Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

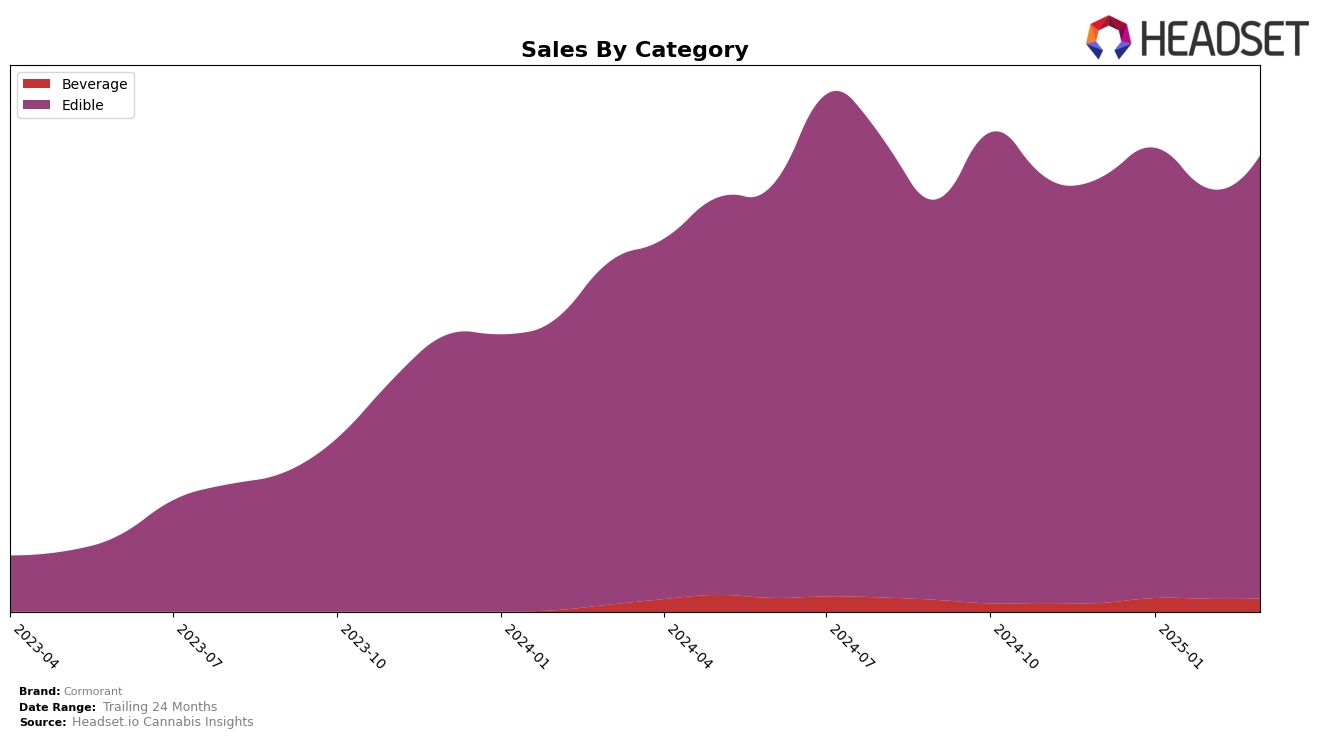

Cormorant has demonstrated consistent performance in the Edible category in Washington, maintaining a steady rank of 10th place from December 2024 through March 2025. This stability in ranking suggests a strong foothold in the market, despite minor fluctuations in sales figures. For instance, while sales dipped in February 2025, they rebounded in March, indicating resilience and potentially effective market strategies. However, it is noteworthy that Cormorant's presence is not evident in the top 30 brands in other states or categories, which might suggest areas for growth or market expansion.

In terms of category performance, Cormorant's consistent ranking in the Edible category in Washington highlights its specialization and possibly a strong brand identity within this segment. The lack of presence in other categories or states could imply a focused strategy, but it also points to untapped opportunities. Observing the stability in Washington, it raises questions about how Cormorant could leverage this success to penetrate other markets or diversify its product offerings. The insights from Washington's performance could serve as a blueprint for strategic decisions in other regions.

Competitive Landscape

In the Washington Edible market, Cormorant consistently held the 10th rank from December 2024 to March 2025, indicating a stable position amidst fluctuating sales trends. Despite this steady rank, Cormorant's sales saw a notable increase from December 2024 to January 2025, followed by a dip in February 2025, and a recovery in March 2025. This sales pattern suggests resilience in a competitive landscape. Competitors like Swifts (WA) maintained a higher rank, fluctuating between 6th and 8th, while Ceres consistently ranked just below Cormorant at 9th. Meanwhile, Marmas and Mr. Moxey's remained stable at 11th and 12th respectively, indicating that while Cormorant is not leading, it is outperforming several other brands in the market. This competitive positioning highlights Cormorant's potential for growth, especially if it can capitalize on the fluctuations in sales and rank of its competitors.

Notable Products

In March 2025, the top-performing product for Cormorant was CBD/THC 1:1 Mango Sorbet (100mg CBD, 100mg THC, 4oz) maintaining its consistent position as the number one ranked product since December 2024, with sales of 7991 units. Watermelon Sorbet (100mg THC, 4oz) held the second position, showing an improvement from its fifth position in January. Mango Infused Sorbet (100mg THC, 4oz) entered the rankings at third place, indicating a strong debut. Blueberry Sorbet (100mg THC, 4oz) improved its ranking to fourth place from fifth in February. Strawberry Lemonade Sorbet Frozen (100mg THC, 4oz) re-entered the rankings in fifth position, following a previous absence in January and February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.