Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

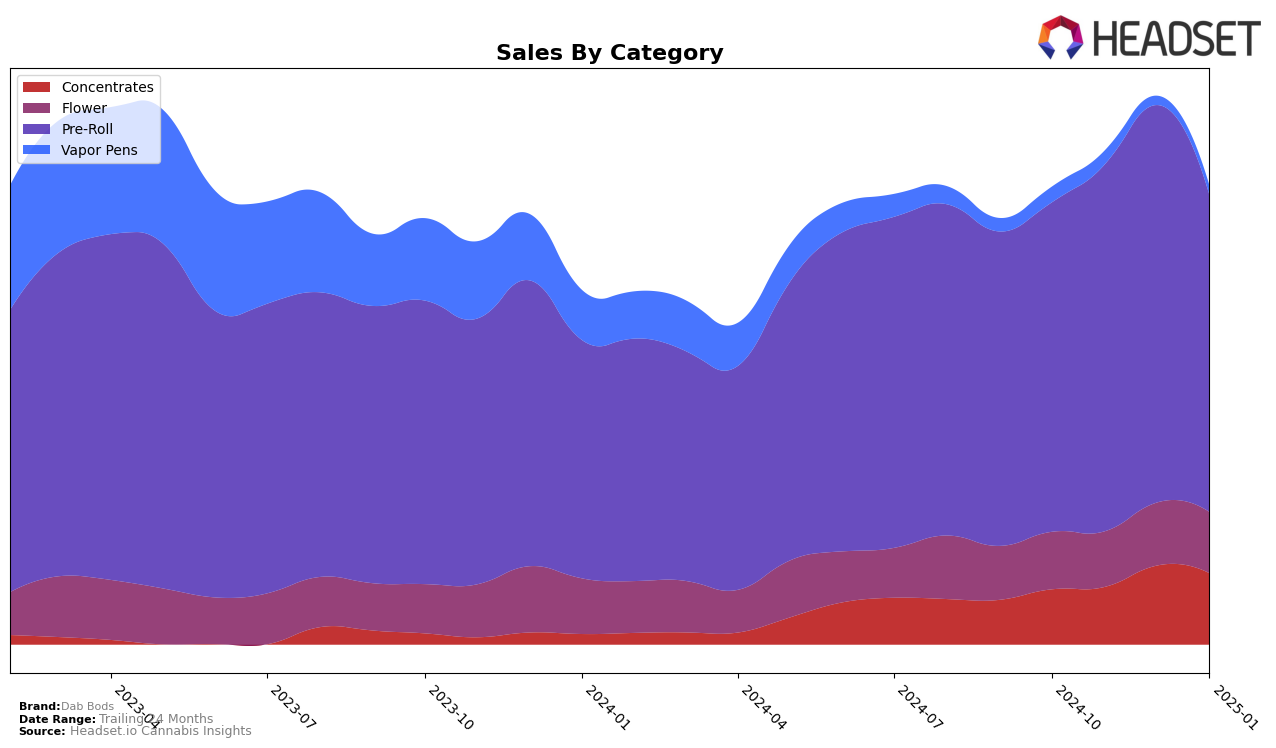

Dab Bods has demonstrated consistent performance across several categories in Alberta. Notably, the brand has maintained a strong position in the Concentrates category, consistently ranking second from October 2024 through January 2025. This stability suggests a loyal customer base or effective market penetration strategies in this category. In the Pre-Roll segment, Dab Bods also shows impressive performance, holding the second position for three consecutive months after a slight dip to third place in October 2024. However, their performance in the Vapor Pens category is less robust, with rankings missing for two months, indicating a potential area for improvement or strategic focus.

In contrast, British Columbia presents a different landscape for Dab Bods. Here, the brand has shown a notable upward trajectory in the Concentrates category, climbing from outside the top 30 to a commendable fifth place by January 2025. This positive movement signals growing brand recognition or increased consumer preference for Dab Bods' offerings in this category. Meanwhile, in Ontario, Dab Bods holds steady in the Concentrates category, maintaining the eleventh position for multiple months, which suggests a stable performance in a competitive market. However, challenges are apparent in the Flower category, where the brand's rankings hover around the mid-90s, indicating potential competitive pressures or market dynamics that Dab Bods might need to address.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Alberta, Dab Bods has shown a consistent performance, maintaining its rank at second place from November 2024 to January 2025, after climbing from third place in October 2024. Despite a slight dip in sales from December 2024 to January 2025, Dab Bods has managed to sustain its position, indicating a strong brand presence and customer loyalty. The leading brand, General Admission, consistently holds the top rank, with significantly higher sales figures, which suggests a dominant market share. Meanwhile, Spinach experienced a decline in rank from second to fourth place over the same period, which could potentially benefit Dab Bods if this trend continues. Additionally, Space Race Cannabis has shown improvement, moving up from fifth to third place by January 2025, indicating increasing competition. These dynamics highlight the importance for Dab Bods to innovate and strengthen its market strategies to maintain and potentially improve its standing in the Alberta Pre-Roll market.

Notable Products

In January 2025, Dab Bods saw the Blue Lobster Double Infused Pre-Roll 3-Pack (1.5g) rise to the top as the best-selling product, with sales of 11,372 units. The Hawaiian Plushers Double Infused Pre-Roll 3-Pack (1.5g) dropped to the second position after leading the sales in November and December 2024. Motor Breath Double Infused Pre-Roll 3-Pack (1.5g) remained steady in the third place, maintaining its rank from December. The Tropical Burst Double Infused Pre-Roll 3-Pack (1.5g) held the fourth position for two consecutive months. Fuzzy Peach 2.0 Shatter (1g) continued to secure the fifth spot, consistent with its December ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.