Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

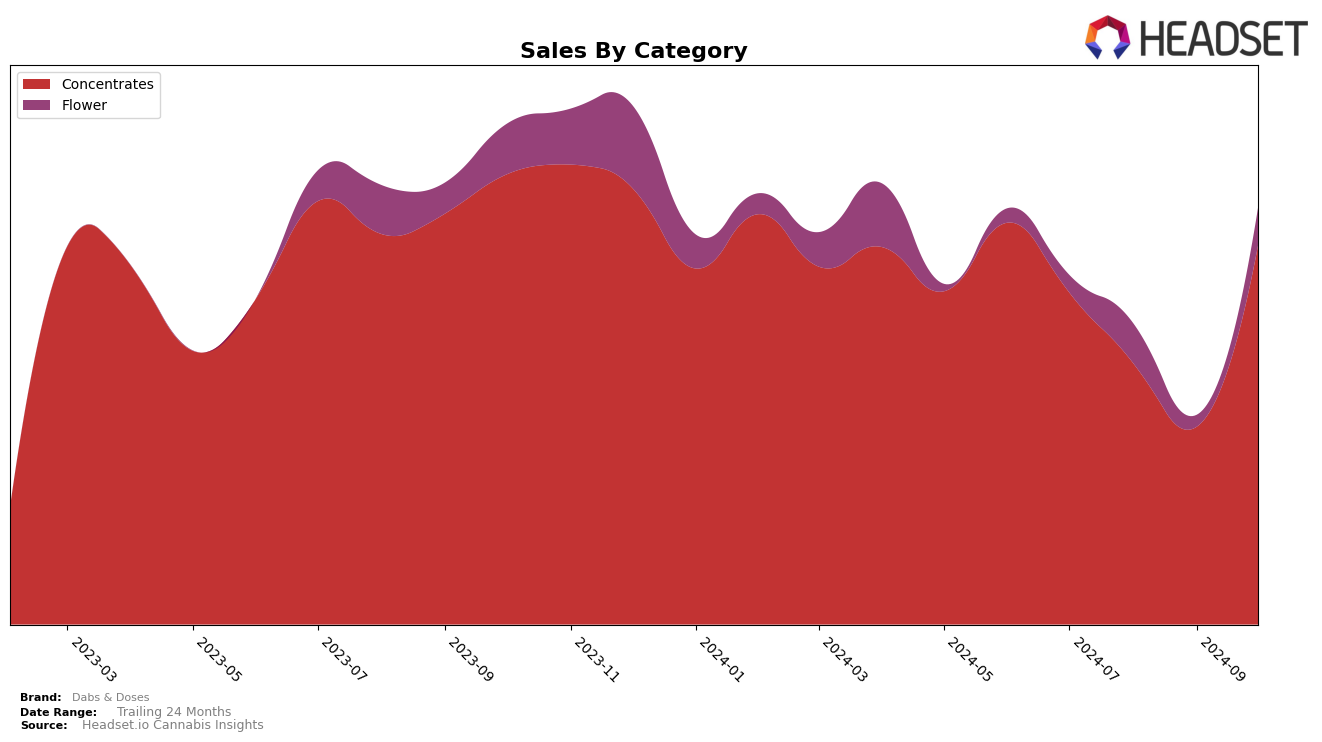

In the Michigan market, Dabs & Doses has shown a notable recovery in the Concentrates category. After slipping out of the top 30 rankings over the summer months, the brand made a strong comeback in October 2024, climbing back to the 30th position. This resurgence is reflected in their sales figures, where they experienced a significant increase from September to October. Such a rebound indicates a strategic adjustment that effectively recaptured market share, suggesting a potential shift in consumer preferences or successful promotional activities.

The absence of Dabs & Doses from the top 30 rankings during July, August, and September in Michigan highlights a period of struggle and competitive pressure in the Concentrates segment. This absence can be interpreted as a challenging period for the brand, as it faced intense competition from other players in the market. However, their return to the rankings in October is a positive sign, showing resilience and adaptability. This movement underscores the dynamic nature of the cannabis industry, where brands must continuously innovate and adapt to maintain their position.

Competitive Landscape

In the Michigan concentrates market, Dabs & Doses has experienced a fluctuating yet promising trajectory in recent months, indicating potential for growth amidst competitive pressures. While Dabs & Doses ranked 35th in July 2024, it saw a dip to 44th and 46th in August and September, respectively, before climbing back to 30th in October. This rebound suggests a positive response to market dynamics or strategic adjustments. In contrast, Cloud Cover (C3) experienced a significant drop from 9th in September to being out of the top 20 by October, highlighting potential vulnerabilities. Meanwhile, Rise (MI) and Fresh Coast have shown upward trends, with Rise (MI) moving from 48th to 28th and Fresh Coast from 56th to 29th over the same period, suggesting increasing consumer interest or effective marketing strategies. These shifts underscore the competitive landscape Dabs & Doses operates within, emphasizing the importance of strategic positioning to maintain and improve its market standing.

Notable Products

In October 2024, the top-performing product for Dabs & Doses was Value - California Roll Cured Resin Budder (1g) in the Concentrates category, achieving the number one rank with sales of 1977 units. This product saw a significant rise from fifth place in September 2024. Following closely, Value - Phantom Menace Cured Resin Sugar (1g) secured the second position, maintaining a strong presence after being ranked third in September. Value - Redpop Cured Resin Budder (1g) dropped to third place after previously holding the top spot in September. Notably, Value - Mochalope Cured Resin Sugar (1g) made its debut in the rankings at fourth place, while Value - Mocha Monster Cured Resin Sugar (1g) entered at fifth position.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.