Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

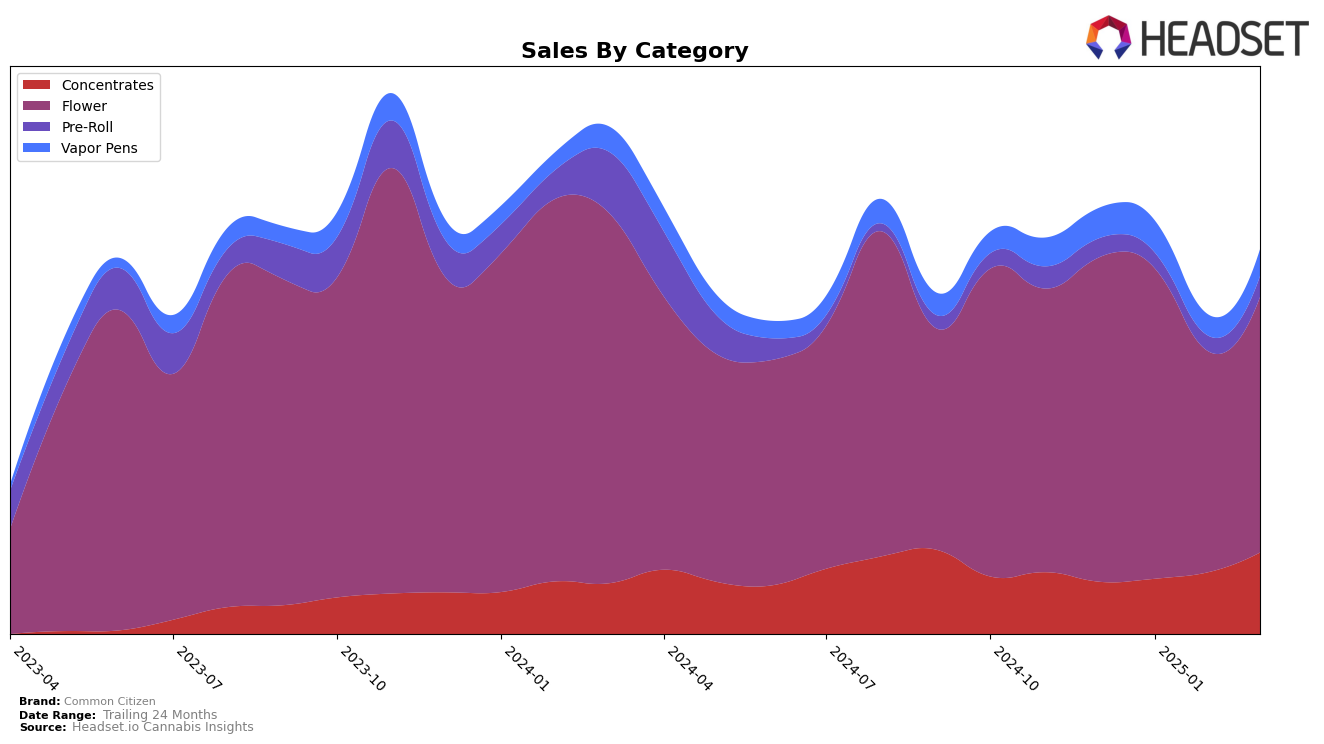

Common Citizen has shown notable performance in the Michigan cannabis market, particularly in the Concentrates category. The brand has experienced a steady climb in rankings from ninth in December 2024 to fourth by March 2025, reflecting a significant upward trajectory. This positive movement is supported by a substantial increase in sales, demonstrating growing consumer preference and market penetration in this category. In contrast, the Flower category saw a decline in rankings from fifth to fourteenth over the same period, indicating potential challenges in maintaining market share despite an overall increase in sales from February to March 2025.

In the Pre-Roll and Vapor Pens categories, Common Citizen's performance in Michigan has been less remarkable. The brand did not make it into the top 30 brands for Pre-Rolls and Vapor Pens in December and January, highlighting areas where they could improve their competitive positioning. However, there is a slight improvement in Pre-Roll rankings from 50th to 41st by March 2025, suggesting a slow but positive trend. Similarly, Vapor Pens saw a fluctuation in rankings, indicating a volatile market presence that could benefit from strategic adjustments. These mixed results point to opportunities for Common Citizen to capitalize on their strengths in Concentrates while addressing challenges in other categories.

Competitive Landscape

In the Michigan flower category, Common Citizen experienced notable fluctuations in its ranking and sales performance from December 2024 to March 2025. Starting strong with a consistent 5th place rank in December and January, Common Citizen saw a decline to 12th in February and further to 14th in March. This downward trend in rank coincided with a decrease in sales, particularly noticeable in February. Meanwhile, competitors like High Supply / Supply and Grip also experienced rank volatility, with High Supply dropping out of the top 20 in February and Grip maintaining a relatively stable position. Interestingly, Simply Herb and Zones showed upward momentum, with Zones making a significant leap from 23rd in February to 12th in March, potentially impacting Common Citizen's market share. These dynamics suggest a competitive landscape where Common Citizen may need to strategize to regain its earlier strong positioning amidst shifting consumer preferences and competitor advancements.

Notable Products

In March 2025, Puffo Gelato Pre-Roll (1g) maintained its top position as the leading product from Common Citizen, with sales reaching 8,903 units. Purple Pop (3.5g) emerged as the second-highest selling product, showing significant growth from its unranked status in previous months. Sugar Leaf - Fruitie Pebblez 99 Pre-Roll (1g) secured the third position, marking its entry into the top ranks. Diamond Dust (3.5g) and Biker Kush (3.5g) rounded out the top five, indicating a strong performance in the Flower category. This shift in rankings highlights a growing preference for Pre-Roll products in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.