Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

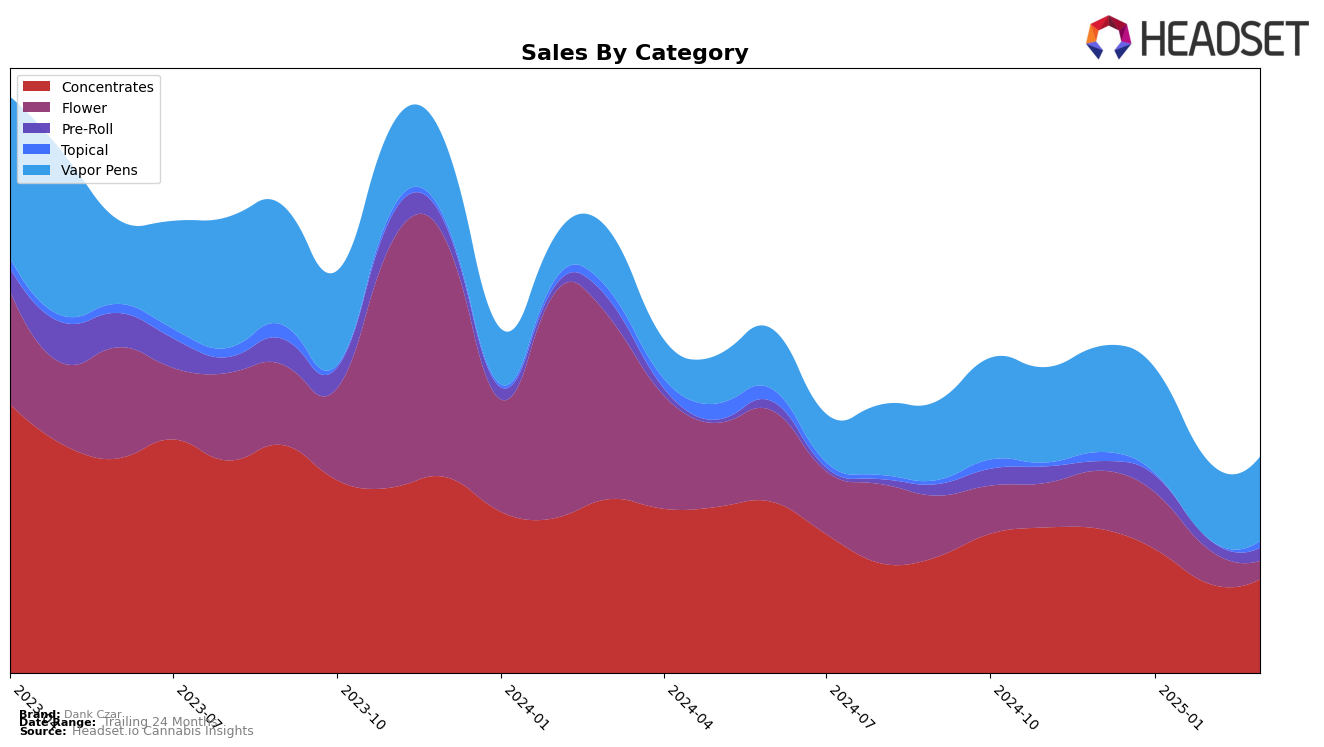

Dank Czar's performance in the Washington market has shown some fluctuations across different product categories, particularly in the Concentrates segment. The brand was ranked 28th in December 2024 and slipped to 41st by March 2025, indicating a decline in its market position. This downward trend is further emphasized by the decrease in sales from $70,940 in December 2024 to $47,679 in March 2025. The inability to maintain a position within the top 30 brands in recent months suggests increasing competition or shifts in consumer preferences within the state. Such movements may necessitate strategic adjustments for Dank Czar to regain its standing in the Concentrates category.

In the Vapor Pens category, Dank Czar has faced challenges in breaking into the top 30 rankings in Washington. The brand hovered around the 70s and 80s in terms of rank, with a slight improvement from 84th in February 2025 to 80th in March 2025. Despite this slight upward movement, the brand's sales decreased from December 2024 to February 2025, before seeing a modest recovery in March 2025. This performance highlights the competitive nature of the Vapor Pens market and suggests that while there may be potential for growth, significant effort is required to enhance brand visibility and consumer engagement in this category.

Competitive Landscape

In the Washington concentrates market, Dank Czar has experienced a notable decline in rank from December 2024 to March 2025, dropping from 28th to 41st position. This downward trend in rank is accompanied by a decrease in sales over the same period, suggesting a potential loss in market share. Competitors such as From the Soil and Falcanna have maintained relatively stable positions, with From the Soil consistently ranking higher than Dank Czar. Meanwhile, Bodhi High and Treats remain lower in rank, indicating that while Dank Czar faces challenges, it still holds a competitive edge over some brands. The data suggests that strategic adjustments may be necessary for Dank Czar to regain its standing and reverse the sales decline in this competitive market.

Notable Products

In March 2025, Dank Czar's top-performing product was the Guava Cake Distillate Cartridge in the Vapor Pens category, securing the second rank with notable sales of 287 units. The Flavour Stix - Blue Razz Infused Pre-Roll, categorized under Pre-Roll, maintained a consistent presence, ranking third, although it saw a drop from its second position in January. Birthday Cake Distillate Cartridge, another Vapor Pens entry, fell to fifth place after topping the ranks in February. Meanwhile, the Strawberry Banana Sherbet Distillate Cartridge debuted in fourth place, indicating a strong entry into the market. Overall, March saw a mix of consistent performers and new entries reshaping the sales landscape for Dank Czar.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.