Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

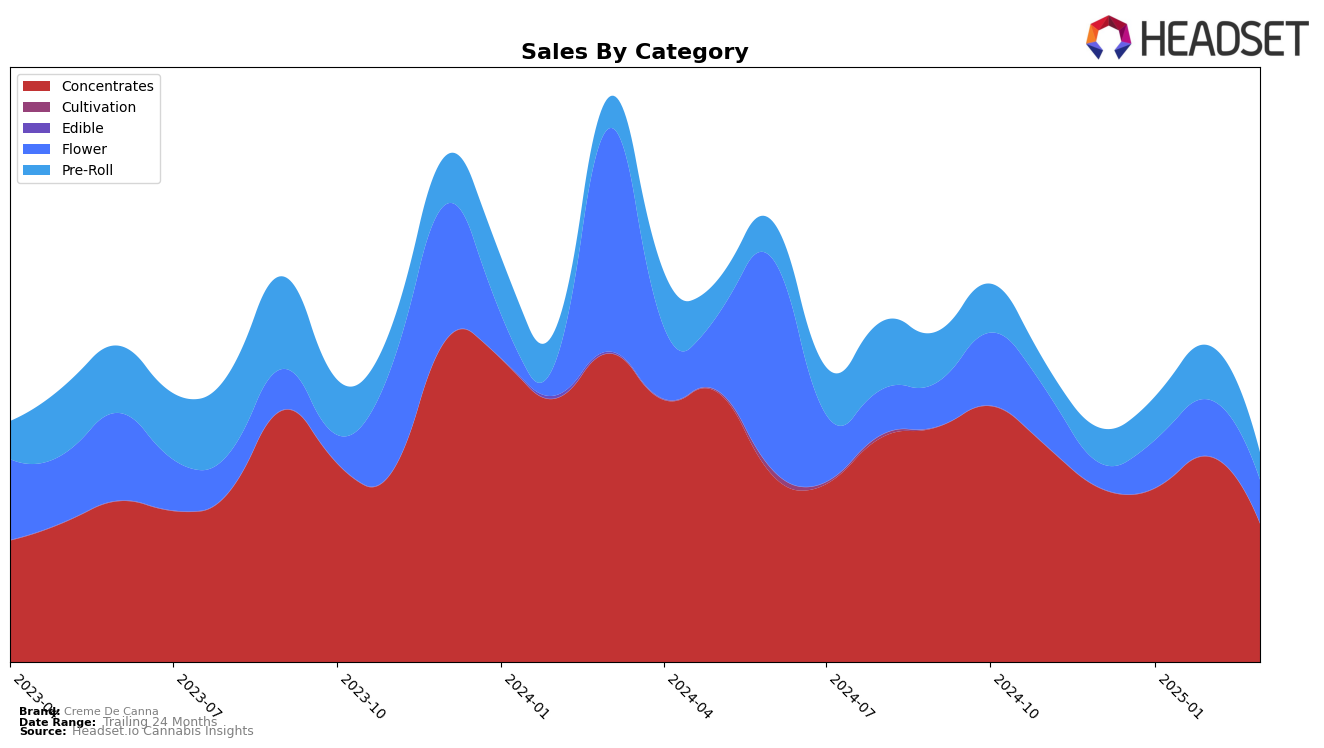

Creme De Canna has shown fluctuating performance in the Concentrates category within the state of California. Starting from December 2024, the brand was ranked 24th, showing an improvement to 21st in January 2025, and further climbing to 16th in February 2025. However, this upward momentum was not sustained, as March 2025 saw a significant drop to 28th place, indicating potential challenges in maintaining its competitive edge. This decline in ranking in March might be a signal for the brand to reassess its strategies in the California market to regain lost ground.

Despite the ranking fluctuations, Creme De Canna experienced a notable increase in sales from January to February 2025, which suggests that they were able to capture consumer interest effectively during that period. However, the subsequent drop in sales in March aligns with their decreased ranking, highlighting a potential correlation between sales performance and market position. The absence of a ranking in the top 30 for some months could be concerning for stakeholders looking to maintain a consistent presence in the competitive landscape. Such insights into market dynamics are crucial for understanding the broader implications of market strategies and consumer preferences.

Competitive Landscape

In the competitive landscape of California's concentrates category, Creme De Canna has experienced notable fluctuations in its market rank over the past few months. Starting from December 2024, Creme De Canna was ranked 24th, climbing to 21st in January 2025, and further improving to 16th in February 2025, before dropping to 28th in March 2025. This volatility highlights the dynamic nature of the market. Competitors like UP! and Clsics have shown varied performances, with UP! starting strong at 21st in December but dropping to 27th by March, while Clsics improved from 32nd to 26th over the same period. Meanwhile, Team Elite Genetics and Hashtag have been climbing the ranks, with Hashtag moving from 54th to 30th, indicating a positive trend. These shifts suggest that while Creme De Canna has seen some success, it faces stiff competition and must strategize to maintain and improve its position in the California concentrates market.

Notable Products

In March 2025, the top-performing product from Creme De Canna was Runtz Popz Diamond Sauce (1g) in the Concentrates category, which climbed to the number 1 rank from 3rd place in February. Another standout was Platinum Kush Diamond Infused Pre-Roll (1g), which maintained its strong position at 2nd place. Kush Cream Diamond Sugar (1g) saw an improvement, moving from 5th in February to 3rd in March, with sales reaching 551.0. Lemon Driver Diamond Sugar (1g) debuted in 4th place, while Medellin Jet Fuel Diamond Sauce (1g) dropped from 4th to 5th place. Overall, the Concentrates category showed dynamic shifts, with several products experiencing changes in rankings month over month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.