Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

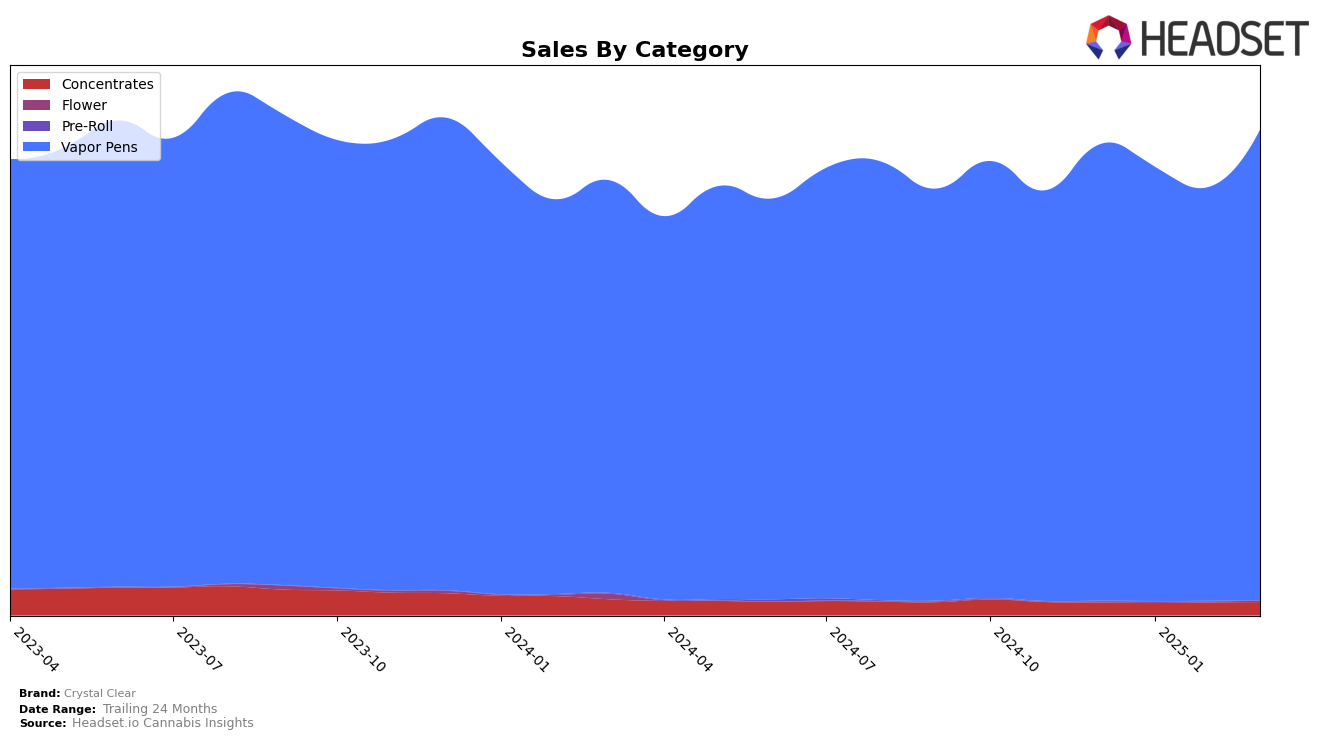

Crystal Clear's performance in the vapor pen category shows varied results across different states. In California, the brand has struggled to break into the top 30, consistently ranking outside of it from December 2024 to March 2025. This suggests a challenging market environment or increased competition. Conversely, in Illinois, Crystal Clear maintained a steady position around the 17th and 18th ranks, with a notable increase in sales in March 2025. In Massachusetts, the brand improved its rank from 11th in December 2024 to 9th by March 2025, indicating a positive trend in consumer preference or market penetration.

In Washington, Crystal Clear's presence in the concentrates category saw a rank improvement from 18th in December 2024 to 13th in February 2025, before slightly dropping to 16th in March 2025. This fluctuation could reflect shifts in consumer demand or competitive pressures. However, the brand's performance in the vapor pens category in Washington is notably strong, consistently holding the 2nd rank throughout the period, with sales peaking in March 2025. This consistency suggests a robust brand presence and consumer loyalty in the state. Understanding these dynamics can provide insights into the brand's strategic positioning and potential growth areas.

Competitive Landscape

In the Washington Vapor Pens category, Crystal Clear consistently maintained its position as the second-ranked brand from December 2024 through March 2025. Despite a steady rank, Crystal Clear faced stiff competition from Mfused, which held the top spot throughout the same period, indicating a significant lead in market dominance. Crystal Clear's sales showed a positive trend in March 2025, suggesting a potential closing of the gap with the leading brand. Meanwhile, Sticky Frog and Micro Bar maintained their positions but did not pose a significant threat to Crystal Clear's rank, as they remained consistently lower in both rank and sales. This competitive landscape highlights Crystal Clear's strong market presence and potential for growth in the Washington Vapor Pens market.

Notable Products

In March 2025, Northern Lights Distillate Cartridge (1g) maintained its position as the top-performing product for Crystal Clear, with sales reaching 7187 units. Blue Dream Terp Sauce Cartridge (1g) held steady in second place, although its sales figures slightly decreased compared to previous months. Maui Wowie Blast Distillate Disposable (1g) showed a notable improvement, climbing to third place from fourth in February 2025. Maui Wowie Distillate Cartridge (1g) experienced a slight decline, dropping to fourth place from its consistent third-place ranking in prior months. Alaskan Thunder Fuck Distillate Cartridge (1g) re-entered the rankings at fifth place, indicating a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.