Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

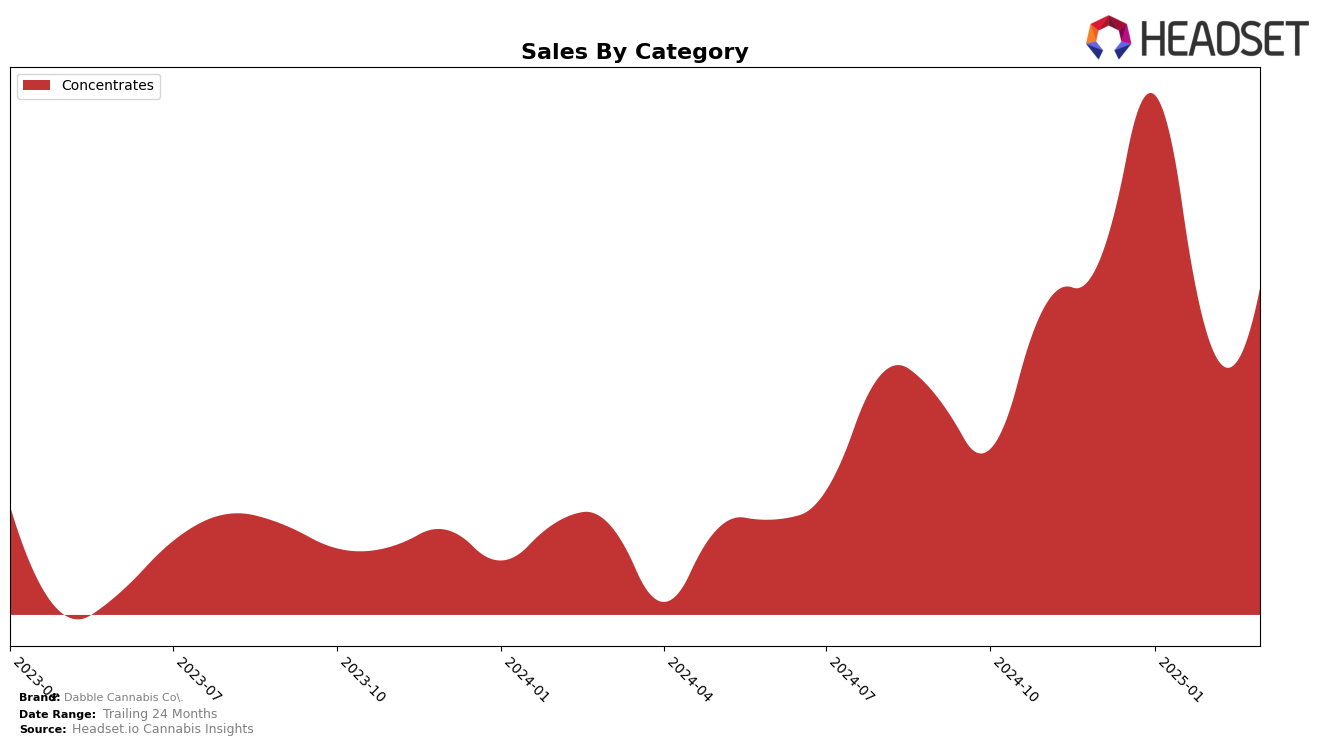

Dabble Cannabis Co. has shown consistent performance in the Concentrates category within British Columbia, maintaining a steady rank of 4th place from December 2024 through March 2025. This stability in ranking suggests a strong foothold in the market, despite fluctuations in monthly sales figures. Notably, January 2025 saw a significant spike in sales, reaching $258,478, which indicates a potential seasonal demand or successful promotional activity. However, the subsequent months experienced a decline, pointing to possible market saturation or increased competition.

While Dabble Cannabis Co. has secured a top position in British Columbia, their absence from the top 30 brands in other states or provinces across various categories highlights areas for potential growth and expansion. The lack of presence in additional markets could be seen as a missed opportunity to capitalize on emerging trends or consumer preferences outside of British Columbia. This situation presents a dual narrative of strength in a local market but also underscores the need for strategic efforts to diversify their market presence across different regions to enhance brand visibility and sales performance.

Competitive Landscape

In the competitive landscape of the concentrates category in British Columbia, Dabble Cannabis Co. consistently held the 4th rank from December 2024 through March 2025. Despite maintaining a steady position, Dabble Cannabis Co. faces strong competition from brands like Brindle Farms and Vortex Cannabis Inc., which have consistently ranked higher, with Brindle Farms even climbing to the 2nd position by March 2025. Notably, Dab Bods showed a fluctuating performance, yet managed to surpass Dabble Cannabis Co. in March 2025, indicating a competitive push. Meanwhile, Pura Vida demonstrated volatility in their rankings, which could present an opportunity for Dabble Cannabis Co. to capitalize on any potential market share shifts. The sales trajectory for Dabble Cannabis Co. saw a dip in February 2025 but rebounded in March, suggesting resilience amidst competitive pressures. This competitive analysis underscores the importance of strategic positioning and market responsiveness for Dabble Cannabis Co. to enhance its standing in the concentrates market in British Columbia.

Notable Products

In March 2025, the top-performing product from Dabble Cannabis Co. was Strawberry Jam Live Rosin (1g) in the Concentrates category, which achieved the first rank with a notable sales figure of 1370 units. Dabbleberry Live Rosin (1g) closely followed, moving down to the second position from its previous top rank in February. Hash Plant Live Rosin (1g) maintained a stable performance, holding the third rank for the second consecutive month. Dabbleberry Live Hash Rosin (1g) remained in the fourth position, showing a slight increase in sales compared to previous months. The product XXX Live Rosin (1g) did not rank in March, as it was last recorded in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.