Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

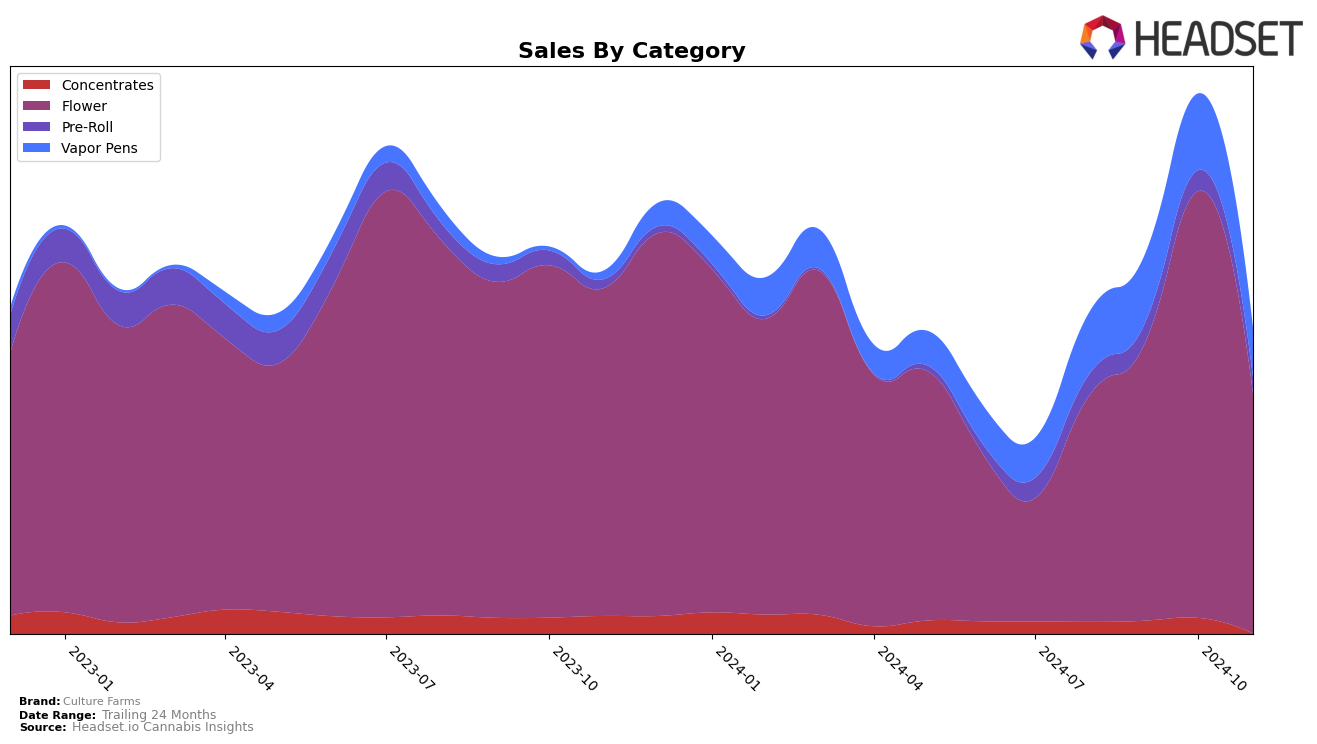

Culture Farms has demonstrated notable performance shifts across various product categories in Oregon. In the Flower category, the brand experienced a significant rise, reaching the top spot in October 2024 before settling at rank 5 in November. This indicates a strong market presence and consumer preference for their flower products, despite a slight dip in ranking. Conversely, the Concentrates category shows an upward trajectory, with Culture Farms moving from rank 46 in August to 38 in October, although they did not make it into the top 30 by November. This suggests a growing interest but also highlights room for improvement to break into the top tier.

In other categories, Culture Farms' performance is more varied. Their Vapor Pens category saw a steady climb from rank 32 in August to 28 in October, but a drop to 34 in November suggests some volatility, possibly due to market competition or changes in consumer preferences. The Pre-Roll category remains a challenge for Culture Farms, as they consistently ranked outside the top 30, peaking at rank 48 in October before falling to 54 in November. This indicates that while there is some consumer interest, the brand may need to innovate or adjust its strategy to gain a stronger foothold in this segment.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Culture Farms has demonstrated significant fluctuations in its market positioning, which could impact its sales trajectory. After achieving the top rank in October 2024, Culture Farms experienced a decline to the 5th position by November 2024. This drop follows a remarkable peak in sales during October, suggesting a potential short-lived surge or a reaction to market dynamics. In contrast, Chalice Farms consistently maintained a strong presence, holding the 3rd rank in both September and November, indicating stable consumer preference and possibly a more robust brand loyalty. Meanwhile, High Tech showed a notable recovery from the 10th position in September to the 4th in November, reflecting a positive sales momentum that could pose a competitive threat to Culture Farms. Additionally, Oregon Roots made a significant leap from the 13th position in October to the 7th in November, highlighting an upward trend that Culture Farms should monitor closely. These shifts underscore the dynamic nature of the Oregon flower market and the need for Culture Farms to strategize effectively to maintain and enhance its market share.

Notable Products

In November 2024, Culture Farms' top-performing product was the White Rose Cured Resin Cartridge (1g) in the Vapor Pens category, ascending to the number one rank with sales of 2387 units. The Uncle Snoop (Bulk) from the Flower category followed closely in second place, marking its first appearance in the rankings. The Fried Bananas Cured Resin Cartridge (1g) debuted at the third position in the Vapor Pens category. Notably, the Uncle Snoop Cured Resin Cartridge (1g) maintained a steady presence, holding the fourth rank as it did in October. The Q Latto Pre-Roll (1g) entered the rankings at fifth place, showing a strong performance in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.