Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

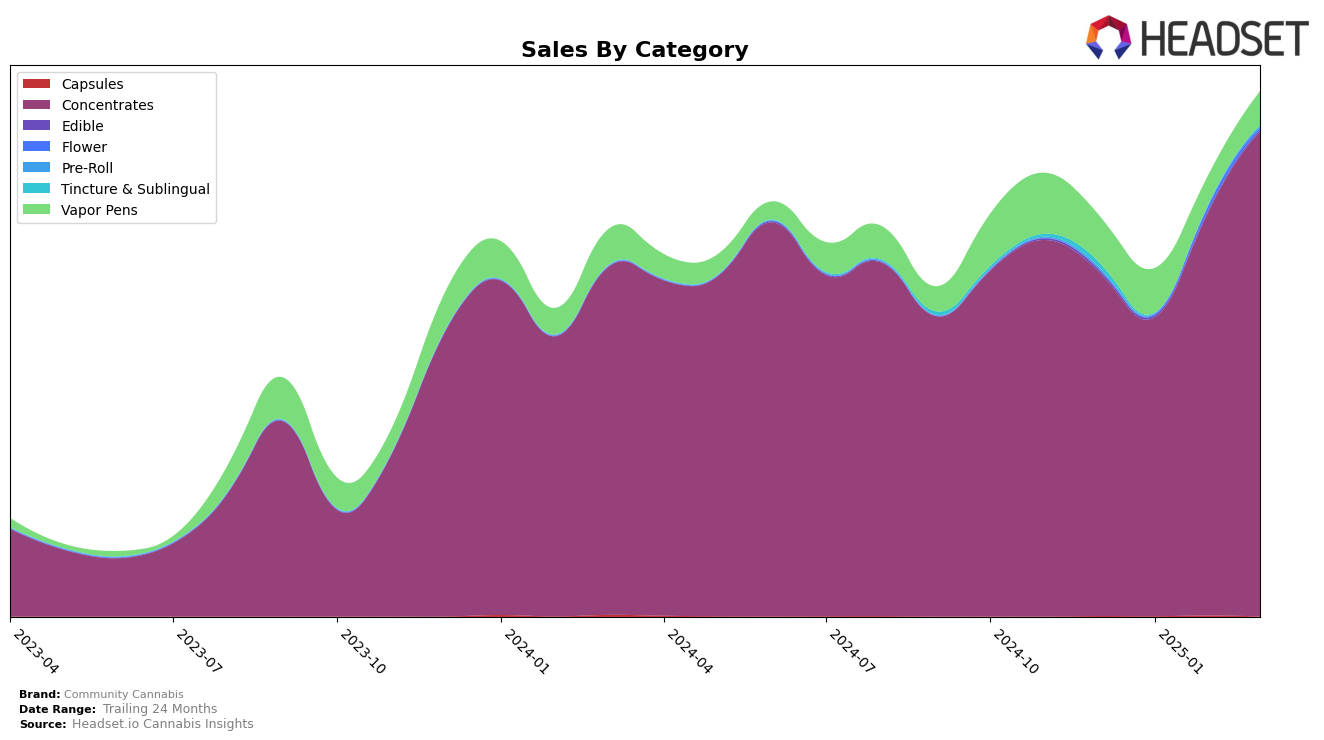

In the state of California, Community Cannabis has shown a consistent upward trajectory in the Concentrates category. Starting from a rank of 12 in December 2024, they improved to the 10th position by March 2025. This upward movement is significant, indicating a growing presence and possibly an increasing consumer preference for their products in this category. Despite a dip in sales from December to January, the brand rebounded strongly in February and March, with March sales reaching a noteworthy figure. This trend suggests a positive reception and a strengthening foothold in the California market.

In contrast, the performance of Community Cannabis in Ontario within the Vapor Pens category highlights a different scenario. The brand did not appear in the top 30 rankings from December 2024 to February 2025, only making an entry at rank 96 in March 2025. This late appearance suggests challenges in gaining traction in the Ontario market compared to their performance in California. The lack of early rankings could point to either a competitive market environment or a need for strategic adjustments to enhance their brand visibility and sales in Ontario.

Competitive Landscape

In the competitive landscape of California's concentrates market, Community Cannabis has shown a promising upward trajectory in recent months. Starting from a rank of 12 in December 2024, Community Cannabis improved its position to 10 by March 2025, indicating a positive trend in market presence. This rise in rank is complemented by a significant increase in sales, particularly noticeable from February to March 2025, where sales surged from 310,961 to 374,236. In comparison, ABX / AbsoluteXtracts experienced a slight decline in rank, moving from 9 to 11, although their sales showed a modest increase. Himalaya, despite a higher rank, faced a downward sales trend, which could potentially benefit Community Cannabis if the trend continues. Meanwhile, Bear Labs and Roll Bleezy have also shown fluctuations in rank and sales, but Community Cannabis's consistent improvement in rank and sales positions it as a strong contender in the California concentrates market.

Notable Products

In March 2025, the top-performing product for Community Cannabis was Yellow Zushi Cold Cure Rosin (1g) in the Concentrates category, maintaining its number one rank from February with a notable sales figure of 942.0. Cherry Cheesecake Cold Cure Live Rosin (1g) emerged as the second-best seller, making its debut in the rankings this month. Spritzer x Strawguava Cold Cure Live Rosin (1g) secured the third position, showing a positive move from its absence in February. First Class Funk Cold Cure Rosin (1g) and Lemon Royale Cold Cure Rosin (1g) both entered the rankings at fourth place, indicating a strong performance for new entries. Overall, March witnessed a dynamic shift with several new products climbing the ranks, reflecting changing consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.