Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

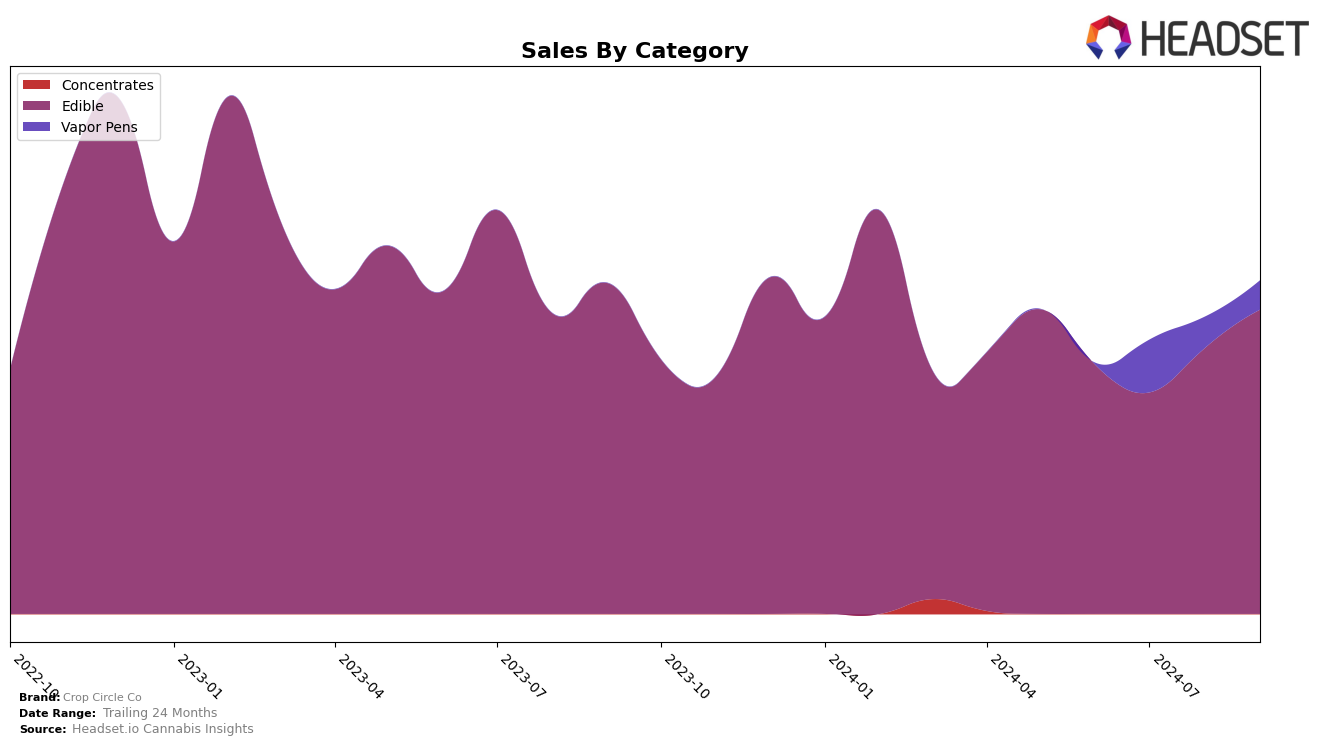

Crop Circle Co has shown notable movements in the Oregon market, particularly within the Edible category. In June 2024, they were ranked at 34th, but they were not in the top 30 in July, indicating a potential drop in visibility or sales during that month. However, the brand rebounded in August, securing the 36th spot, and further improved to 28th by September. This upward trajectory suggests a positive trend in their market performance, possibly driven by a strategic adjustment or increased consumer demand. The sales figures for September, which saw a notable increase, underscore this improvement.

It's worth noting that Crop Circle Co's absence from the top 30 in July could highlight a competitive market environment or seasonal fluctuations affecting their performance. The brand's ability to re-enter and climb the rankings in subsequent months indicates resilience and potential adaptability in their business strategy. By September, their enhanced ranking suggests a strengthening position within the Oregon market, which could be a promising sign for stakeholders keeping an eye on emerging trends in the cannabis industry. However, further analysis would be needed to understand the specific factors contributing to these shifts fully.

Competitive Landscape

In the competitive landscape of the Oregon edible market, Crop Circle Co has shown a promising upward trajectory in recent months. Despite not ranking in the top 20 in July 2024, the brand made significant strides, climbing from 36th in August to 28th by September. This improvement in rank coincides with a noticeable increase in sales, suggesting a growing consumer preference for their products. In comparison, Green State of Mind maintained a relatively stable position, hovering around the 29th rank in September, while SugarTop Buddery experienced a slight decline, dropping to 30th. Notably, Willamette Valley Alchemy and She Don't Know consistently outperformed Crop Circle Co in sales, yet both showed a downward trend over the months, indicating potential opportunities for Crop Circle Co to capture more market share if this trend continues.

Notable Products

In September 2024, Crop Circle Co's top-performing product was the Strawberry Lemonade Rosin Truffle (100mg) in the Edible category, climbing to the number one rank with sales of 272 units. The Raspberry Rosin Truffles (100mg) maintained a strong presence, albeit dropping to the second position from its previous first rank in August, with sales reaching 185 units. The Orange Yuzu Chocolate Truffles 5-Pack (100mg) showed a resurgence, moving from an unranked position in August to third place in September. The Blueberry Rosin Truffle (100mg) and High Dose Truffle Mint Chocolate (50mg) both secured the fourth position, indicating consistent demand despite not being ranked in August. Overall, the Edible category dominated the top ranks, showcasing a significant shift in consumer preference towards these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.