Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

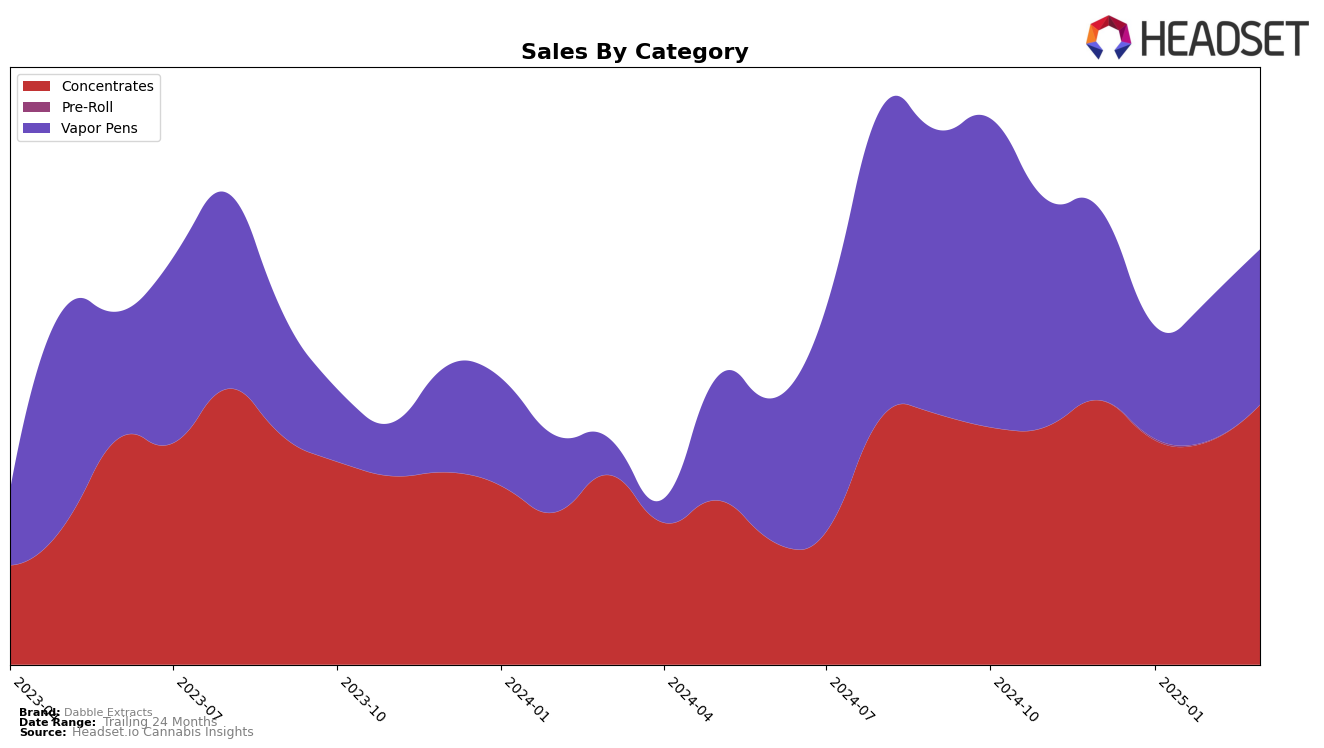

Dabble Extracts has shown a consistent performance in the Colorado market, particularly in the Concentrates category. From December 2024 to March 2025, the brand maintained a strong presence, ranking consistently at 5th position, except for a slight dip to 6th in January 2025. This stability in ranking suggests a robust market presence and consumer loyalty in this category. The sales figures reflect a return to near December levels by March, indicating a recovery from the lower sales in January and February. The ability to maintain a top 5 ranking across these months highlights the brand's competitive edge in the Concentrates category within the state.

In contrast, Dabble Extracts' performance in the Vapor Pens category in Colorado shows a different trend. The brand did not make it into the top 30 in January 2025, ranking 42nd, which could be seen as a setback. However, they managed to climb back to 36th in February and maintain this position in March. Although not as strong as their Concentrates performance, this upward movement suggests a potential for growth in the Vapor Pens category. The brand's ability to rebound in rankings, despite not breaking into the top 30 consistently, is noteworthy and may indicate strategic adjustments or shifts in consumer preferences that could be capitalized on in the future.

Competitive Landscape

In the competitive landscape of the Colorado concentrates market, Dabble Extracts has maintained a consistent presence, ranking 5th in December 2024 and March 2025, with a slight dip to 6th in January 2025. Despite this minor fluctuation, Dabble Extracts has shown resilience, with sales rebounding from a low in January to a significant increase by March. This stability is noteworthy, especially when compared to competitors like Denver Dab Co, which experienced more pronounced rank changes, and Nomad Extracts, which also fluctuated in rank. Meanwhile, 710 Labs and Spectra have consistently held higher ranks, indicating a strong market position. However, Dabble Extracts' ability to maintain a top 5 position amidst these competitors suggests a loyal customer base and effective market strategies, positioning it well for future growth.

Notable Products

In March 2025, the top-performing product for Dabble Extracts was the Concord Grape Distillate Cartridge (1g) in the Vapor Pens category, securing the number one rank with a notable sales figure of 2397 units. Following closely, the Odder Popz Distillate Cartridge (1g) took the second spot, showing a significant rise from fifth place in February. The Strawberry Cough Distillate Cartridge (1g) debuted strongly at the third position. The Star Fruit Chew Distillate Cartridge (1g) dropped to fourth place after being second in February, indicating a shift in consumer preference. Meanwhile, the Blue Garlic Budder (1g) maintained a steady presence in the top five, ranking fifth in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.