Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

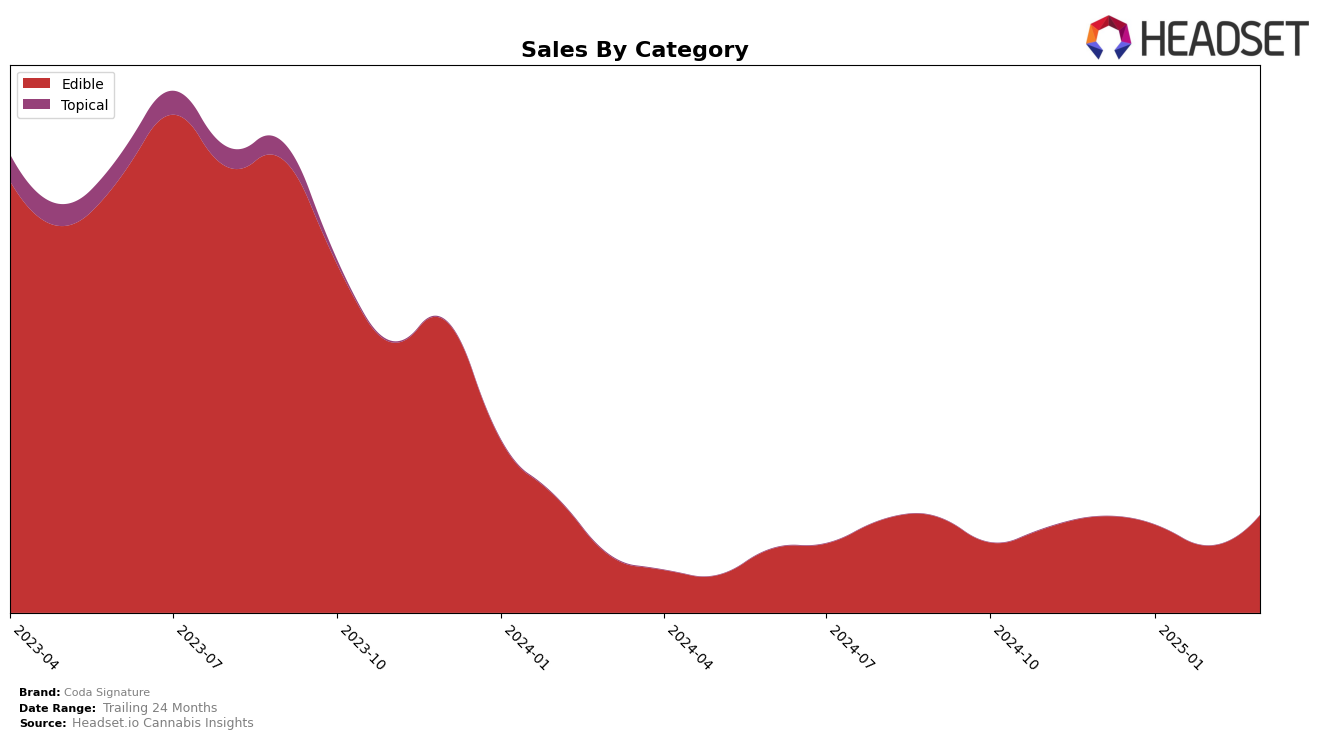

Coda Signature has shown a varied performance across different categories and states, with notable fluctuations in its rankings. In the Colorado market, the brand has maintained a presence in the Edible category, with rankings fluctuating between 19th and 21st place from December 2024 to February 2025. However, March 2025 saw an improvement as the brand climbed to the 16th position, indicating a positive trend in consumer preference or strategic adjustments by the company. This movement suggests a potential strengthening of their market position in the state, although the earlier dip in February might indicate competitive pressures or seasonal variations affecting sales.

Interestingly, the sales figures for Coda Signature in Colorado reveal a significant dip in February 2025, followed by a recovery in March. The brand's sales reached $114,498 in March, which surpassed the December 2024 figures, hinting at a possible resurgence or successful promotional efforts. The absence of rankings in other states and categories suggests that Coda Signature might be focusing its efforts predominantly in Colorado, or it may face challenges in breaking into the top 30 in other markets. Such insights could be pivotal for stakeholders looking to understand the brand's strategic focus and market dynamics.

Competitive Landscape

In the competitive landscape of the Colorado edible market, Coda Signature has experienced notable fluctuations in its ranking and sales performance from December 2024 to March 2025. Initially ranked 19th in December 2024, Coda Signature maintained this position in January 2025 but dropped out of the top 20 in February before rebounding to 16th place in March. This recovery indicates a positive trend, suggesting effective strategic adjustments or successful marketing efforts. Meanwhile, competitors like DOSD Edibles and Cheeba Chews consistently performed better, with DOSD Edibles maintaining a rank between 13th and 16th, and Cheeba Chews improving from 17th to 15th. Dixie Elixirs and Dablogic also showed more stable rankings, staying within the top 20 throughout the period. These dynamics highlight the competitive pressure Coda Signature faces in maintaining and improving its market position, emphasizing the need for continued innovation and customer engagement strategies.

Notable Products

In March 2025, the top-performing product from Coda Signature was the Coffee & Doughnuts Milk Chocolate Bar 20-Pack (100mg) in the Edible category, maintaining its first-place rank from the previous months with sales of 1807 units. The Cream & Crumble White Chocolate Bar 20-Pack (100mg) secured the second position, consistently improving from a third place in December and January to second in February. The Maple & Pecan Milk Chocolate Bar 20-Pack (100mg) held steady in third place after a brief rise to second in January. Notably, the CBD:THC 1:1 Cream & Crumble White Chocolate Bar 20-Pack (100mg CBD, 100mg THC) entered the rankings at fourth place in March, showing a strong presence despite its absence in February. The Toffee & Sea Salt Chocolate Bar 20-Pack (100mg) rounded out the top five, recovering its position after a dip in the rankings in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.