Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

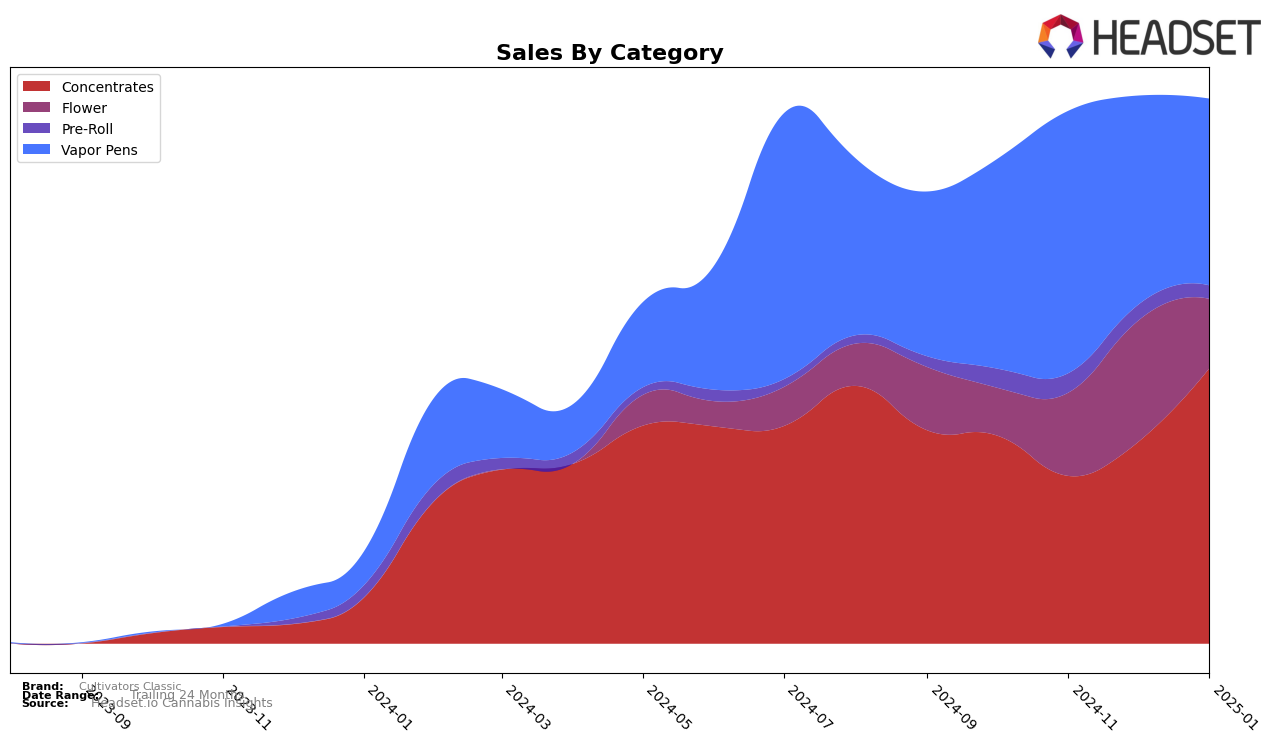

Cultivators Classic has demonstrated a strong performance in the Massachusetts market, particularly in the Concentrates category, where it consistently ranked within the top five brands from October 2024 to January 2025. This stability highlights the brand's robust positioning and appeal within this segment, with a notable improvement in January 2025 when it climbed to the third position. Such performance suggests effective market strategies and consumer preference for their concentrates. In contrast, their presence in the Flower category was less prominent, as they did not make it into the top 30 in October 2024, only to later emerge in the rankings in subsequent months, peaking at 66th place in December 2024. This fluctuation may indicate challenges in maintaining a competitive edge in the Flower market.

In the Vapor Pens category, Cultivators Classic's performance was somewhat variable, with rankings oscillating between the 25th and 31st positions across the observed months. Despite this variability, the brand managed to maintain a presence within the top 30, suggesting a steady, albeit modest, foothold in this category. Interestingly, while sales figures for Vapor Pens showed fluctuations, the brand's ability to stay within the top rankings could imply a loyal customer base or effective promotional efforts. The absence from the top 30 in the Flower category during October 2024, however, indicates potential areas for growth or reevaluation of strategies to enhance their standing in this segment.

Competitive Landscape

In the Massachusetts concentrates market, Cultivators Classic has experienced notable fluctuations in its ranking and sales performance over the past few months. Starting in October 2024, Cultivators Classic held the 4th position, but slipped to 5th in December, before rebounding to 3rd in January 2025. This upward movement in rank is particularly significant given the competitive landscape dominated by brands like Good Chemistry Nurseries, which consistently held the top spot, and Crispy Commission Concentrates, maintaining a steady 2nd place. Despite the challenges, Cultivators Classic's January sales showed a strong recovery, surpassing its October figures, indicating a positive trend and potential for increased market share. Meanwhile, Nature's Heritage experienced a decline in rank from 3rd to 4th, and Bountiful Farms saw a brief rise to 4th in December before returning to 5th, highlighting the dynamic shifts within the top tier of this category.

Notable Products

In January 2025, Jungle Cheesecake Sugar (1g) emerged as the top-performing product for Cultivators Classic, achieving the highest sales figure of 2478 units. Following closely, Tropical Trainwreck Live Badder (1g) secured the second rank with notable sales performance. Rocket Pop Distillate Cartridge (1g) was ranked third, demonstrating strong demand within the Vapor Pens category. Lemon Headz OG Distillate Cartridge (1g) improved its position from fifth in November 2024 to fourth in January 2025, indicating a positive trend in its popularity. Cotton Candy x OG Live Resin Badder (1g) rounded out the top five, maintaining a consistent presence in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.