Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

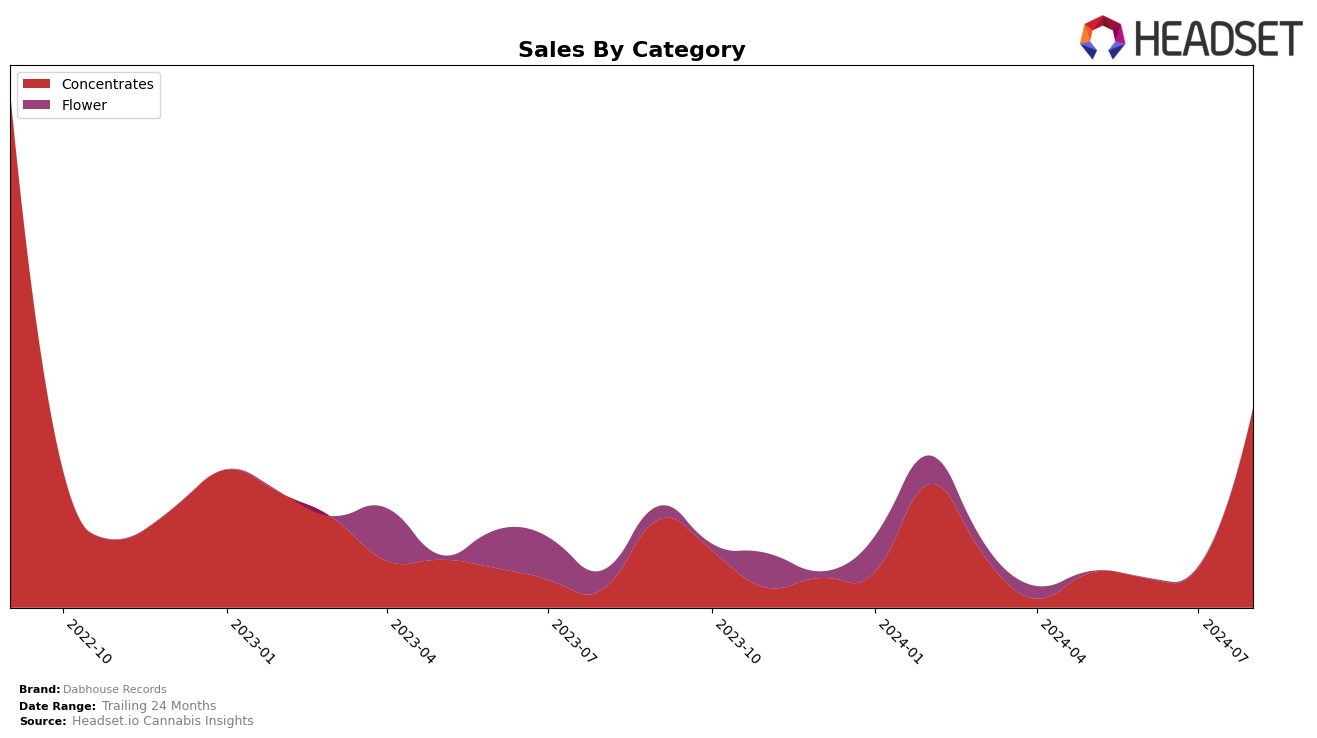

Dabhouse Records has shown a significant upward trend in the concentrates category within Michigan. Starting from a rank of 96 in May 2024, the brand has steadily climbed the rankings, reaching the 29th position by August 2024. This ascent is notable, especially considering the brand's absence from the top 30 in the earlier months. Such a movement indicates a positive reception and growing popularity among consumers in Michigan, reflecting a successful strategy or product line introduction during this period.

While Dabhouse Records has made impressive strides in Michigan, it is important to note that the brand did not make it into the top 30 in other states or categories for the same period. This absence could be perceived as a gap in market penetration or competitive positioning in those regions. However, the strong performance in Michigan could serve as a blueprint for expansion strategies in other markets. The brand's ability to break into the top 30 in a highly competitive category suggests potential for similar success elsewhere if the right conditions and strategies are applied.

Competitive Landscape

In the Michigan concentrates market, Dabhouse Records has shown a remarkable upward trend in recent months, moving from a rank of 96 in May 2024 to 29 in August 2024. This significant improvement in rank indicates a substantial increase in market presence and consumer preference. Compared to competitors, Monster Xtracts and Rollganic have also seen positive rank changes, but not as dramatic as Dabhouse Records. Society C experienced fluctuations, peaking at rank 22 in July 2024 but dropping to 30 in August 2024, which may indicate instability in their market strategy. Meanwhile, Magic showed a steady climb, reaching rank 31 in August 2024. The rapid ascent of Dabhouse Records suggests a successful marketing campaign or product innovation that has resonated well with consumers, positioning them as a strong contender in the Michigan concentrates category.

Notable Products

In August 2024, the top-performing product from Dabhouse Records was Juicy Zkittles Live Resin Sugar (1g) in the Concentrates category, which saw a significant rise to the number one spot with sales figures reaching 3680. Summertime Sherbert Live Resin (1g) debuted strongly at the second position. Cheetah Piss Live Resin (1g) moved up to third place from its previous rank of fourth in July. Paris OG Resin (1g) maintained a consistent presence, ranking fourth in both July and August. Motown Gelato Live Resin (1g) entered the rankings for the first time, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.