Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

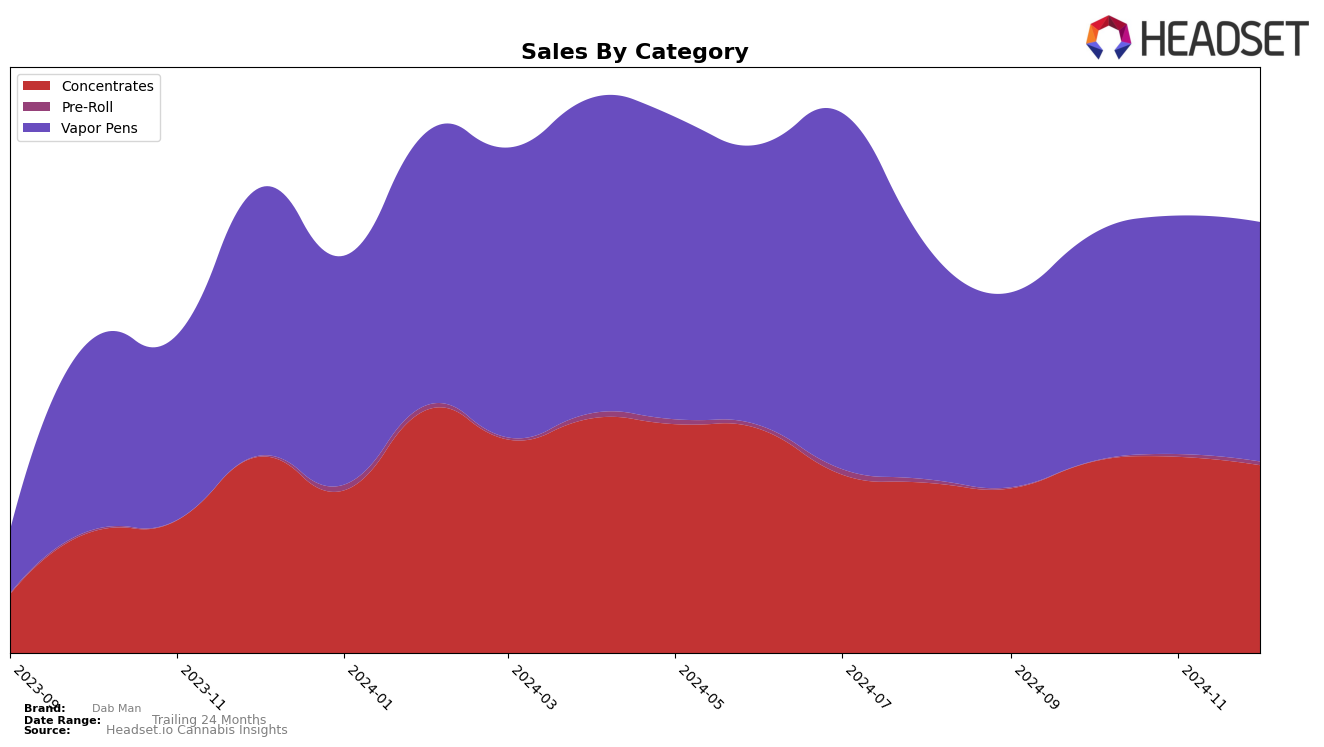

In the state of Washington, Dab Man has shown a consistent presence in the Concentrates category. Over the last four months of 2024, the brand maintained a steady ranking, hovering around the mid-20s, with a slight dip in October followed by a recovery in November and December. This stability suggests a resilient market position despite fluctuations in sales, which peaked in November. The consistent top 30 ranking indicates that Dab Man is a recognized player in this category, although there remains room for improvement to climb higher in the ranks.

For Vapor Pens in Washington, Dab Man did not make it into the top 30 rankings, which highlights a significant opportunity for growth or a need for strategic adjustments in this category. Despite not breaking into the top tier, the brand experienced a positive trend in sales, showing incremental growth each month from September to December. This upward trajectory in sales, coupled with the absence from the top 30, suggests that while Dab Man is gaining traction, further efforts are needed to enhance brand visibility and competitiveness in the Vapor Pens market.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Dab Man has shown a steady improvement in its ranking, moving from 68th in September 2024 to 61st by December 2024. This upward trend is indicative of a positive reception in the market, despite the presence of strong competitors. For instance, Falcanna consistently outperformed Dab Man, maintaining a higher rank throughout the period, although it experienced fluctuations, ending at 55th in December. Meanwhile, Passion Flower Cannabis saw a decline from 42nd to 57th, suggesting potential vulnerabilities that Dab Man could capitalize on. Notably, Flawless demonstrated significant improvement, climbing from 82nd to 66th, which could pose a future challenge for Dab Man if this trend continues. Overall, Dab Man's consistent sales growth and improved rankings suggest a strengthening position in the Washington vapor pen market, although it must remain vigilant of competitors like Falcanna and Flawless who are also making strategic advances.

Notable Products

In December 2024, the top-performing product for Dab Man was Gold - Cinderella's Dream Wax (1g) in the Concentrates category, maintaining its first-place ranking consistently from September through December, with sales of 1587 units. The Yoda Distillate Cartridge (1g) in the Vapor Pens category secured the second spot, improving from fifth place in November to second in December. Skywalker Distillate Cartridge (1g) followed closely, ranking third after debuting at second place in October. Notably, the Headband Distillate Cartridge (1g) entered the rankings at fourth place in December. Trainwreck Distillate Cartridge (1g) rounded out the top five, marking its entry into the rankings for the first time this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.