Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

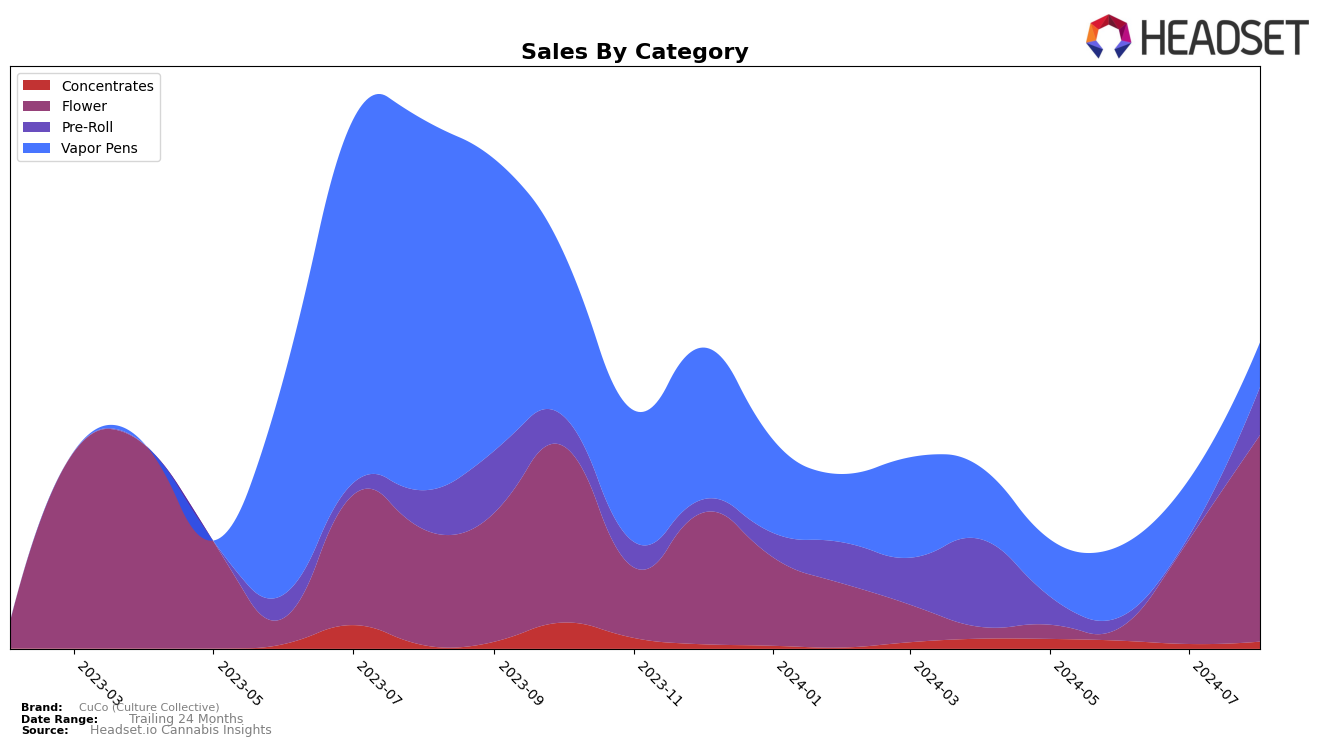

CuCo (Culture Collective) has demonstrated varied performance across different product categories in Missouri. In the Concentrates category, the brand did not make it to the top 30 rankings in any of the months from May to August 2024, indicating a need for improvement in this segment. However, the Flower category showed a promising upward trend. Starting from 51st place in May, CuCo climbed to 30th place by August, suggesting a significant increase in popularity and sales. This positive movement is a key indicator of the brand's growing footprint in the Flower category within the state.

The performance in the Pre-Roll category also reflects an interesting trajectory. Despite not being in the top 30 in June, CuCo managed to secure the 32nd spot by August, showing resilience and potential for future growth. In the Vapor Pens category, the brand's rankings fluctuated between 44th and 51st place, maintaining a presence but not breaking into the top 30. This consistency, albeit outside the top tier, suggests a stable but limited market share in Vapor Pens. Overall, CuCo's mixed results across categories highlight areas of both strength and potential improvement in Missouri.

Competitive Landscape

In the competitive landscape of the Missouri Flower category, CuCo (Culture Collective) has shown a significant upward trend in rank and sales over the past few months. Starting from a rank of 51 in May 2024, CuCo (Culture Collective) has climbed to rank 30 by August 2024, indicating a strong market presence and increasing consumer preference. This ascent is particularly noteworthy when compared to competitors such as Willie's Reserve, which has fluctuated between ranks 38 and 32, and Cookies, which has seen a decline from rank 26 to 28. Additionally, Blue Arrow experienced a significant drop from rank 19 to 33, while Gold Rush (MO) also showed volatility, moving from rank 37 to 29. CuCo (Culture Collective)'s consistent improvement in rank and sales highlights its growing influence in the Missouri market, making it a brand to watch closely in the Flower category.

Notable Products

In August 2024, the top-performing product for CuCo (Culture Collective) was Bluntz Pre-Roll (1g) in the Pre-Roll category, achieving the number one rank with sales of 8,927 units. Bluntz Popcorn (7g) in the Flower category secured the second spot, showing a significant rise from being unranked in previous months. Strawberry Gelatti (3.5g) also in the Flower category ranked third, marking its first appearance in the top five. Banana Macaroon (7g), another Flower product, dropped to fourth place from its second position in July. Cherry Burger Liquid Cured Resin Disposable (0.5g) in the Vapor Pens category rounded out the top five, experiencing a slight decline from its third-place ranking in July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.