Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

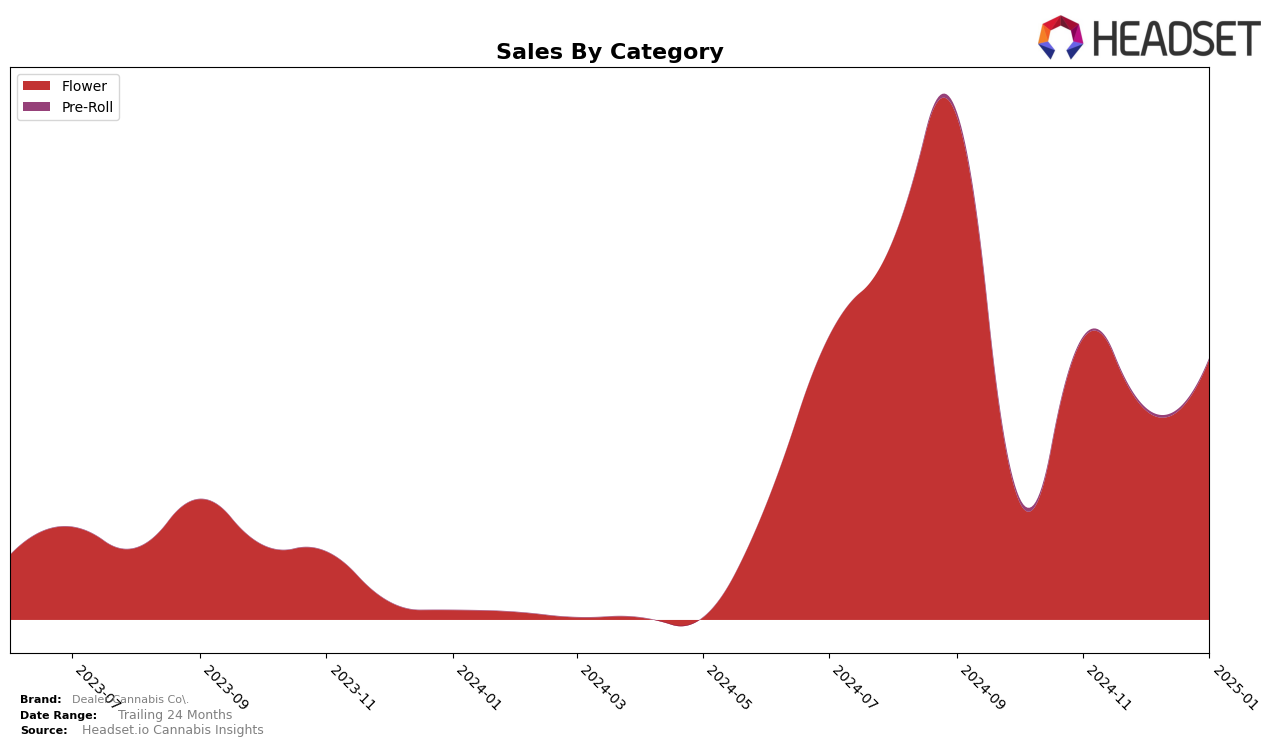

Dealer Cannabis Co. has shown a notable upward trajectory in the New York market, particularly in the Flower category. Starting from October 2024, the brand was not in the top 30, ranking at 51st, but it made significant strides by November, breaking into the top 30 and maintaining its position through December. By January 2025, Dealer Cannabis Co. improved slightly, moving up to 29th place. This consistent climb in rankings suggests a growing acceptance and popularity of their products within the New York market. Although the sales figures fluctuated, with a peak in November, the overall trend indicates a positive reception and increasing market penetration.

Interestingly, the brand's performance in New York highlights a successful strategy or product line that resonates with consumers, allowing them to break into the competitive top 30 rankings. The absence of rankings in other states or categories suggests that Dealer Cannabis Co. may not yet have a substantial presence outside of New York or in other product categories. This could be seen as a limitation, but it also presents an opportunity for expansion if they can replicate their New York success in other markets. Observing their strategic moves and potential category diversification in the coming months will be crucial for understanding their growth trajectory.

Competitive Landscape

In the competitive landscape of the New York flower category, Dealer Cannabis Co. has demonstrated a notable upward trajectory in rank and sales over the past few months. Starting from a rank of 51 in October 2024, Dealer Cannabis Co. improved to 30 by November 2024 and maintained this position in December, before slightly dropping to 29 in January 2025. This positive trend in rank is mirrored by a significant increase in sales, particularly from October to November, where sales more than doubled. In comparison, Old Pal experienced a fluctuating rank, starting at 47 in October and climbing to 30 by January, while Good Green also improved from 55 to 32 in the same period. However, Hudson Cannabis and Zizzle both faced a decline in rank, with Hudson Cannabis dropping from 15 to 27 and Zizzle from 21 to 28. These shifts indicate a competitive market where Dealer Cannabis Co. is gaining ground, potentially at the expense of some established players, suggesting a strategic opportunity for Dealer Cannabis Co. to capitalize on its current momentum.

Notable Products

In January 2025, the top-performing product for Dealer Cannabis Co. was Kiwi Kush x Lemon Cherry Gelato (3.5g) in the Flower category, maintaining its first-place rank from December with significant sales of 3964 units. Kush Mints x Gelato #41 (3.5g) held its position as the second-best seller, consistent with its December ranking. The Hybrid (3.5g) Flower product remained in third place, showing stable performance over the past months. Private Party (3.5g) climbed to fourth place, improving from its fifth-place rank in November. Indica (3.5g) entered the rankings at fifth place, indicating a new interest or increased availability in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.