Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

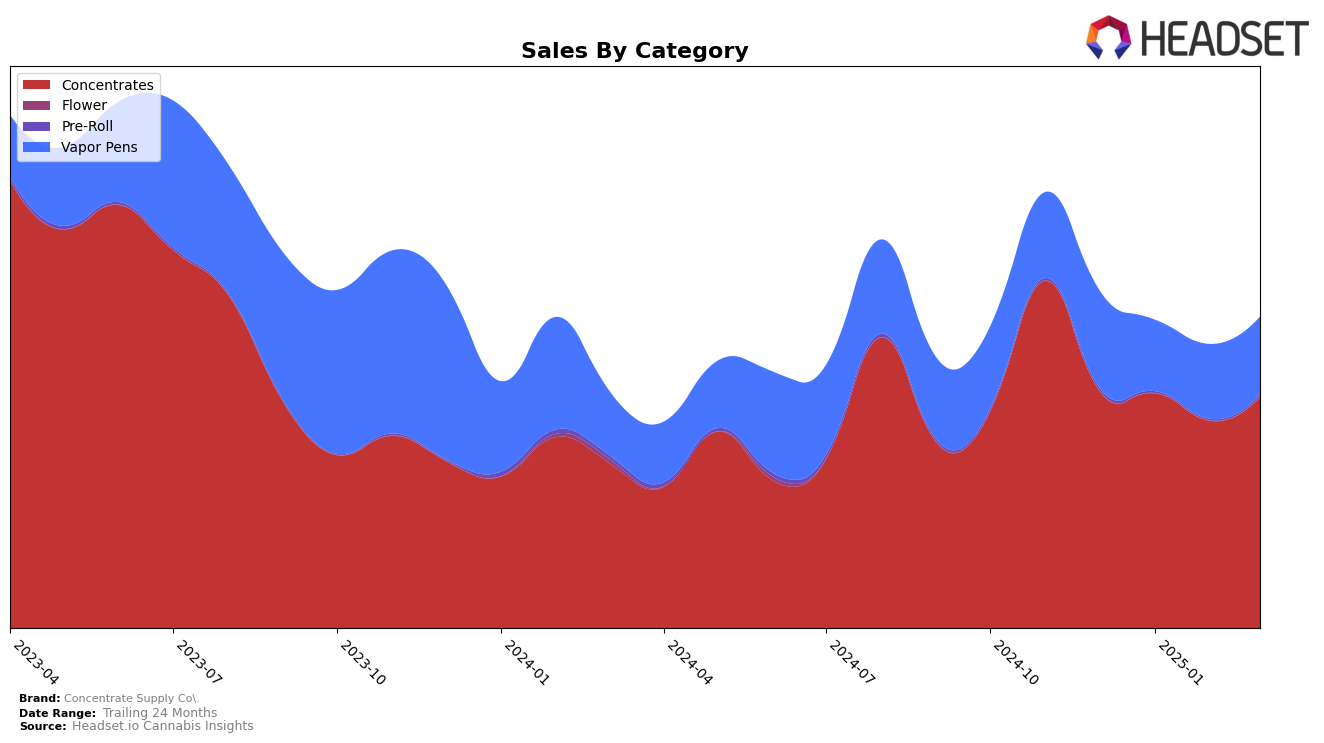

Concentrate Supply Co. has shown a consistent performance in the Concentrates category in Colorado. Holding steady at the 8th position from January to March 2025, the brand has maintained its presence in the top 10, which is a testament to its strong market appeal and customer loyalty in this category. Despite a slight dip in sales in February, there was a recovery in March, indicating a resilient demand for their products. This stability in ranking suggests that Concentrate Supply Co. has effectively navigated the competitive landscape in Colorado's concentrates market.

In contrast, the Vapor Pens category tells a different story for Concentrate Supply Co. in Colorado. The brand's ranking remained outside the top 30, fluctuating between the 49th and 55th positions from December 2024 to March 2025. This performance highlights a challenge for the brand in gaining traction within this segment, as they struggle to break into a more competitive rank. The sales figures, while showing some growth from January to March, suggest that there is potential for improvement, but significant strategic adjustments may be necessary to enhance their standing in the vapor pens market.

Competitive Landscape

In the competitive landscape of the concentrates category in Colorado, Concentrate Supply Co. has maintained a steady presence, consistently ranking 8th from January to March 2025, despite a slight dip in sales from December 2024 to February 2025. This stability in rank contrasts with the fluctuations seen in competitors like Denver Dab Co, which improved its rank from 8th to 5th in January 2025 before settling back to 7th by March, and Next1 Labs LLC, which saw a decline from 6th in December 2024 to 9th by January 2025 and remained there. Meanwhile, Nomad Extracts has shown a positive trajectory, climbing from 7th to 6th by March 2025 with a notable increase in sales. Sunshine Extracts also demonstrated upward mobility, moving from 15th to 10th, indicating a potential threat if this trend continues. For Concentrate Supply Co., maintaining its current rank amidst these shifts suggests a need to strategize on enhancing sales performance to avoid being outpaced by these dynamic competitors.

Notable Products

In March 2025, Concentrate Supply Co.'s top-performing products were Garlic Juice Sugar Wax and Wicked Stepsister Sugar Wax, both leading the ranks in the concentrates category. Orange Ice Pops Wax followed closely, securing the second position. Notably, the CSC x SJS - Lime Sherbert Distillate Cartridge, which ranked first in January, dropped to third in March, with sales reaching 482 units. Gummies Sugar Wax debuted in the fourth position, showing strong performance among concentrates. The rankings indicate a significant shift with Garlic Juice Sugar Wax and Wicked Stepsister Sugar Wax rising to prominence, while the Lime Sherbert Distillate Cartridge saw a decline from its peak earlier in the year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.