Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

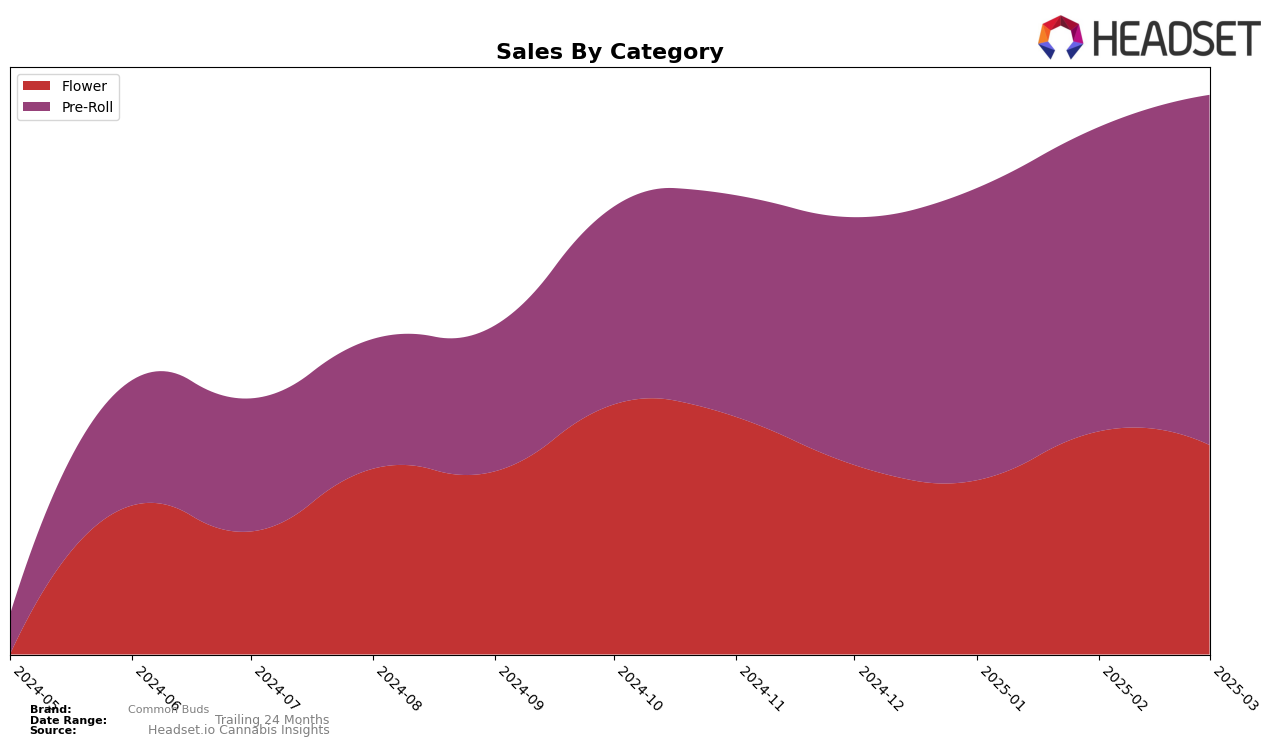

In the state of Massachusetts, Common Buds has shown notable progress in the Pre-Roll category over the first quarter of 2025. Starting from a rank of 29 in December 2024, the brand has climbed to the 17th position by March 2025. This consistent upward movement is indicative of growing consumer preference for their Pre-Roll products. In contrast, their performance in the Flower category has been less dynamic. Despite a slight increase in sales from February to March, the brand has not broken into the top 30 rankings, maintaining a steady position at 53. This contrast highlights the brand's stronger foothold in Pre-Rolls compared to Flower products in Massachusetts.

While Common Buds has demonstrated impressive growth in the Pre-Roll category in Massachusetts, it is worth noting the absence of top 30 rankings in other states and categories. This suggests that the brand's market presence is currently concentrated in Massachusetts, particularly in Pre-Rolls. The lack of ranking in other states or categories could be viewed as a potential area for expansion and growth. The brand's ability to maintain and improve its position in Massachusetts indicates a strong product offering that could potentially be leveraged to enter new markets or categories if strategic efforts are made to replicate their success in Pre-Rolls across other segments.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Massachusetts, Common Buds has shown a promising upward trajectory in terms of rank and sales from December 2024 to March 2025. Starting at rank 29 in December 2024, Common Buds climbed to rank 17 by March 2025, indicating a significant improvement in its market position. This positive trend is noteworthy when compared to competitors such as Kynd Cannabis Company, which started outside the top 20 and only reached rank 18 by March 2025, and Miss Grass, which fluctuated but ended at rank 16. Meanwhile, Fathom Cannabis and Headliners have shown less consistent performance, with Fathom Cannabis dropping to rank 19 and Headliners rising to rank 15 in March 2025. Common Buds' steady rise in rank suggests a growing consumer preference and effective market strategies, positioning it favorably against its competitors in the Massachusetts Pre-Roll market.

Notable Products

In March 2025, the top-performing product for Common Buds was Red Runtz Pre-Roll (1g), which climbed to the number one spot with sales reaching 4509 units. Guava X Pre-Roll (1g) followed closely in second place, making a strong debut in the rankings. Sherbert Cream Pie Pre-Roll (1g) secured the third position, showing a consistent performance from February 2025. Notably, Sherb Cream Pie Pre-Roll (1g) and Fried Ice Cream Pre-Roll (1g) rounded out the top five, both making their first appearances in the rankings. Compared to previous months, Red Runtz Pre-Roll (1g) improved from second place in January, while the other products were newly ranked in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.