Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

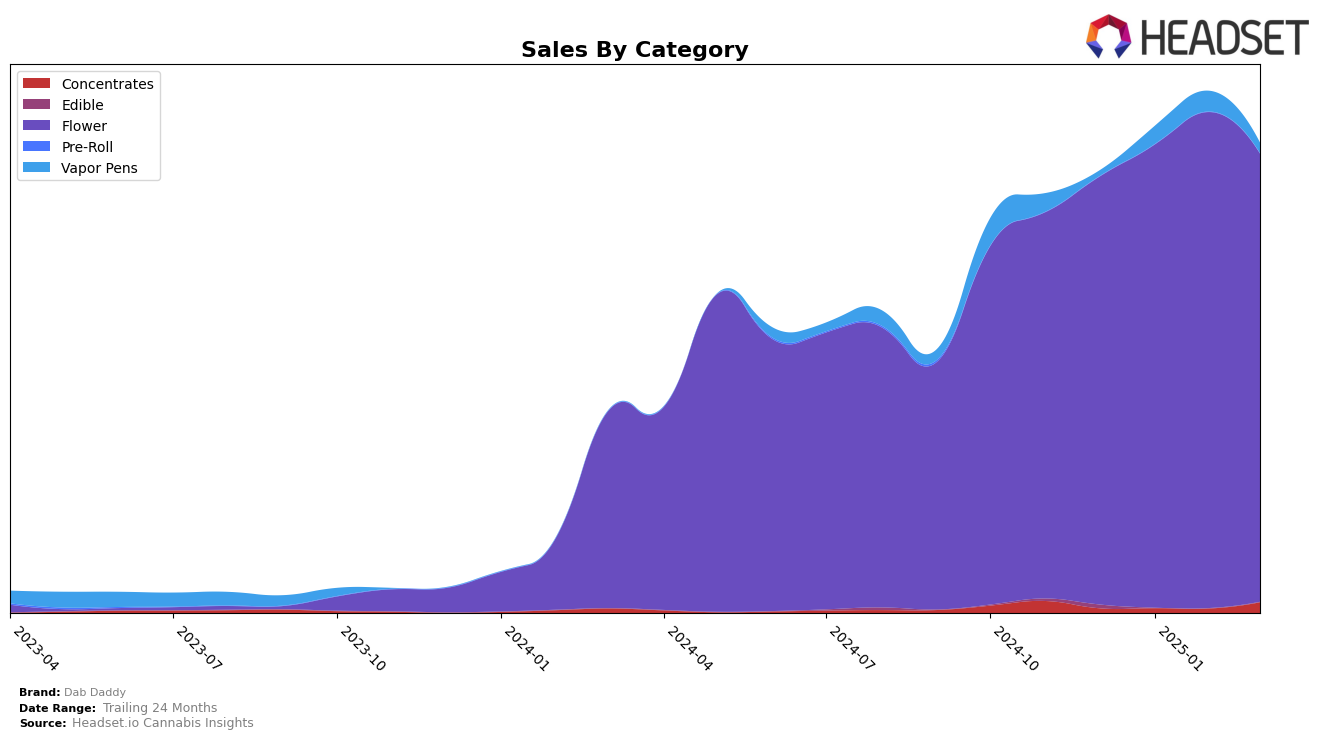

In the competitive landscape of the cannabis industry, Dab Daddy has shown a varied performance across different categories and states. In California, the brand has not made it to the top 30 in the Concentrates category from December 2024 through March 2025, which could be seen as a challenge for their market presence in this segment. This absence from the rankings indicates a potential area for growth or a need for strategic reevaluation in the Concentrates category. On the other hand, the Flower category paints a different picture, with Dab Daddy consistently ranking within the top 30, peaking at 18th place in February 2025. This upward trajectory in the Flower category suggests that Dab Daddy is gaining traction and possibly increasing its market share in California.

Examining the sales figures for Dab Daddy in California's Flower category, there is a noticeable fluctuation in sales from December 2024 to March 2025. After reaching a peak in February 2025, sales slightly dipped in March. Despite this minor decline, the overall positive trend from December to February highlights a period of growth and increased consumer demand for Dab Daddy's Flower products. The brand's ability to climb the rankings within the Flower category underscores its potential to capitalize on this momentum. However, the lack of presence in the Concentrates category suggests that Dab Daddy might need to explore new strategies or product innovations to strengthen its position across all categories.

Competitive Landscape

In the competitive landscape of the California flower category, Dab Daddy has experienced notable fluctuations in its market position over recent months. Starting from a rank of 29 in December 2024, Dab Daddy improved to 18 in February 2025, before slipping back to 29 in March 2025. This volatility highlights a dynamic market environment where competitors like Decibel Gardens and Astronauts (CA) have shown more consistent performance. For instance, Decibel Gardens climbed from rank 39 in December 2024 to 25 in February 2025, maintaining a stable trajectory, while Astronauts (CA) held a relatively steady rank, fluctuating slightly between 22 and 27. Despite Dab Daddy's temporary rise in February, it faces challenges from brands like Traditional Co., which, although experiencing a dip in sales, maintained a more consistent rank around the mid-20s. These insights suggest that while Dab Daddy has the potential for significant upward movement, it must strategize to maintain and capitalize on its gains amidst strong competition.

Notable Products

In March 2025, Dab Daddy's top-performing product was Frosted Donuts (14g) in the Flower category, maintaining its first-place rank from February and December 2024, with notable sales of 2602 units. Orange Creamsicle (14g) climbed to the second position, improving from fifth in January and fourth in February 2025, demonstrating a steady increase in popularity. La Pop Rocks (14g) secured the third spot, recovering from an unranked status in February, after being consistently second in the preceding months. Electric Pineapple (14g) entered the top five for the first time, ranking fourth, indicating a growing consumer interest. Finally, Frosted Donuts (3.5g) debuted at fifth place, suggesting a successful expansion of the Frosted Donuts product line.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.