Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

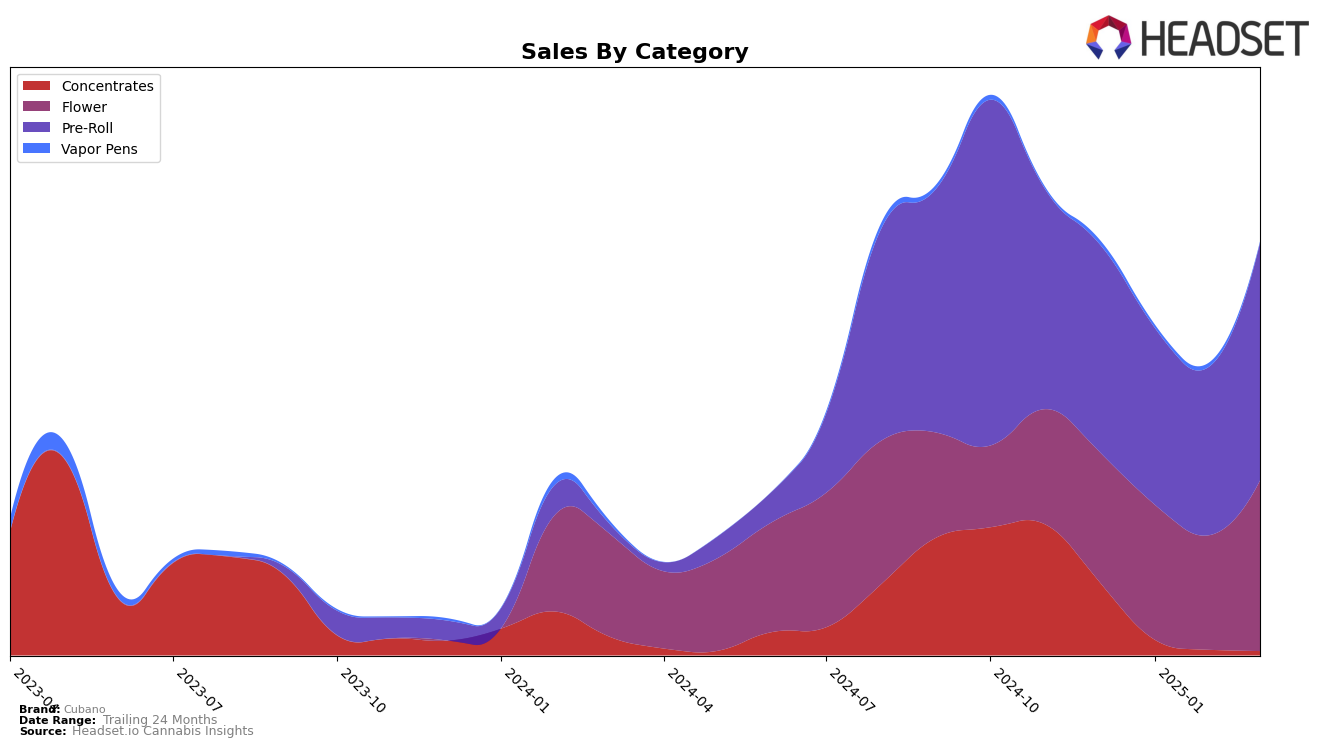

In the state of Missouri, Cubano has shown a dynamic performance across various cannabis categories. Notably, in the Pre-Roll category, Cubano maintained a relatively strong presence, bouncing back to the 25th position in March 2025 after fluctuating slightly in the preceding months. This suggests a resilient demand for their pre-roll products, possibly indicating a loyal consumer base. In contrast, their performance in the Concentrates category saw them falling out of the top 30 by January 2025, highlighting a potential area for improvement or increased competition in this segment. Meanwhile, their Flower category rankings showed some volatility, with a peak in March 2025, suggesting a positive trend worth monitoring.

Analyzing sales trends provides further insights into Cubano's market dynamics in Missouri. Their Flower sales demonstrated a notable upward trajectory, particularly from February to March 2025, where sales figures saw a significant increase. This could be indicative of successful marketing strategies or seasonal demand shifts impacting consumer preferences. On the other hand, the Pre-Roll category experienced a sales dip in January and February 2025, before recovering in March. Such fluctuations might reflect broader market trends or internal brand strategies that have influenced consumer purchasing behavior. The absence of Cubano in the top 30 for Concentrates post-December 2024 could be a point of concern, suggesting either a strategic withdrawal or a need for revitalized competitive tactics to regain market share in this category.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Missouri, Cubano has experienced fluctuating rankings, indicating a dynamic market presence. While Cubano's rank shifted from 26th in December 2024 to 25th by March 2025, it faced stiff competition from brands like Safe Bet and Robust, which both showed improvements in their standings, with Safe Bet reaching the 20th position in February 2025 and Robust peaking at 21st in the same month. Notably, Sundro Cannabis and Cousin Dave also demonstrated significant movement, with Sundro Cannabis climbing back to 26th in March 2025 after a dip, and Cousin Dave making a remarkable leap from 54th in December 2024 to 27th by March 2025. These shifts highlight the competitive pressures Cubano faces, as it strives to maintain and improve its market position amidst brands that are either consolidating or rapidly gaining traction. This analysis underscores the importance of strategic positioning and market responsiveness for Cubano to enhance its rank and sales in the evolving Missouri Pre-Roll market.

Notable Products

In March 2025, Cubano's top-performing product was French Royale Pre-Roll 0.5g in the Pre-Roll category, maintaining its top rank from February with sales reaching 2349 units. Following closely was French Royale Pre-Roll 2-Pack 1g, which rose to the second position. Tropicana Sherbert Pre-Roll 0.5g secured the third spot, marking a new entry in the rankings. Mr. Clean Pre-Roll 3-Pack 1.5g and Cheetoz 3.5g rounded out the top five, with notable sales improvements over previous months. Overall, the Pre-Roll category dominated the top rankings, indicating a strong consumer preference for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.