Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

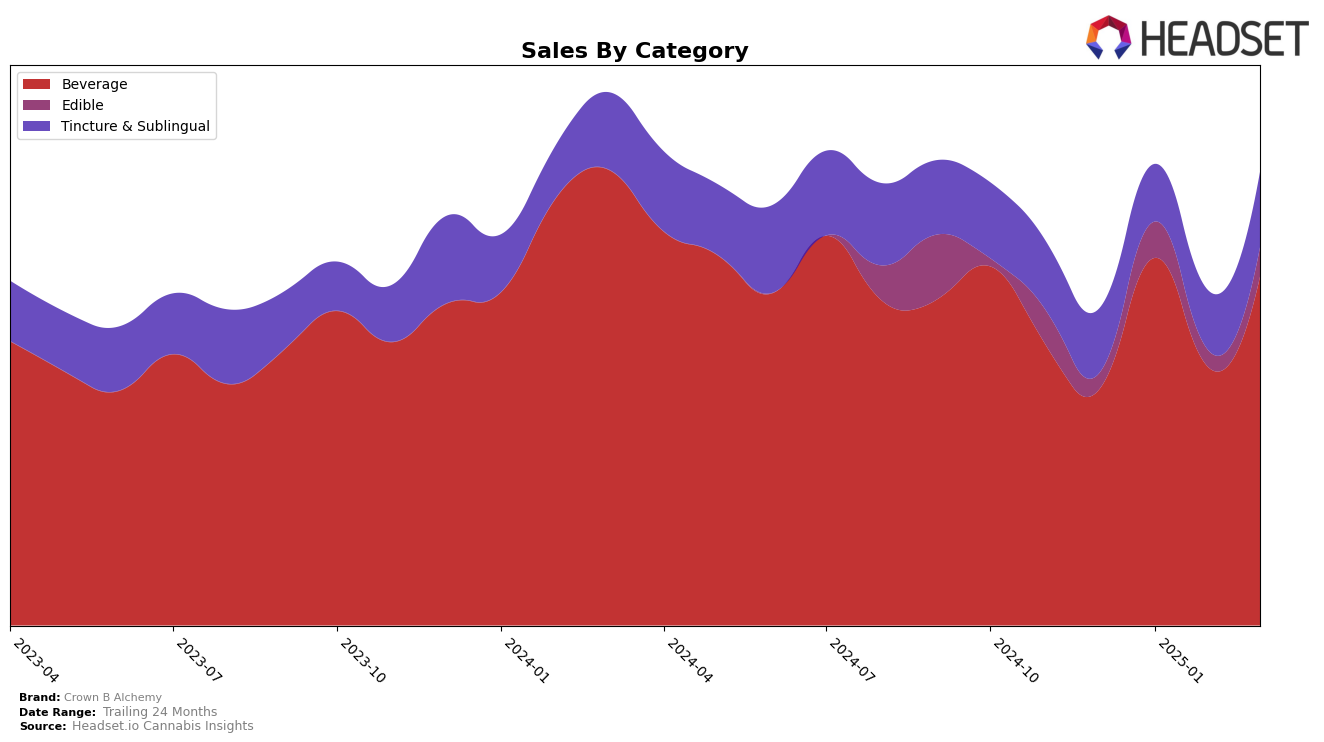

Crown B Alchemy has shown a consistent performance in the Oregon market, particularly in the Beverage category. Maintaining a steady rank of 4th place from December 2024 through March 2025, the brand has demonstrated stability and a solid foothold in this segment. This consistency is further underscored by a notable increase in sales from December to January, followed by a slight dip and then a recovery by March. Such movements suggest a resilient demand for their beverage products, despite fluctuations in monthly sales figures. In contrast, the brand's presence in the Edible category is less stable, with rankings appearing only in January and March, indicating challenges in maintaining a top-tier position consistently.

In the Tincture & Sublingual category, Crown B Alchemy has shown upward momentum within Oregon. Starting at a rank of 10 in December 2024, the brand improved its position to 7th by March 2025, highlighting a positive trend in consumer preference or possibly a strategic market push. This upward trajectory is accompanied by a steady increase in sales, suggesting a growing acceptance and demand for their tincture and sublingual products. However, the absence of a top 30 ranking in the Edible category for two out of the four months suggests areas for potential improvement or market challenges that the brand might need to address to enhance its overall market presence.

Competitive Landscape

In the competitive landscape of the Oregon beverage category, Crown B Alchemy consistently held the 4th rank from December 2024 to March 2025, indicating a stable position amidst fluctuating sales figures. Despite a dip in sales in February 2025, Crown B Alchemy rebounded in March, showcasing resilience in a competitive market. The top competitor, Keef Cola, maintained its dominance with a consistent 2nd rank, significantly outperforming Crown B Alchemy in sales. Meanwhile, Mule Extracts held the 3rd rank, closely trailing Keef Cola but still ahead of Crown B Alchemy. Hapy Kitchen remained steady at 5th place, while Fruit Lust showed some movement, improving from 8th to 6th place by March. This competitive environment underscores the importance for Crown B Alchemy to innovate and differentiate to climb the ranks and increase its market share.

Notable Products

In March 2025, Pineapple Gummies 2-Pack (100mg) emerged as the top-performing product for Crown B Alchemy, maintaining its leadership position from January 2025 after a brief absence in February. The Cannabull - POG Nano Syrup (1000mg THC, 4oz) climbed to second place, showing a notable increase in sales to 479 units from its fifth position in January. Cannabull - Mango Nano Syrup (1000mg THC, 4oz) ranked third, slightly declining from its second-place finish in January. Cannabull - Green Apple Nano Syrup (1000mg THC, 4oz) remained consistent in fourth place, while Cannabull Moonlight Serenade - CBD/THC/CBN 1:1:1 Marionberry Syrup (200mg CBD, 200mg THC, 200mg CBN, 4fl oz) rounded out the top five, dropping from its third-place ranking in January. These shifts highlight a competitive landscape within the beverage category for Crown B Alchemy.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.