Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

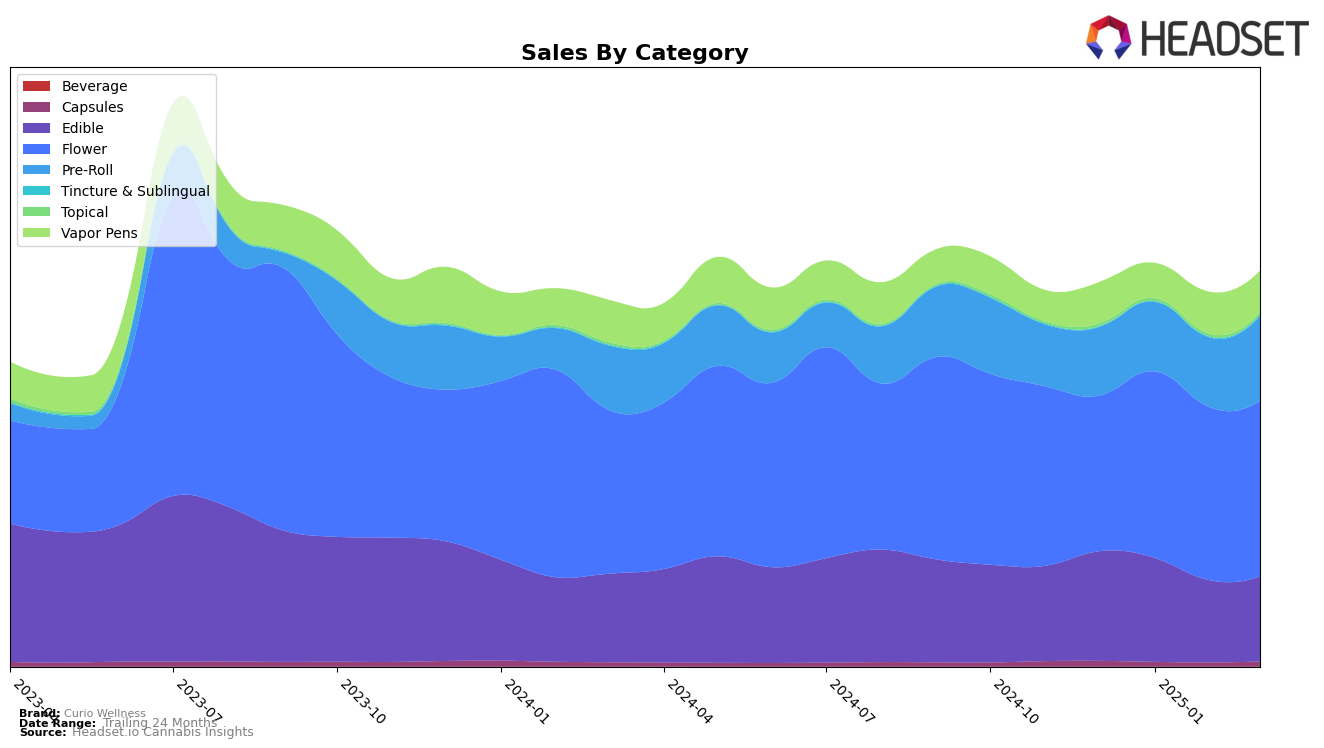

Curio Wellness has demonstrated a varied performance across different product categories in Maryland. In the Edible category, the brand consistently maintained a top 5 ranking from December 2024 to March 2025, despite a gradual decline in sales. The Flower category saw a notable improvement in January 2025, climbing from 10th to 6th place, which indicates a strong reception in the market. However, in the Vapor Pens category, Curio Wellness experienced fluctuating rankings, peaking at 10th in February 2025 but falling back to 14th by March. This movement suggests varying consumer preferences or competitive pressures in that segment.

In Missouri, Curio Wellness's performance presents a different narrative. The brand's presence in the Edible category showed a decline in rankings, dropping from 12th in January 2025 to 20th by March. This decline might reflect challenges in maintaining consumer interest or increased competition. Interestingly, Curio Wellness was absent from the top 30 in the Flower category until February 2025, when it entered at 42nd and slightly improved to 37th by March. This late entry and modest rise could indicate new market penetration or a strategic shift in focus. The absence from the top 30 in earlier months highlights potential opportunities for growth or areas needing strategic realignment.

Competitive Landscape

In the Maryland flower category, Curio Wellness has demonstrated a dynamic performance in recent months, with its rank fluctuating between 6th and 10th place from December 2024 to March 2025. Notably, Curio Wellness achieved its highest rank in January 2025, climbing to 6th place, which coincided with a peak in sales. However, despite a slight dip in sales in February and March, Curio Wellness maintained a stable 8th place rank. In comparison, Savvy consistently outperformed Curio Wellness, maintaining a higher rank in most months, although it experienced a drop from 6th to 7th place by March. Meanwhile, Evermore Cannabis Company showed a significant upward trend, surpassing Curio Wellness by March with a 6th place rank. On the other hand, Grassroots remained close in competition, often ranking just above or below Curio Wellness. Lastly, Roll One demonstrated a notable rise, moving from 15th to 10th place, indicating a growing presence in the market. These competitive dynamics suggest that while Curio Wellness is a strong contender, it faces significant challenges from both established and emerging brands in the Maryland flower market.

Notable Products

In March 2025, the top-performing product for Curio Wellness was Grapecicle Pre-Roll 2-Pack (1g) in the Pre-Roll category, climbing from a previous rank of 4 in December 2024 to secure the number 1 spot with sales of 8,831. Opals and Banonoze Pre-Roll 2-Pack (1g) made its debut in the rankings at number 2, while Crumpets Pre-Roll 2-Pack (1g) followed closely at number 3. Super Lemon Haze Pre-Roll 2-Pack (1g) maintained a strong presence, rising from 5th in December 2024 to 4th in March 2025. Blue Cheese Pre-Roll 2-Pack (1g), previously ranked 1st in February 2025, dropped to 5th place, indicating shifts in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.