Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

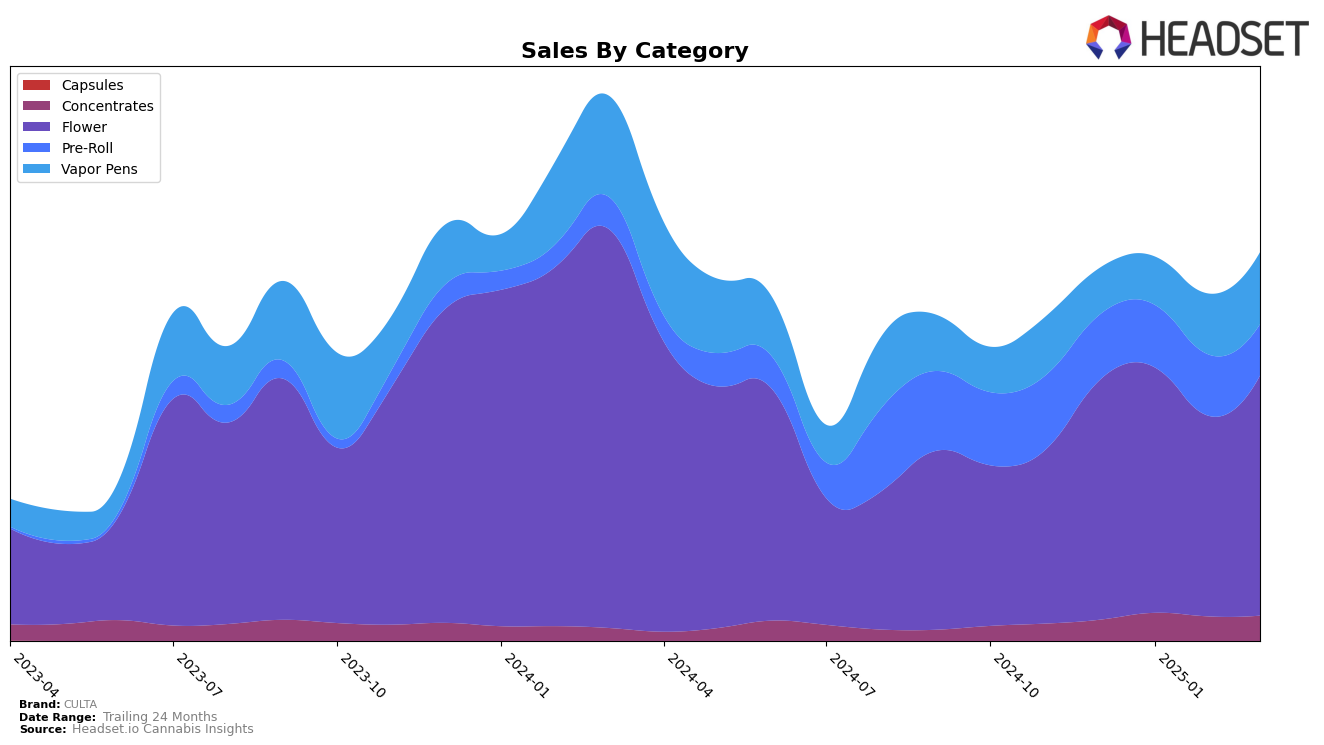

In the state of Maryland, CULTA has shown varied performance across different product categories. The brand has maintained a consistent presence in the top 30 rankings, particularly in the Pre-Roll category where it has consistently held the 10th position from January to March 2025. This stability suggests a strong foothold in the pre-roll market. On the other hand, the Flower category saw a slight decline in March 2025, dropping to the 15th position from the 12th position in January. This movement might indicate competitive pressures or shifting consumer preferences within the flower segment in Maryland.

In the Concentrates category, CULTA has been relatively stable, ranking between 13th and 15th over the past four months. This consistency indicates a steady demand for their concentrates despite fluctuations in sales figures. Notably, the Vapor Pens category witnessed a significant improvement, climbing from 19th in December 2024 to 15th by March 2025. This upward trend in the vapor pens segment could be indicative of successful marketing strategies or product innovations that resonated well with consumers. However, further analysis would be required to understand the specific factors driving these changes across categories.

Competitive Landscape

In the Maryland flower category, CULTA experienced fluctuations in its ranking over the months from December 2024 to March 2025, moving from 14th to 15th place. Despite this slight decline, CULTA's sales showed a positive trend, with a notable increase from February to March 2025. In comparison, Kind Tree Cannabis and Garcia Hand Picked both saw more significant rank changes, with Kind Tree Cannabis dropping from 9th to 14th and Garcia Hand Picked improving from 16th to 13th. Meanwhile, Good Green made a remarkable leap from 38th in December to consistently staying around 16th by March, indicating a strong upward sales trajectory. Nature's Heritage maintained a steady rank at 17th, showing gradual sales growth. These dynamics suggest that while CULTA faces stiff competition, particularly from rapidly ascending brands like Good Green, its sales resilience positions it well for potential future gains in market share.

Notable Products

In March 2025, Banana Bubbles 3.5g emerged as the top-performing product for CULTA, climbing from the fourth position in February to secure the number one spot with sales of 3080 units. Donnie's Element 3.5g made a strong debut, ranking second with notable sales figures. The Banana Bubbles Pre-Roll 5-Pack 2.5g saw a slight decline, dropping from the first position in February to third in March. Schism 3.5g and Guava Lava 3.5g both entered the rankings in March, placing fourth and fifth, respectively. These shifts indicate a dynamic change in consumer preferences, with Banana Bubbles 3.5g gaining significant popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.