Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

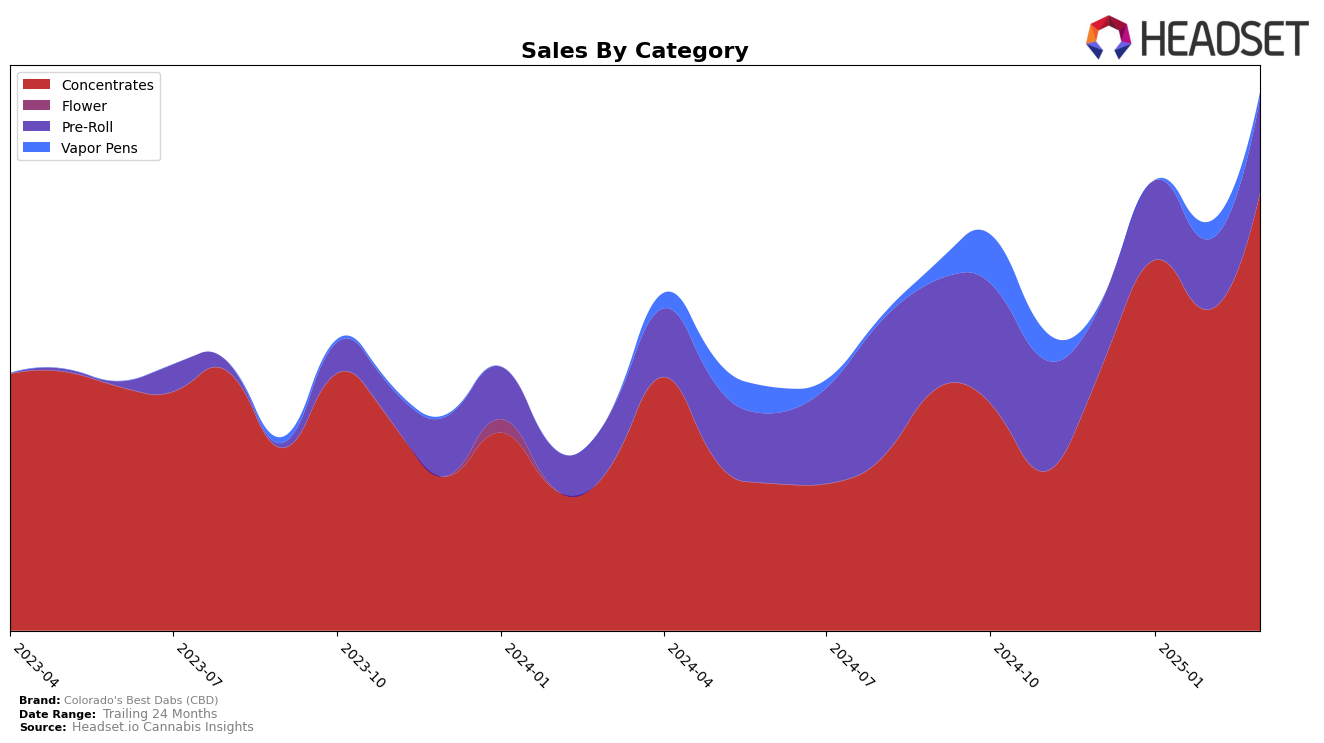

Colorado's Best Dabs (CBD) has shown noteworthy progress in the Colorado market, particularly in the Concentrates category. Starting from December 2024, the brand was ranked 26th and steadily climbed to the 15th position by March 2025. This upward trajectory is indicative of a strong market presence and growing consumer preference, as evidenced by a significant increase in sales from $88,689 in December 2024 to $150,638 in March 2025. Such performance highlights the brand's successful strategies in capturing the interest and loyalty of consumers in this competitive category. In contrast, the Pre-Roll category saw more modest improvements, with the brand moving from 61st to 50th position over the same period, indicating room for growth and potential opportunities for the brand to explore.

While Colorado's Best Dabs (CBD) has made strides in the Colorado market, the absence of rankings in other states or categories suggests that the brand has yet to establish a significant footprint beyond its home state. The lack of top 30 rankings in other regions could be seen as a potential area for expansion, highlighting opportunities for the brand to diversify and strengthen its market presence. The brand's performance in the Pre-Roll category, although improving, suggests that there is still a considerable gap to bridge before it can compete with leading brands. As the brand continues to innovate and adapt, it will be interesting to observe how it leverages its success in concentrates to enhance its performance across other categories and states.

Competitive Landscape

In the competitive landscape of the concentrates category in Colorado, Colorado's Best Dabs (CBD) has shown a promising upward trajectory in rank and sales over the first quarter of 2025. Starting from a rank of 26 in December 2024, the brand climbed to 15 by March 2025, indicating a significant improvement in market positioning. This upward trend is contrasted with brands like Olio, which experienced fluctuations, dropping to a rank of 23 in January and February before recovering slightly to 17 in March. Meanwhile, El Sol Labs and AO Extracts maintained relatively stable positions, though both saw a slight dip in March compared to earlier months. Notably, Billo emerged as a strong competitor, climbing from a rank of 31 in December to 13 in March, surpassing Colorado's Best Dabs (CBD) in the final month. These dynamics suggest a competitive but opportunity-rich environment for Colorado's Best Dabs (CBD) to capitalize on its recent momentum and further enhance its market share in the concentrates category.

Notable Products

In March 2025, Colorado's Best Dabs (CBD) saw London Pound Mints Wax Stix Infused Pre-Roll (1g) leading the sales as the top-performing product with a notable sales figure of 782 units. Following closely, Mac Diamond Infused Pre-Roll (1g) and Mango Mintz Budder (1g) both secured the second position in their respective categories of Pre-Roll and Concentrates. Root Beer N' Runtz Budder (1g) and Slurricrasher Budder (1g) ranked third and fourth in the Concentrates category. Comparing these rankings to previous months, London Pound Mints Wax Stix Infused Pre-Roll (1g) had a significant rise, as it was not ranked in prior months. Similarly, the other top products have maintained or slightly improved their standings, indicating consistent demand and popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.