Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

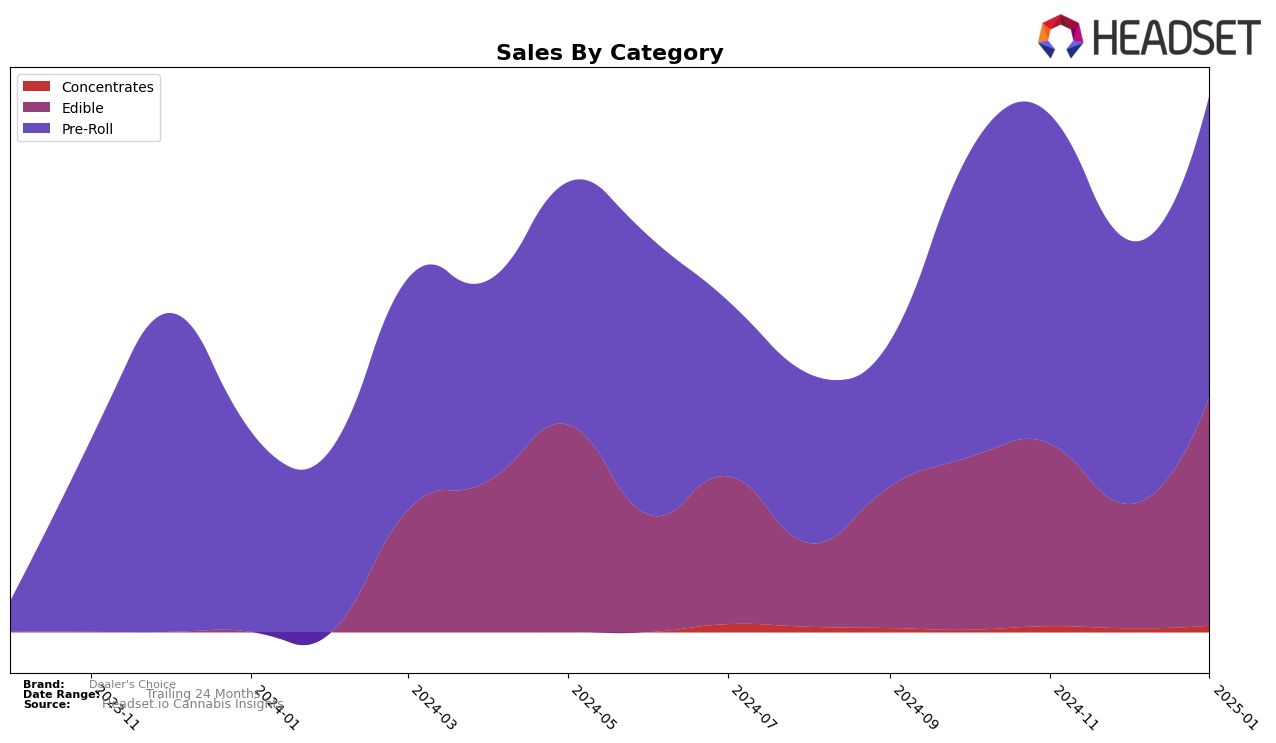

Dealer's Choice has shown a mixed performance across different states and product categories. In Michigan, the brand has experienced fluctuations in the Edible category, with rankings dropping from 59 in October 2024 to 71 in December 2024. However, there was a significant improvement in January 2025, where the brand climbed to the 56th position. This upward trend in January coincided with a notable increase in sales, indicating a potential recovery or successful marketing strategy implementation. Despite not making it to the top 30, the movement suggests that Dealer's Choice may be gaining traction in this competitive market.

In contrast, the performance of Dealer's Choice in the Pre-Roll category in Missouri has been relatively stable. The brand maintained a position within the top 30, with rankings oscillating slightly between 27 and 34 from October 2024 to January 2025. This consistency could indicate a strong foothold in the Missouri market, despite the slight dip in December. The sales figures support this stability, showing only minor fluctuations over the months. The ability to remain in the top 30 consistently suggests that Dealer's Choice has a solid customer base in Missouri, which could be leveraged for future growth.

Competitive Landscape

In the Missouri pre-roll category, Dealer's Choice has experienced fluctuations in its ranking over the past few months, reflecting a competitive landscape. Starting in October 2024, Dealer's Choice held the 30th position, improved to 27th in November, but then dropped to 34th in December before recovering slightly to 30th in January 2025. This volatility is indicative of the intense competition from brands like TRIP, which, despite a downward trend from 19th to 28th place, maintained higher sales figures throughout the period. Meanwhile, Kaviar and Sublime also demonstrated resilience, with Kaviar consistently ranking in the high 20s and Sublime showing a notable sales increase in December. The data suggests that while Dealer's Choice is holding its ground, it faces significant challenges from competitors who are either stabilizing or improving their market positions, highlighting the need for strategic adjustments to enhance its competitive edge.

Notable Products

In January 2025, the top-performing product for Dealer's Choice was Tropic Strawberry Gummies 10-Pack (200mg), maintaining its first-place ranking from previous months with notable sales of 10,046 units. Tart Berry Gummies 10-Pack (200mg) held steady in the second position, showing consistent popularity. Sativa Pre-Roll (1g) emerged as a new entrant, securing the third spot with impressive sales figures. Blue Slush Gummies 10-Pack (200mg) returned to the rankings at fourth place after being absent in December 2024. Frozen Limes Gummies 4-Pack (200mg) experienced a slight drop from fourth to fifth place, indicating a minor shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.