Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

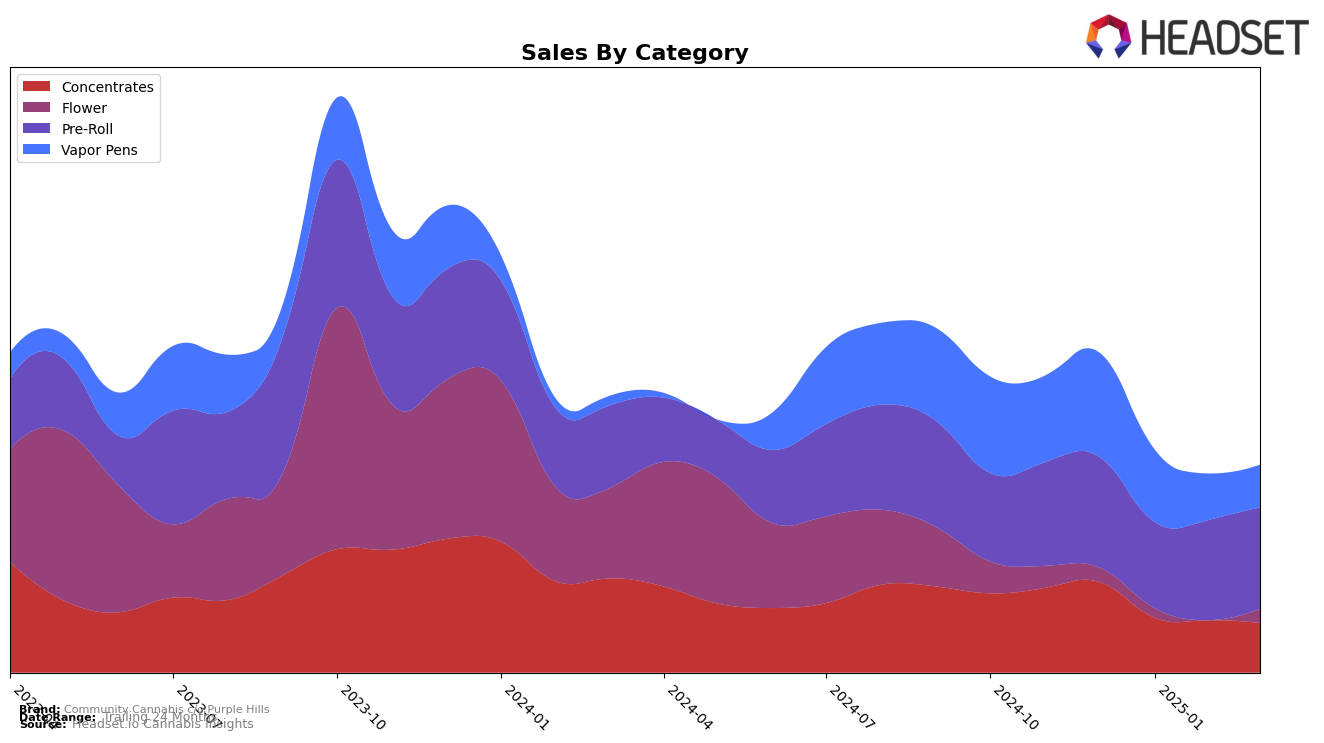

Community Cannabis c/o Purple Hills has shown consistent performance in the Ontario market, particularly in the Concentrates category. Despite a slight drop in ranking from 18th to 19th place from February to March 2025, their presence in the top 20 indicates a stable foothold in this segment. Interestingly, their sales figures have seen a gradual decline over the months, which could suggest a need for strategic adjustments to maintain their competitive edge. This trend is worth monitoring as it might impact their future positioning in the market.

In the Pre-Roll category, Community Cannabis c/o Purple Hills has demonstrated upward movement, climbing from 75th in December 2024 to 65th by March 2025, showing resilience and potential growth in this segment. This positive shift is noteworthy, although they still remain outside the top 30, which highlights room for improvement. Meanwhile, their performance in the Vapor Pens category has been relatively stable, hovering around the mid-40s ranking. Despite this steadiness, the lack of a top 30 ranking across these categories suggests there are opportunities for the brand to enhance its market presence and climb higher in the competitive landscape of Ontario.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Community Cannabis c/o Purple Hills has shown a steady performance, maintaining a rank within the top 65 brands from December 2024 to March 2025. Despite a slight dip in rank from 63 in February 2025 to 65 in March 2025, the brand has managed to keep its sales relatively stable, with a slight increase from January to March 2025. In comparison, Potluck has consistently held a similar rank of 63, indicating a close competition. Meanwhile, Vox has shown a downward trend in rank, moving from 57 in December 2024 to 64 in March 2025, which could present an opportunity for Community Cannabis c/o Purple Hills to capitalize on. On the other hand, Castle Rock Farms has improved its rank significantly from 99 in December 2024 to 67 in March 2025, suggesting a rising competitor in the market. The fluctuating performance of Fleur De L'ile, which saw its rank drop from 62 in December 2024 to 66 in March 2025, further highlights the dynamic nature of the market, emphasizing the need for Community Cannabis c/o Purple Hills to continuously innovate and adapt to maintain its competitive edge.

Notable Products

In March 2025, the top-performing product for Community Cannabis c/o Purple Hills was the TwoFer Pre-Roll 2-Pack (2g) in the Pre-Roll category, maintaining its consistent first-place ranking from the previous months with sales of 9057. The Hybrid Hash (3g) in the Concentrates category also held steady at the second position, showing stable performance over the months despite a slight dip in sales earlier in the year. The Bakery Preroll 14-Pack (7g) continued its streak in third place, with a modest increase in sales compared to February. The Indica XL Distillate Cartridge (1.2g) remained in fourth place, indicating a consistent demand for vapor pens. Notably, the Purple Hills XL Distillate Cartridge (1.2g) reappeared in the rankings at fifth place in March, after a temporary absence in February, suggesting a rebound in consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.