Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

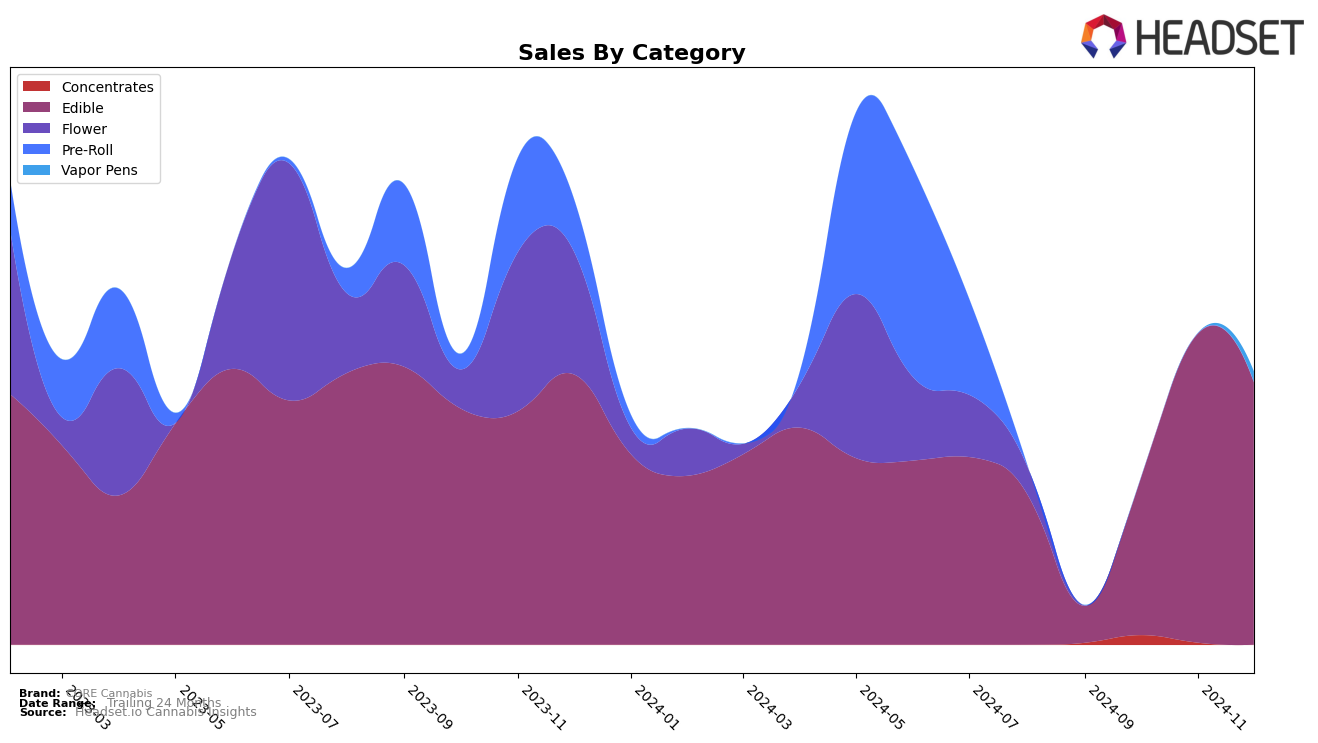

In the state of Missouri, CORE Cannabis has shown notable progress within the Edible category over the last few months. Beginning in September 2024, the brand was ranked 44th, but by October, it had climbed into the top 30, reaching the 30th position. This upward trajectory continued in November, where CORE Cannabis improved its standing to 25th, although it experienced a slight dip to 26th in December. This consistent presence in the top 30 highlights CORE Cannabis's growing influence in Missouri's edible market, marking a significant improvement from its initial position outside the top 30.

Despite the fluctuations in Missouri, the brand's performance in other states remains a mystery as there is no ranking data available for CORE Cannabis in any other state or category, suggesting that it did not break into the top 30 elsewhere. This absence could indicate either a strategic focus on Missouri or challenges in penetrating other markets. Regardless, the substantial increase in sales from September to October in Missouri is a positive indicator of the brand's potential for growth and expansion, although challenges remain in maintaining and improving this momentum across different regions and product categories.

Competitive Landscape

In the Missouri Edible category, CORE Cannabis has demonstrated a notable upward trajectory in brand rank over the last few months, moving from a rank of 44 in September 2024 to 26 by December 2024. This improvement is significant when compared to competitors such as goodnight, which has seen a decline from rank 19 in September to 25 in December, and Vivid (MO), which fluctuated but ultimately fell to rank 27 in December. Additionally, Vibe Cannabis (MO) showed some improvement, reaching rank 24 in December, but CORE Cannabis's consistent climb suggests a stronger market presence. The brand's sales have also shown a positive trend, aligning with its improved ranking, indicating a growing consumer preference and potential for further market penetration. This competitive landscape highlights CORE Cannabis's strategic positioning and potential to capture a larger market share in the Missouri Edible sector.

Notable Products

In December 2024, CORE Cannabis's top-performing product was Sleep - Grape Gummies 20-Pack (100mg), maintaining its leading position from the previous two months. Active - Peach Mango Gummies 20-Pack (100mg) ranked second, showing consistent performance since October. Chill - CBD/THC 1:1 Blueberry Gummies 20-Pack (100mg CBD, 100mg THC) dropped to third place, despite leading in September. Notably, Tangie Banana Distillate Disposable (0.5g) emerged in the rankings at fourth place, with sales reaching 228 units. The Flower category's Apple Fritter (3.5g) also appeared in the fourth position, indicating a new entry into the top rankings for this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.