Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

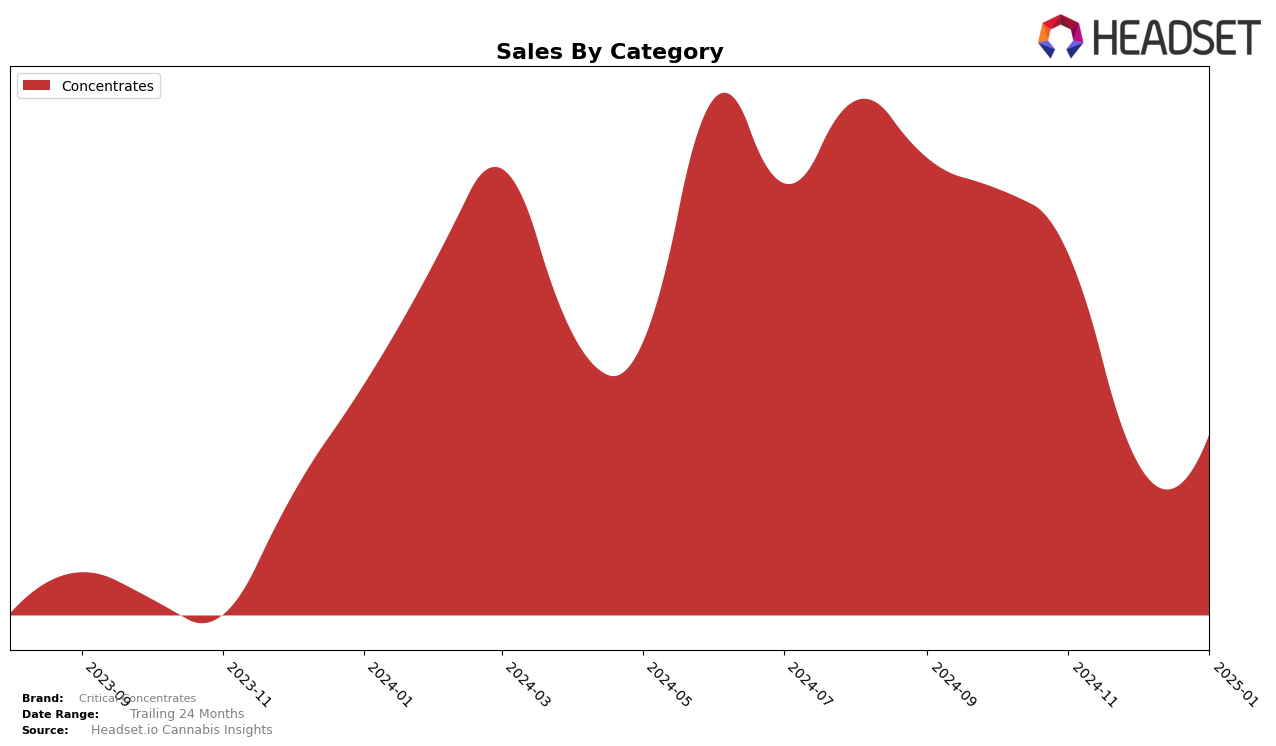

Critical Concentrates has shown a dynamic performance in the New York market, specifically within the concentrates category. Over the recent months, the brand's ranking has experienced fluctuations, moving from 8th place in October 2024 to 14th place by January 2025. This movement indicates a notable shift in market positioning, suggesting either increased competition or changes in consumer preferences. Despite the drop in ranking, it's important to note that Critical Concentrates has maintained a presence in the top 30 brands, which underscores its sustained relevance and appeal in the New York market.

Analyzing the sales trends, Critical Concentrates experienced a decline in sales from October to December 2024, with a significant drop in December. However, January 2025 saw a slight recovery in sales figures, suggesting a potential stabilization or strategic adjustment by the brand. The absence of Critical Concentrates from the top 30 in any other states or provinces during this period highlights a concentrated market presence primarily in New York. This focus could be interpreted as a strategic decision to strengthen its foothold in a specific geographic market, rather than spreading resources thin across multiple regions.

Competitive Landscape

In the competitive landscape of the concentrates category in New York, Critical Concentrates has experienced notable fluctuations in its market position from October 2024 to January 2025. Initially ranked 8th in October, the brand saw a decline to 12th in November and further slipped to 15th in December, before slightly recovering to 14th in January. This downward trend in rankings coincides with a significant drop in sales during the same period. In contrast, House of Sacci maintained a relatively stable position, consistently ranking around 11th to 12th, with sales figures showing resilience. Meanwhile, American Hash Makers held steady at 13th place throughout these months, indicating a stable performance despite Critical Concentrates' volatility. The consistent presence of urbanXtracts and Lobo in the lower ranks suggests a less competitive threat, yet their stable sales may indicate niche market appeal. These dynamics highlight the challenges Critical Concentrates faces in maintaining its market share amidst strong competition and shifting consumer preferences.

Notable Products

In January 2025, Critical Concentrates' top-performing product was Kiyomi Live Rosin (1g), maintaining its first-place rank from the previous two months, with sales reaching 277 units. Champaya Cold Cure Live Rosin (1g) showed a significant rise, moving up from fifth to second place with 202 units sold. Rated R Live Rosin (1g) re-entered the top rankings, securing third place, although its sales decreased to 117 units. Tahoe Brunch Fresh Pressed Live Rosin (1g) made its debut in the rankings at fourth place. Lemon Haze Cold Cure Live Rosin (1g) dropped to fifth place, continuing its decline from the top spot in October 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.