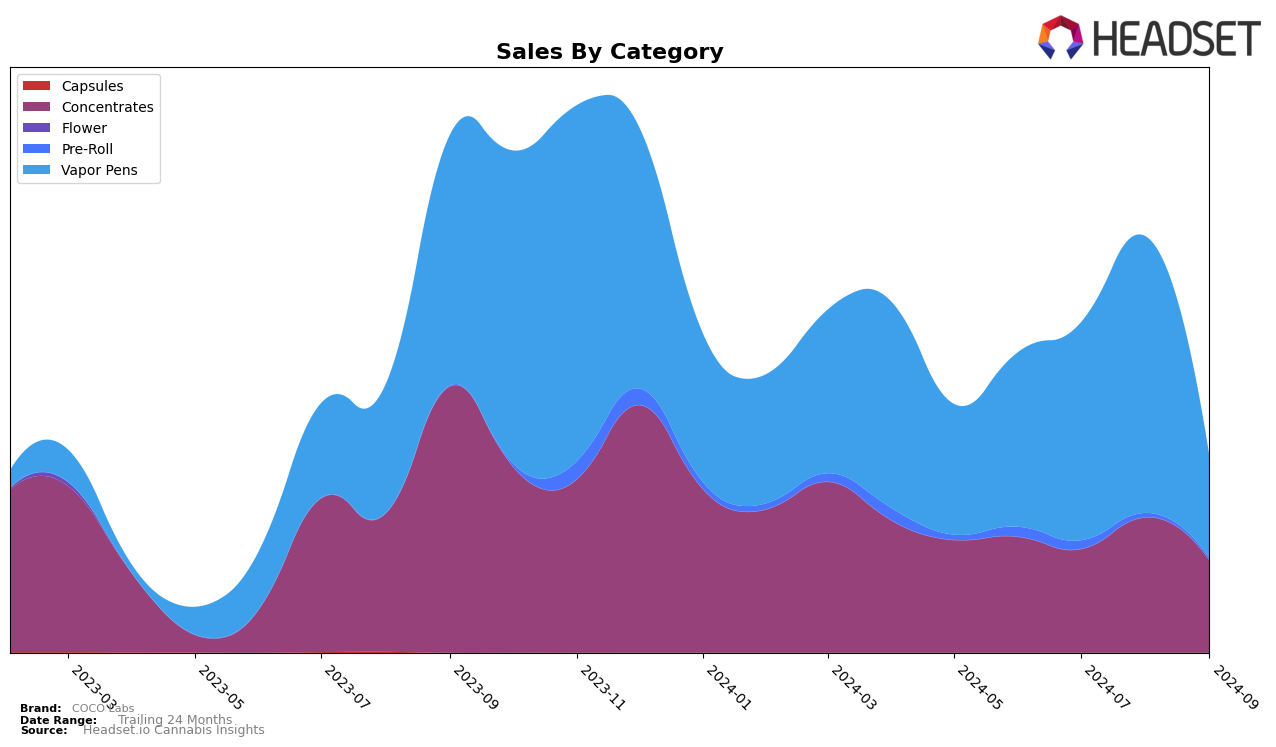

COCO Labs has shown varied performance across different product categories and states over the past few months. In the Concentrates category in Missouri, the brand has maintained a relatively stable presence, ranking between 14th and 16th from June to September 2024. This indicates a consistent demand, although there was a notable dip in sales in September compared to August. In the Vapor Pens category, COCO Labs experienced a significant fluctuation, peaking at the 26th position in August before dropping to 35th in September. This volatility suggests potential challenges in maintaining market share in this category.

In terms of Pre-Rolls, COCO Labs did not make it into the top 30 rankings in Missouri for August and September, highlighting a potential area for improvement. This absence from the top rankings contrasts with their earlier positions of 69th and 64th in June and July, respectively, indicating a downward trend. The brand's performance in these categories suggests both opportunities and challenges, with a need to strategize effectively to maintain and improve their market position, particularly in the Pre-Roll and Vapor Pens segments.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, COCO Labs has experienced notable fluctuations in its ranking and sales performance over recent months. Starting from June 2024, COCO Labs held the 30th position, maintaining this rank in July before climbing to 26th in August, only to drop to 35th by September. This volatility contrasts with the steady ascent of Kosmik Brands, which improved its rank from 46th in June to 33rd by September. Meanwhile, Fuzed entered the top 50 in August and quickly rose to 34th by September, indicating a rapid gain in market presence. Ratio showed more stability, hovering around the mid-30s, while Greenlight experienced a dramatic fall from 8th in June to 37th by September. These movements suggest that COCO Labs faces intense competition, particularly from brands like Kosmik Brands and Fuzed, which are gaining traction, potentially impacting COCO Labs' market share and necessitating strategic adjustments to maintain its competitive edge.

Notable Products

In September 2024, Sour Diesel Distillate Disposable (0.5g) from the Vapor Pens category emerged as the top-performing product for COCO Labs, rising to the first rank despite a slight decrease in sales to 554 units. Jack Herer Live Terps Disposable (0.5g) also showed impressive performance, climbing to the second rank from fourth in August, indicating a strong upward trend in popularity. Killer G x Lava Cake Badder (1g) made its debut in the rankings, securing the third position in the Concentrates category, reflecting growing consumer interest. Meanwhile, Northern Lights Distillate Cartridge (1g) experienced a drop to the fourth rank, despite previously holding a consistent second place over the summer months. The FECO Syringe (1g) maintained its presence in the top five, signaling steady demand within the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.