Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

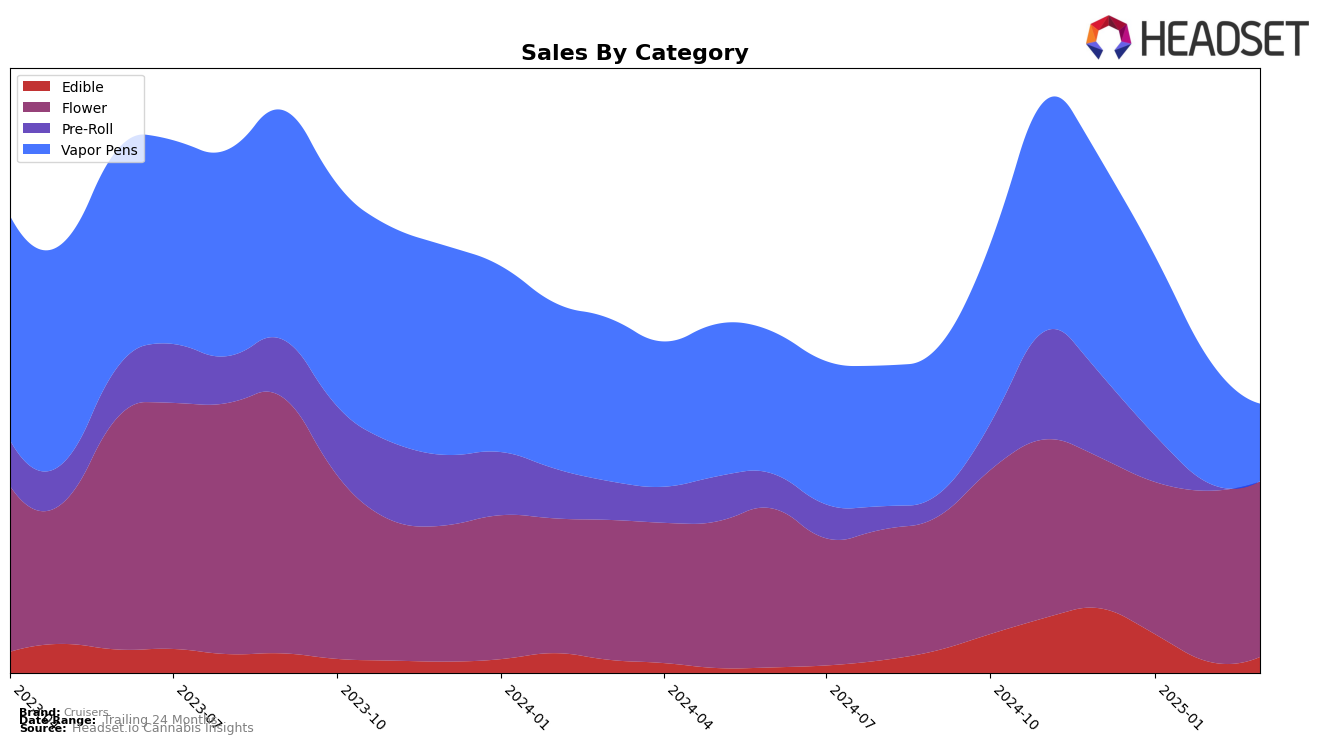

In California, the performance of Cruisers across different categories has shown notable fluctuations. In the Edible category, Cruisers experienced a decline in rank, moving from 17th in December 2024 to 35th by March 2025. This indicates a significant drop, as they were not even in the top 30 during February 2025. In contrast, the Flower category saw a positive trend, with Cruisers climbing from 30th in January 2025 to 19th by February 2025, before slightly dipping to 24th in March. This upward movement in Flower suggests a growing consumer preference for their offerings in this category, even though the Edible segment struggled to maintain its position.

The Pre-Roll and Vapor Pens categories present a mixed picture for Cruisers. While the Pre-Roll category saw them drop out of the top 30 after January 2025, reflecting a concerning decline, the Vapor Pens category also showed a downward trajectory, with their rank falling from 17th in December 2024 to 40th by March 2025. Despite this decline, the Vapor Pens segment still managed to generate substantial sales, indicating a potential area for strategic focus. These movements highlight the varying dynamics within the California market, underscoring the importance of category-specific strategies for maintaining competitive positioning.

Competitive Landscape

In the competitive landscape of the Flower category in California, Cruisers has demonstrated notable fluctuations in its market position from December 2024 to March 2025. Starting at rank 28 in December 2024, Cruisers improved significantly to rank 19 in February 2025, before settling at rank 24 in March 2025. This upward trend in rank is indicative of a positive reception and increased sales momentum, contrasting with competitors like Jungle Boys, which fell from rank 17 to 23 over the same period, and Maven Genetics, which consistently ranked lower than Cruisers. Despite Yada Yada maintaining a relatively stable position, Cruisers' ability to surpass them in February suggests a competitive edge. Furthermore, Originals showed a slight improvement, but Cruisers' consistent sales growth highlights its potential to capture more market share. These dynamics underscore Cruisers' strategic positioning and potential for continued growth in the California Flower market.

Notable Products

In March 2025, the top-performing product for Cruisers was the Lemon Jack Distillate Cartridge (1g) in the Vapor Pens category, achieving the number one rank with sales of 8,750 units. The San Fernando Valley OG Distillate Cartridge (1g), also in Vapor Pens, secured the second position, improving from fifth place in February. Mango Gummies 20-Pack (100mg) emerged as a strong contender in the Edible category, ranking third without prior rankings in earlier months. Diesel Jack (3.5g) in the Flower category made its debut at fourth rank. Pineapple Express Distillate Cartridge (1g) saw a drop from second to fifth, indicating a shift in consumer preferences within the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.