Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

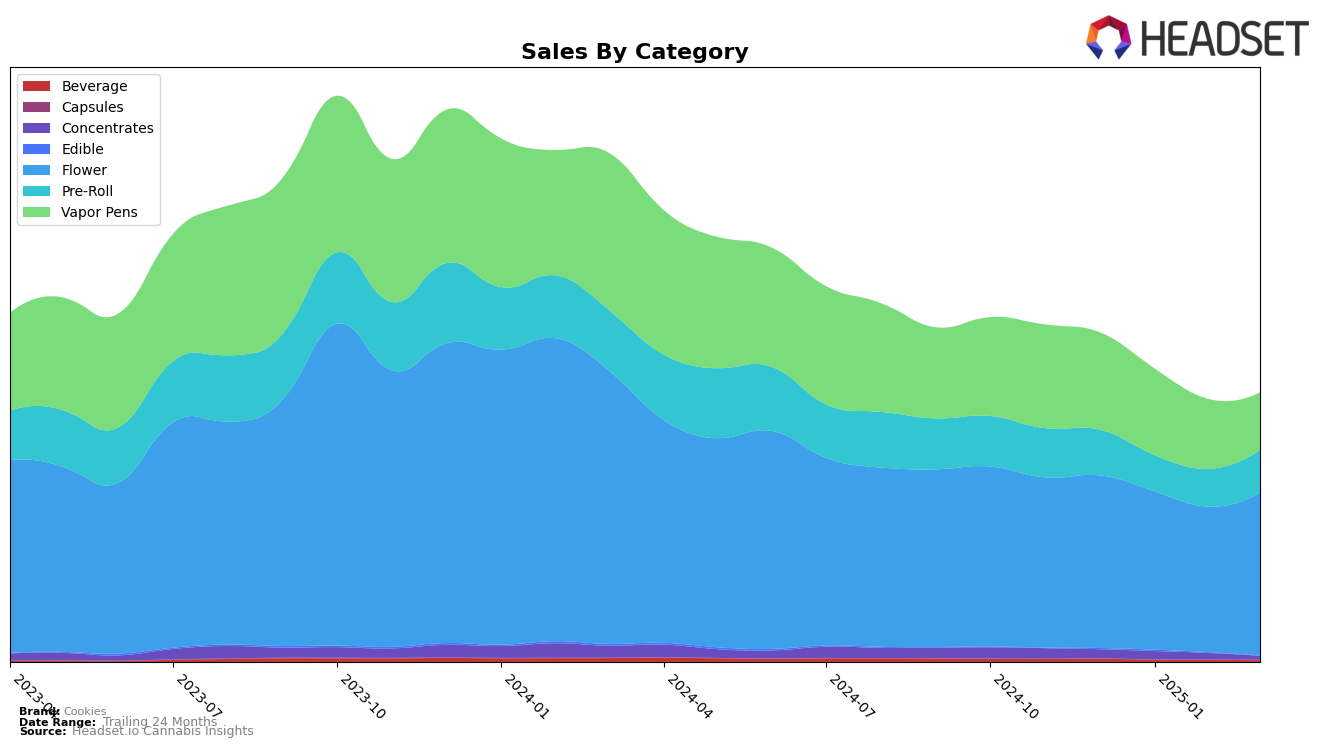

Cookies has demonstrated varied performance across different states and categories, with notable fluctuations in ranking and sales figures. In California, the brand's Flower category saw a significant rebound in March 2025, climbing back to the 50th position after slipping to 66th in February. This recovery is noteworthy given the competitive nature of the California market. Meanwhile, in Maryland, Cookies maintained a relatively stable presence in the Flower category, although it experienced a gradual decline from 17th place in December 2024 to 23rd in March 2025. The brand's Pre-Roll category in Maryland also showed resilience, reappearing in the rankings in February 2025 after not being listed in January.

In New Jersey, Cookies has consistently performed well in the Vapor Pens category, although its ranking dropped from 12th place in December 2024 to 26th in March 2025, indicating a potential shift in consumer preferences or increased competition. Conversely, the Flower category in New York exhibited a positive trajectory, with Cookies rising from not being ranked in December 2024 to securing the 28th position by March 2025. In Ontario, the brand's performance in the Flower category has been less favorable, with a decline from the 50th position in December 2024 to 64th by March 2025, suggesting challenges in maintaining a strong foothold in this Canadian market.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, Cookies has experienced a notable decline in its market position from December 2024 to March 2025. Initially ranked 13th in December 2024, Cookies slipped to 18th by March 2025. This downward trend is contrasted by the performance of competitors such as Brute's Roots, which maintained a relatively stable rank, hovering around the 15th and 16th positions during the same period. Meanwhile, Old Pal showed a significant improvement, climbing from 25th in December 2024 to 17th by March 2025, surpassing Cookies in the process. Niche also demonstrated a strong upward trajectory, moving from 42nd to 19th place, indicating a growing presence in the market. These shifts suggest that while Cookies remains a recognized brand, its competitors are gaining traction, potentially impacting its sales and market share in New Jersey's Flower category.

Notable Products

In March 2025, Ridgeline Lantz (3.5g) reclaimed the top spot in Cookies' product lineup, leading the Flower category with sales of $5,602. Blue Raz (3.5g) followed closely in the second position, marking a slight drop from its previous first-place ranking in February. That Badu (3.5g) maintained a consistent presence, ranking third, despite fluctuating positions in prior months. TQ Sunrise Pre-Roll (1g) held steady in fourth place, reflecting a stable performance since January. Notably, Blueberry Banana Pre-Roll (1g) emerged in the fifth position, marking its first appearance on the March rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.