Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

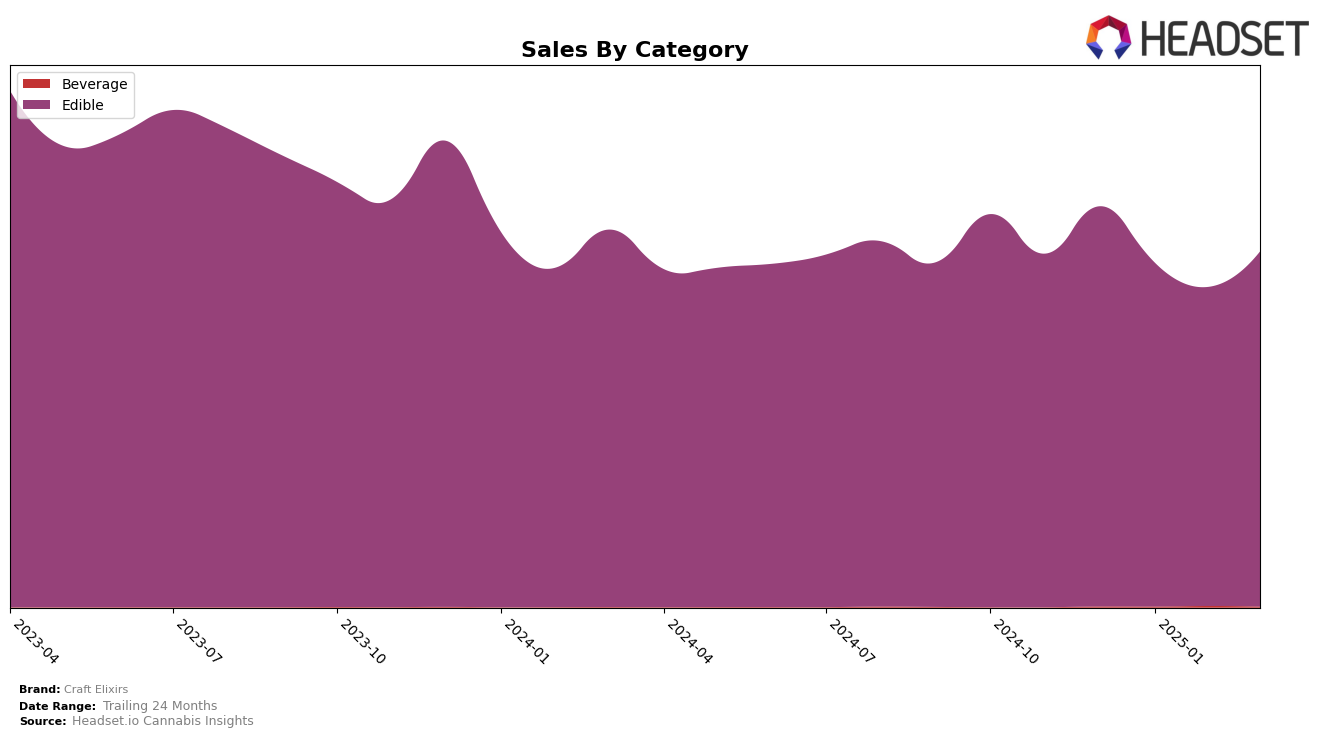

Craft Elixirs has shown consistent performance in the Washington market, particularly within the Edible category. Across the months from December 2024 to March 2025, the brand has maintained a steady presence in the top five rankings, oscillating between the 4th and 5th positions. This stability suggests a robust brand presence and a loyal customer base in the state. Despite a dip in sales from December to February, the brand experienced a rebound in March, indicating resilience and potential seasonal or promotional influences at play. The ability to remain in the top tier despite fluctuations highlights Craft Elixirs' strong foothold in the Washington edible market.

However, it's worth noting that Craft Elixirs was not present in the top 30 brands for any other state or province during this period. This absence could be viewed as a missed opportunity for expansion or a strategic focus on their home market of Washington. While the brand's performance in Washington is commendable, the lack of presence in other markets might suggest areas for growth or diversification. Observing how Craft Elixirs navigates these dynamics in future months will be crucial for understanding their broader market strategy and potential for scaling beyond Washington.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Washington, Craft Elixirs has shown resilience and consistency in maintaining its position among the top brands. As of March 2025, Craft Elixirs holds the 5th rank, a slight dip from its 4th position in December 2024. This fluctuation indicates a competitive tussle with Journeyman, which has alternated positions with Craft Elixirs, reflecting a closely matched sales performance. Despite this, Craft Elixirs remains a strong contender, consistently outperforming Smokiez Edibles and Good Tide, both of which have seen lower sales figures. However, Hot Sugar maintains a steady 3rd rank, suggesting a significant sales lead over Craft Elixirs. This competitive environment underscores the importance for Craft Elixirs to innovate and strategize effectively to regain and potentially surpass its previous rankings.

Notable Products

In March 2025, the top-performing product for Craft Elixirs was Pioneer Squares - Black & Blueberry Fruit Nom 10-Pack (100mg), maintaining its number one rank for four consecutive months with a sales figure of 5942. Pioneer Squares - Pink Lemonade Fruit Nom Chews 10-Pack (100mg) and Pioneer Squares - Watermelon Kiwi Fruit Nom 10-Pack (100mg) both shared the second rank, with the Pink Lemonade variant climbing up from third place in February. Pioneer Squares - Pineapple Crush Fruit Nom 10-Pack (100mg) improved to third place, up from fourth in February. Notably, the Pioneer Squares - THC:CBG 1:1 Key Lime Pie Fruit Nom Gummies 10-Pack (100mg THC, 100mg CBG) entered the rankings for the first time in March at fourth place, indicating a strong debut. This dynamic shift highlights the growing consumer interest in new product offerings within the Edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.