Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

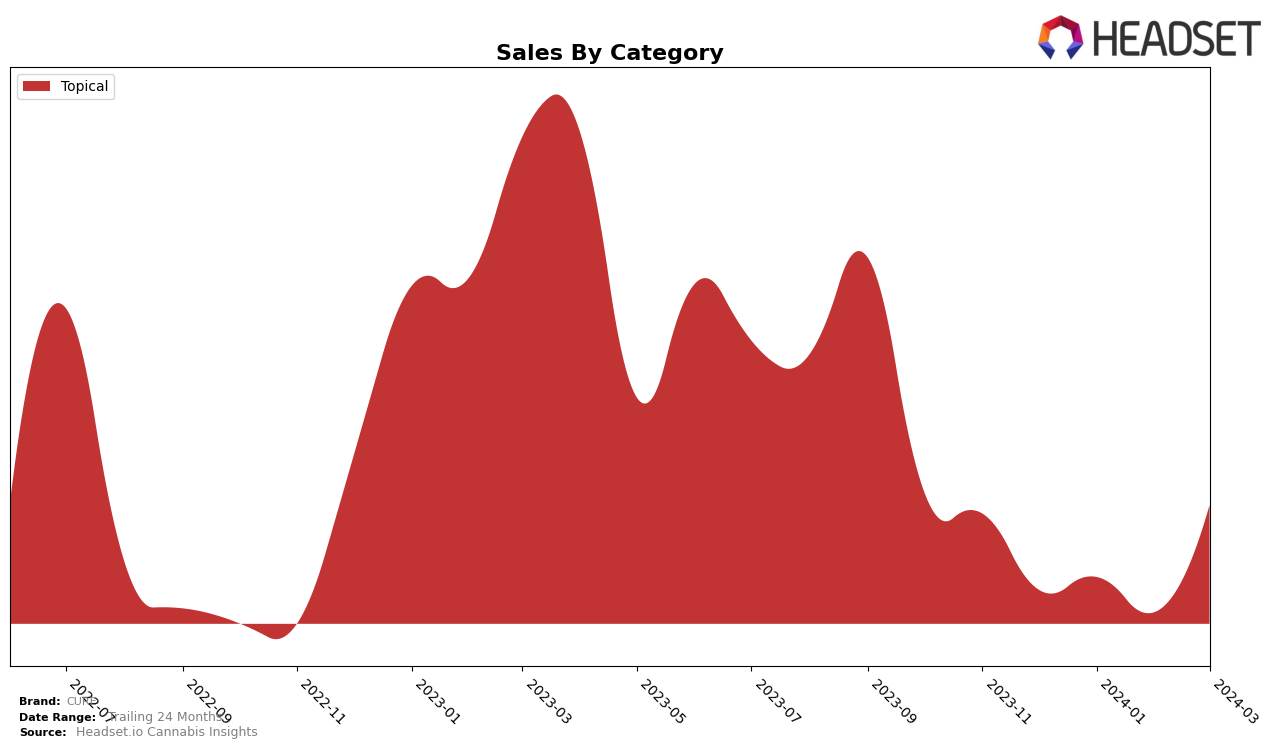

In Michigan, the cannabis brand CURE has shown a notable performance within the Topical category, demonstrating a consistent presence in the competitive landscape. Over the recent months, CURE's ranking has seen a slight fluctuation, moving from 29th in December 2023 to 28th in January 2024, dipping back to 29th in February 2024, before making a significant leap to 23rd in March 2024. This upward movement in March suggests a positive reception to CURE's products in the market, potentially influenced by strategic marketing efforts or product launches. The sales figures reflect this trajectory, with a notable jump from 395 units sold in February to 1357 units in March, indicating a strong consumer demand and a successful month for CURE in the Topical category.

While the data presents an encouraging trend for CURE in the Topical category, the absence of information across other categories and states/provinces suggests a more focused or limited market penetration for the brand. The improvement in ranking within Michigan's Topical category from February to March 2024 is particularly impressive, considering the competitive nature of the cannabis market. However, the lack of presence in the top 30 brands across other categories or states/provinces could be seen as an area for growth or a strategic decision by the brand. This targeted approach might indicate CURE's strategy to consolidate its position and reputation in specific segments before expanding further. The significant sales increase in March 2024 serves as a testament to the brand's potential and the effectiveness of its market strategies in Michigan.

Competitive Landscape

In the competitive landscape of the topical cannabis category in Michigan, CURE has demonstrated a notable upward trajectory in its market position. Initially ranked 29th in December 2023, CURE improved its standing to 23rd by March 2024, underscoring a positive trend in both rank and sales amidst stiff competition. Noteworthy competitors include Fatty's, which also showed gradual rank improvement but with fluctuating sales figures, and Zova, which, despite an absence in rankings for two months, managed to secure the 21st position by March 2024. Lit Labs and Leilani Bee experienced more variable movements in both sales and rankings, indicating a potentially volatile market. CURE's consistent rank improvement, especially in a category with such dynamic shifts, suggests a growing consumer preference and market presence, positioning it as a brand to watch in Michigan's topical cannabis sector.

Notable Products

In March 2024, CURE's CBD/THC 3:2 Balm Warm Vanilla Fragrance-Free (200 CBD, 300 THC) from the Topical category maintained its position as the top-selling product, marking its fourth consecutive month in the lead. Notably, this product saw a significant increase in sales, reaching 78 units sold. This consistent performance highlights the strong consumer preference for this particular product within CURE's range. There were no other products listed for comparison in the provided data, making the CBD/THC 3:2 Balm the standout product for CURE in March 2024. The sales figures and rankings indicate a solid market presence and suggest a growing consumer trust in this product's quality and efficacy.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.