Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

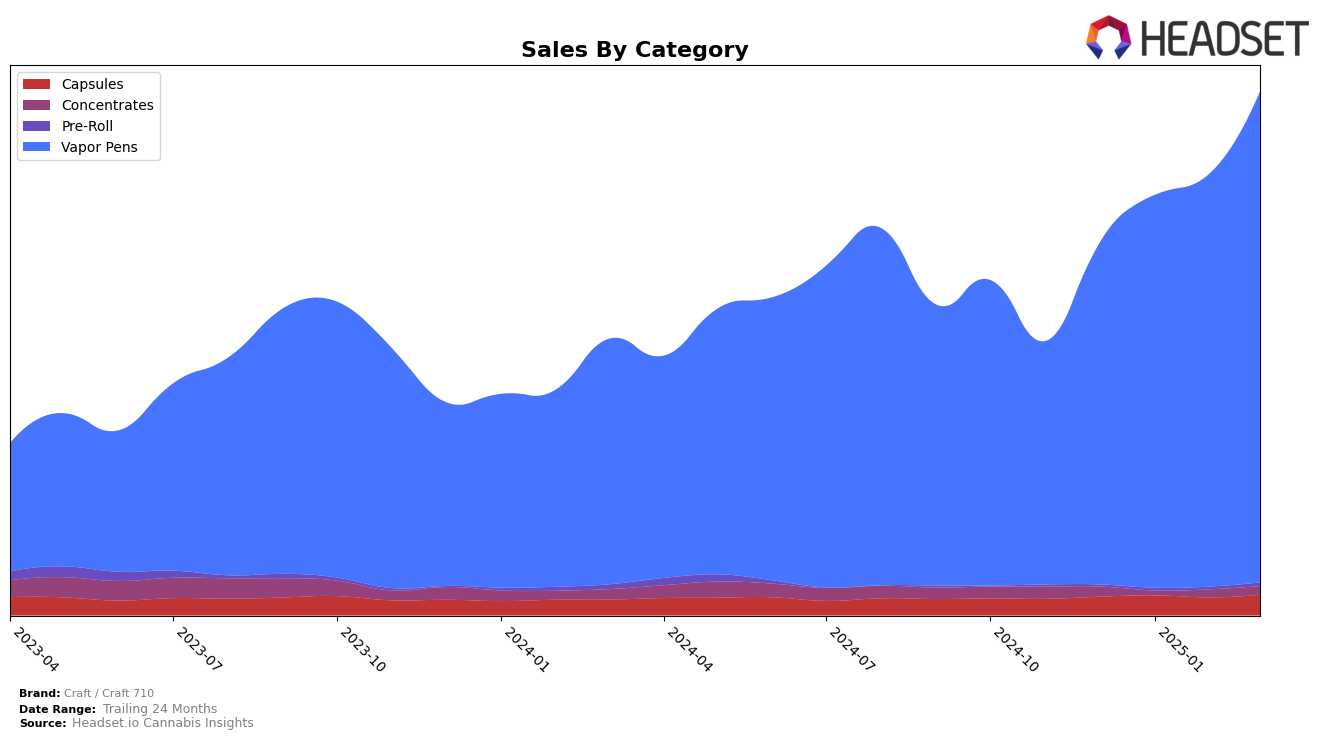

Craft / Craft 710 has exhibited a consistent performance in the Colorado market, particularly within the Capsules category, maintaining a steady second-place ranking from December 2024 through March 2025. This stability is indicative of a strong foothold in the market, with sales figures showing a positive trend, culminating in a noticeable increase in March. However, the brand's presence in the Concentrates category is less prominent, with a ranking of 46 in December 2024, and no subsequent ranking in the top 30 for the following months, suggesting either a strategic shift away from this category or increased competition.

In the Vapor Pens category, Craft / Craft 710 has demonstrated robust growth in Colorado, moving from fifth place in December 2024 to maintaining a solid fourth place from January to March 2025. This upward trajectory in ranking is accompanied by a significant increase in sales, indicating strong consumer demand and effective market strategies. The absence of rankings in other states or provinces could imply a concentrated effort in the Colorado market or challenges in expanding their footprint beyond this region. This focused approach might be serving the brand well in maintaining its leading positions in its key categories within Colorado.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Craft / Craft 710 has demonstrated a consistent upward trajectory in both rank and sales from December 2024 to March 2025. Starting at rank 5 in December 2024, Craft / Craft 710 improved to rank 4 by January 2025 and maintained this position through March 2025, indicating a strengthening market presence. This upward movement is complemented by a notable increase in sales, with March 2025 figures showing a significant rise compared to December 2024. In contrast, Packs (fka Packwoods) remained at rank 6 during the same period, with sales showing a fluctuating pattern. Meanwhile, Batch Extracts experienced a decline from rank 3 in December 2024 to rank 5 in January 2025, where it stayed through March 2025, alongside a decrease in sales. Bonanza Cannabis Company consistently held the second position, with sales figures significantly higher than Craft / Craft 710, while PAX maintained a steady rank 3, showing robust sales growth. These dynamics suggest that Craft / Craft 710 is effectively capturing market share and enhancing its competitive stance in the Colorado vapor pen category.

Notable Products

In March 2025, the top-performing product for Craft / Craft 710 was Sativa Dablets - Energy Tablets 10-Pack (100mg) from the Capsules category, maintaining its first-place rank consistently from December 2024 to March 2025, with sales reaching 5927 units. Dablets - Sleep Tablets 10-Pack (100mg), also in the Capsules category, held steady in second place throughout the same period. Ghost Banana Oil Distillate Cartridge (1g) emerged as a strong contender in the Vapor Pens category, debuting at third place in March. Watermelon Ice Hash Oil Distillate Cartridge (1g), another Vapor Pens product, slipped from third place in February to fourth place in March. Finally, Orange Sorbet Oil Tanker Disposable (4g) entered the rankings at fifth place in March, showcasing a solid performance among new entries.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.