Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

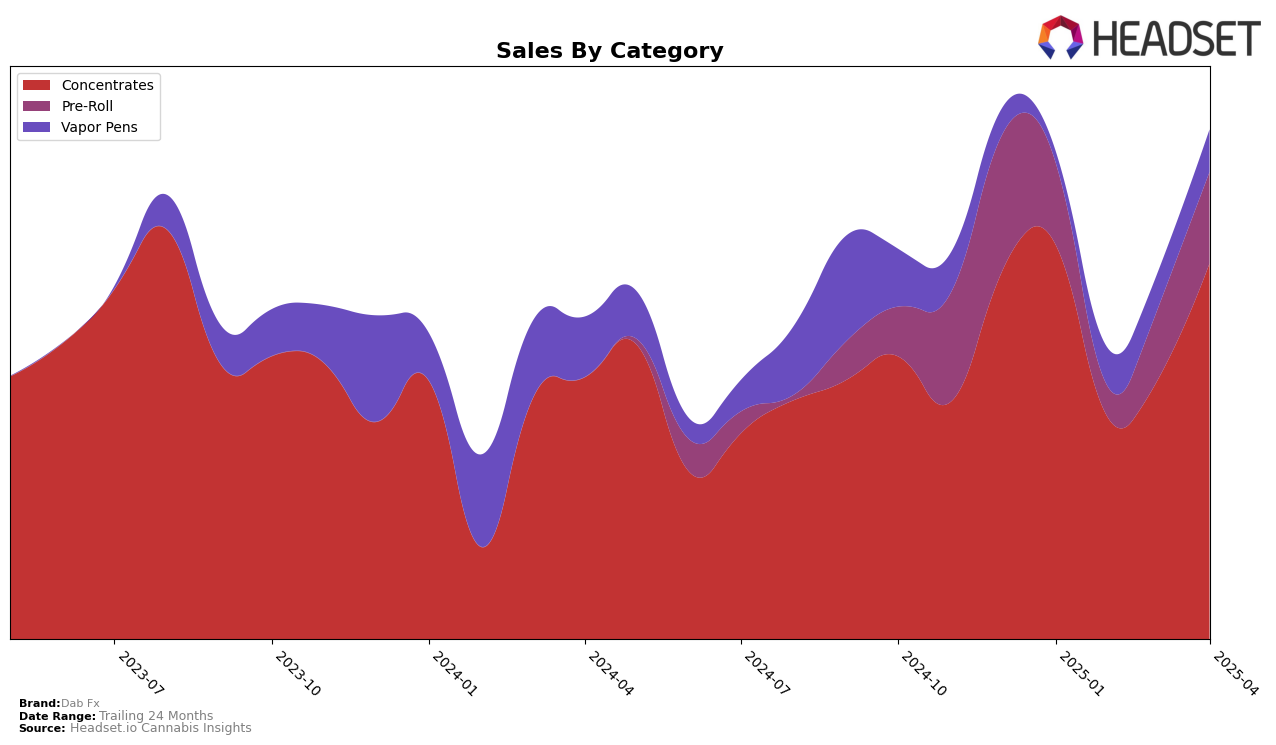

In the Massachusetts market, Dab Fx has shown some notable shifts in its performance within the Concentrates category over the first four months of 2025. Starting the year at rank 15, the brand experienced a dip in February, falling to rank 23, but demonstrated resilience by climbing back to rank 22 in March and further improving to rank 16 in April. This fluctuation suggests a volatile but recovering market presence for Dab Fx in Massachusetts, which could be attributed to strategic adjustments or changing consumer preferences. Interestingly, even with these rank fluctuations, the brand managed to increase its sales from February to April, indicating a positive trend in revenue despite the competitive challenges.

However, it's worth noting that Dab Fx's presence outside of Massachusetts is absent from the top 30 rankings in other states or provinces, which may be a point of concern or an opportunity for growth. The absence of rankings in these regions suggests that Dab Fx either does not have a significant market presence or is facing stiff competition that prevents it from breaking into the top tier. This could be seen as a potential area for expansion or increased marketing efforts to bolster their brand visibility and consumer base in new markets. Keeping a close eye on how Dab Fx navigates these challenges and opportunities could provide valuable insights into their strategic direction and adaptability in the evolving cannabis industry.

Competitive Landscape

In the Massachusetts concentrates market, Dab Fx has experienced fluctuating rankings and sales, indicative of a competitive landscape. Initially ranked 15th in January 2025, Dab Fx saw a drop to 23rd in February before rebounding to 16th by April. This volatility contrasts with competitors like DRiP (MA), which maintained a relatively stable position, ranking between 11th and 18th over the same period. Meanwhile, Resinate showed a significant upward trajectory, moving from outside the top 20 in February to 14th in April, suggesting a strong growth in sales. Similarly, Glaze Cannabis improved its rank from outside the top 20 in January to 20th in April, indicating a positive sales trend. These dynamics highlight the importance for Dab Fx to strategize effectively to regain and maintain a higher rank amidst rising competition.

Notable Products

For April 2025, the top-performing product from Dab Fx was Ice Cream Man Badder (1g) in the Concentrates category, achieving the number one rank with sales of 303 units. This product improved from its previous rank of 2.0 in March. Following closely, 99 Cookies Crumble (1g), also in the Concentrates category, secured the second position, marking its debut in the rankings. Jolt Live Resin Cartridge (0.5g) in the Vapor Pens category maintained a strong position by moving up to the third rank from fourth in March. Gorilla Glue #4 Infused Pre-Roll (1g) in the Pre-Roll category and Lavender Jones Sugar (1g) in Concentrates rounded out the top five, both entering the rankings for the first time in April.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.