Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

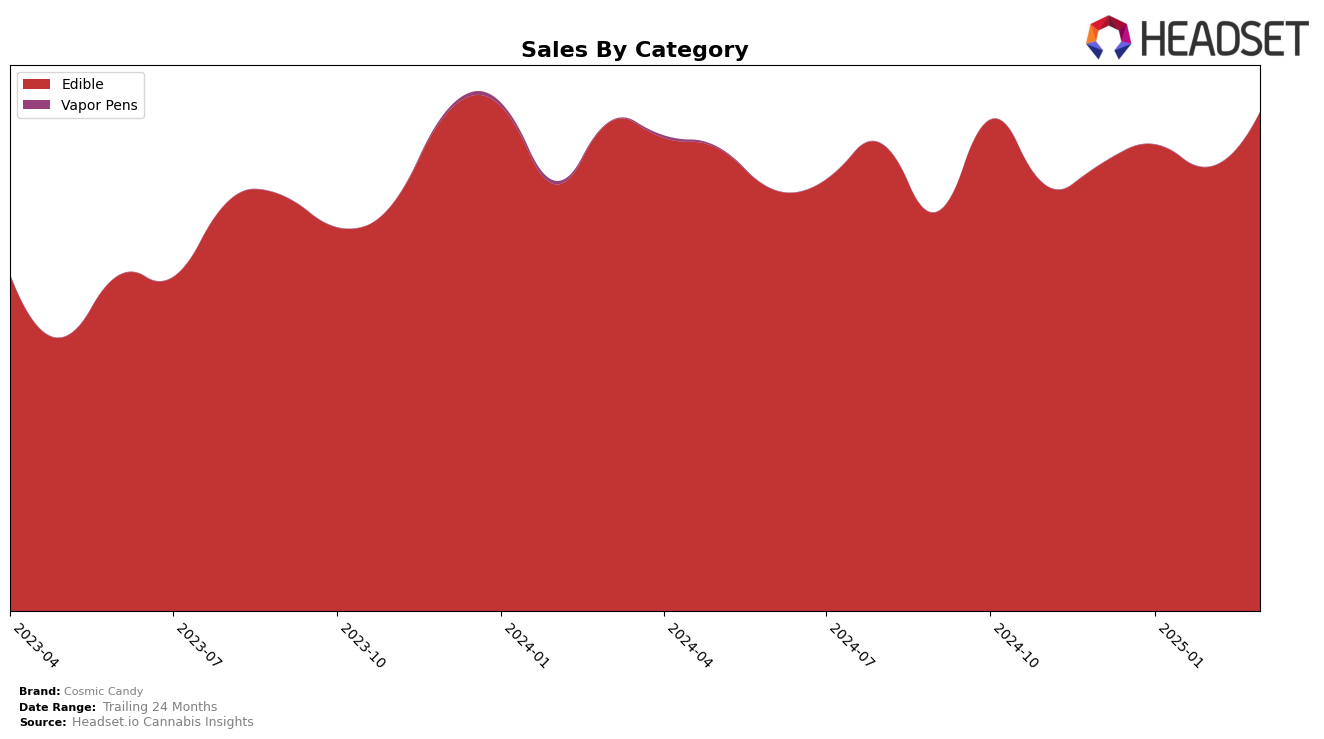

Cosmic Candy's performance in the Edible category within Washington shows a consistent upward trend in brand ranking from December 2024 through March 2025. Starting at the 20th position in December, the brand improved its rank to 18th by March 2025. This steady climb indicates a strengthening presence in the Washington edible market. Despite a slight dip in sales in February, where sales fell to $101,728, Cosmic Candy managed to bounce back in March with a notable increase in sales, reaching $114,285. This rebound in sales, coupled with an improving rank, suggests effective strategies in place to capture market share in this competitive category.

Across other states and categories, Cosmic Candy's absence from the top 30 rankings indicates varying levels of market penetration. While their presence in Washington's edible market is noteworthy, the lack of ranking in other states or categories could highlight opportunities for growth or areas needing strategic adjustments. The data suggests that the brand might be focusing its efforts more heavily in Washington, which could be a strategic decision or a reflection of market challenges in other regions. Understanding these dynamics could be crucial for stakeholders looking to capitalize on Cosmic Candy's potential growth in the broader cannabis market.

Competitive Landscape

In the competitive landscape of the Edible category in Washington, Cosmic Candy has shown a promising upward trend in its rankings over the first quarter of 2025. Starting from the 20th position in December 2024, Cosmic Candy improved its rank to 18th by March 2025, indicating a positive trajectory in market presence. This improvement is noteworthy considering the performance of competitors like Verdelux, which experienced a decline from 17th to 19th place, and Constellation Cannabis, which also saw fluctuations but maintained a higher rank than Cosmic Candy. Meanwhile, Honu consistently held a stronger position, fluctuating between 15th and 16th place. Despite these competitive pressures, Cosmic Candy's sales growth from $102,106 in December 2024 to $114,285 in March 2025 reflects a strategic advantage in capturing consumer interest and suggests potential for further market share gains.

Notable Products

In March 2025, the top-performing product for Cosmic Candy was the Flying Saucer Indica Big Bang Blue Raspberry Gummies 10-Pack, maintaining its number one rank across all months with sales reaching 3015 units. The Flying Saucer Sativa Big Bang Blue Raspberry Gummies 10-Pack consistently held the second position, showing a notable increase in sales to 1952 units. The Flying Saucers Indica Supernova Strawberry Gummy 10-Pack remained steady at rank three, with a gradual sales increase to 1432 units. The Flying Saucer Sativa Planetary Peach Gummies 10-Pack, ranked fourth, saw a slight dip in sales compared to the previous month. Lastly, the Flying Saucers Sativa Supernova Strawberry Gummies 10-Pack secured the fifth position, maintaining its rank since its introduction in February 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.