Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

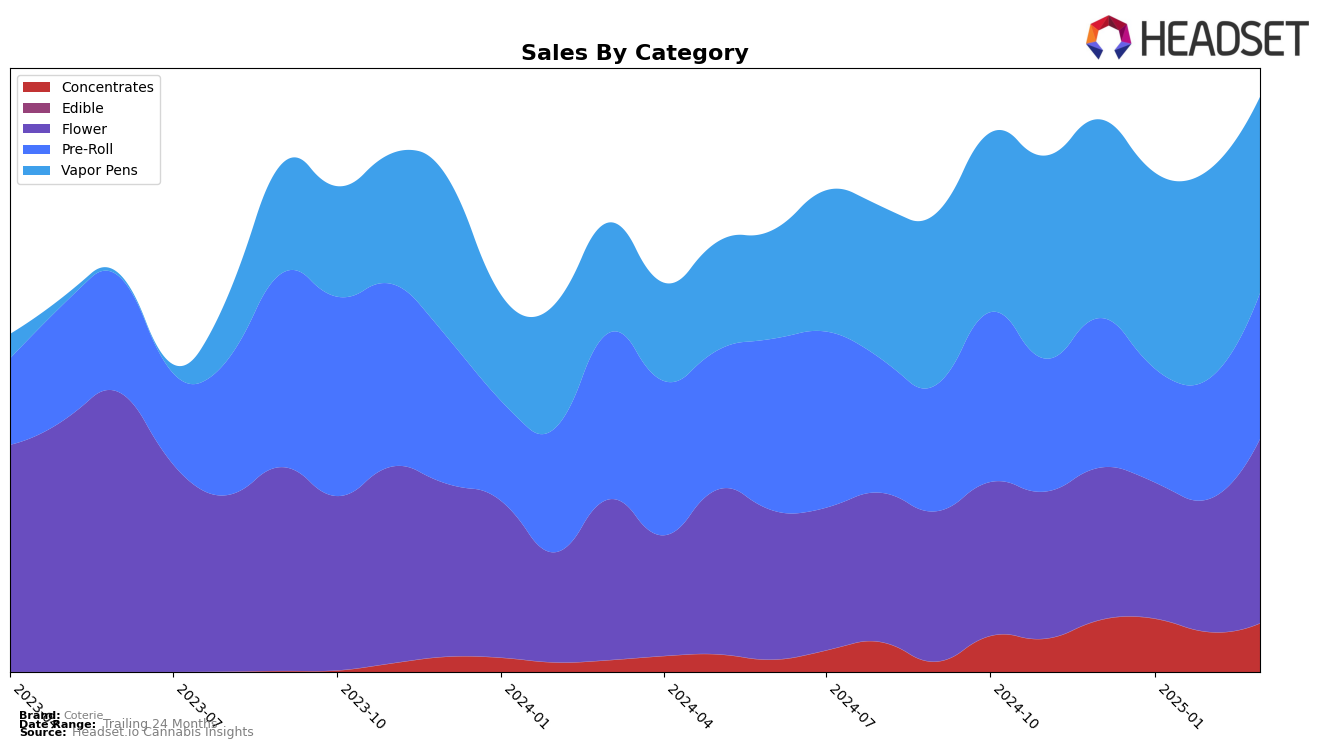

In Alberta, Coterie has shown varied performance across different cannabis categories. The brand maintained a consistent position in the Vapor Pens category, holding steady at the 22nd rank from January to March 2025. This stability suggests a strong foothold in this segment, despite a slight decline in sales in March. Conversely, Coterie's performance in the Flower category has been less stable, with a drop from 62nd in January to 83rd in March. This indicates challenges in maintaining market competitiveness in this category. The Pre-Roll category, however, saw a consistent rank of 52nd in February and March, demonstrating some level of resilience despite fluctuations in sales. Concentrates showed some improvement, moving from 17th in February to 15th in March, which could be indicative of strategic adjustments or increased consumer interest.

In Ontario, Coterie's performance in the Flower category improved significantly, climbing from 82nd in January to 49th in March. This upward trend suggests a strengthening market presence and possibly effective product offerings or marketing strategies. The Vapor Pens category also saw positive movement, improving from 69th in January to 53rd in March. However, Coterie only entered the top 30 brands in the Vapor Pens category in Saskatchewan in February, ranking 31st, which indicates potential for growth in this new market. Notably, Coterie was not ranked in the top 30 for Pre-Rolls in Ontario until February, when they entered at 97th, eventually moving to 88th by March. This late entry into the rankings could signify emerging opportunities or increased competition in the region.

Competitive Landscape

In the Ontario flower category, Coterie has demonstrated a notable upward trajectory in its rankings over the past few months, moving from 81st in December 2024 to an impressive 49th by March 2025. This positive trend indicates a significant improvement in market presence and consumer preference. In contrast, 5 Points Cannabis and Catch Me Outside have shown fluctuating rankings, with 5 Points Cannabis slightly improving from 43rd to 48th and Catch Me Outside remaining relatively stable around the 50th mark. Meanwhile, PIFF has seen a slight decline, dropping from 45th to 50th. Interestingly, BC Smalls has made a remarkable leap from 90th to 46th, surpassing Coterie in March 2025. Despite this, Coterie's sales have shown a strong upward trend, particularly in March 2025, suggesting a growing consumer base and potential for continued rank improvement. This competitive landscape highlights Coterie's potential to capitalize on its momentum and further solidify its position in the Ontario flower market.

Notable Products

In March 2025, the top-performing product from Coterie was the Prickly Pear Liquid Diamonds Cartridge (1g) in the Vapor Pens category, which ascended to the number one rank with sales of 3,419 units. This product climbed from its consistent second position in the previous months. The Fruity Pebbles Double Infused Blunt (1g) in the Pre-Roll category also showed strong performance, rising to second place from third in February, with notable sales figures. The Granny Smith Live Resin Cartridge (1g), despite its drop to third place, maintained robust sales, having previously held the top rank for three consecutive months. Lastly, the Sour Apple Double Infused Blunt (1g) maintained its fourth position, while the Platinum Pressed Temple Ball Hash (2g) remained steady in fifth place, showing a slight recovery in sales from February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.