Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

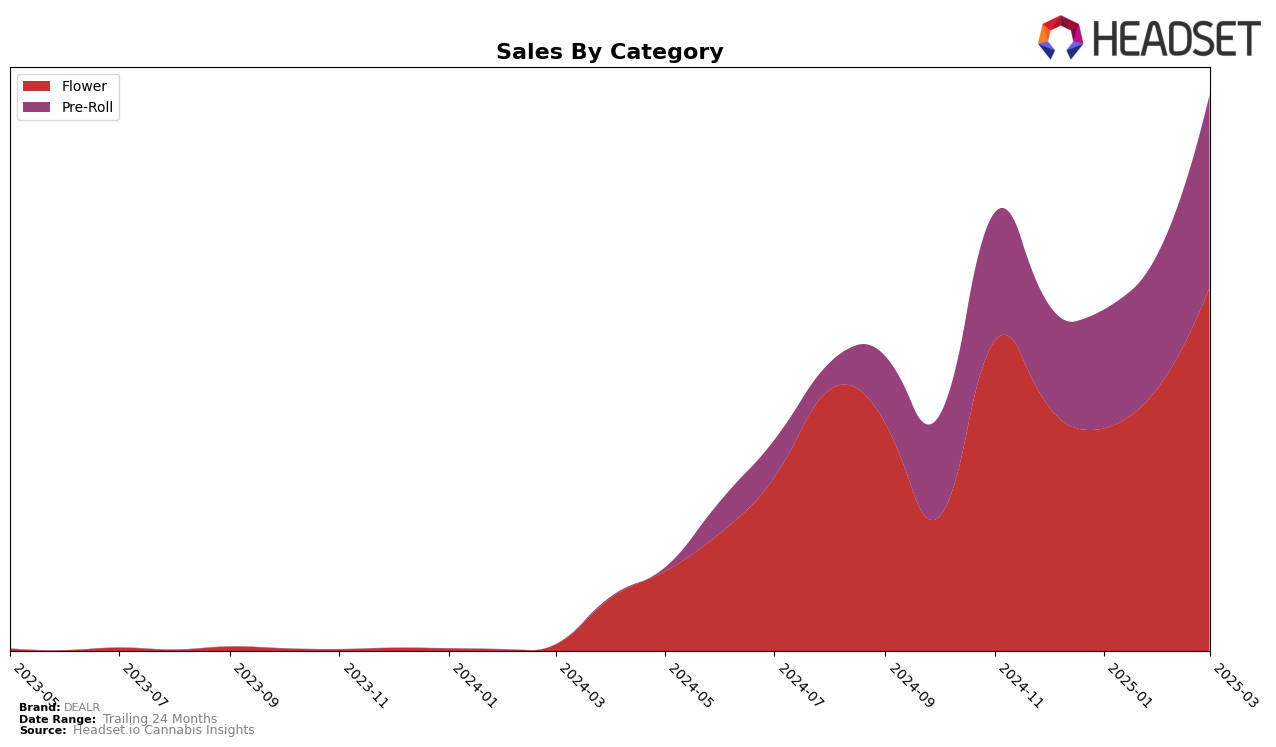

In the British Columbia market, DEALR has shown notable improvement in the Flower category, climbing from the 18th position in December 2024 to a remarkable 9th place by March 2025. This upward trajectory is underscored by a substantial increase in sales, indicating a strong consumer preference and effective market penetration. In contrast, the Pre-Roll category, while showing some progress, still lags behind as DEALR moved from 36th to 23rd place over the same period. This suggests that while DEALR is gaining traction, there is room for growth in the Pre-Roll segment to match its Flower success.

In New York, DEALR's performance in the Flower category paints a different picture. The brand has not managed to break into the top 30, with rankings slipping from 58th in December 2024 to 78th by March 2025. This decline, coupled with a decrease in sales, highlights challenges in establishing a foothold in this competitive market. DEALR's contrasting performances in these two regions underscore the importance of tailored strategies to address specific market dynamics and consumer preferences. Further analysis could reveal the underlying factors contributing to these regional disparities.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, DEALR has shown a remarkable upward trajectory in its rankings over the first quarter of 2025. Starting from a rank of 18 in December 2024, DEALR was not in the top 20 in January 2025, but it made a significant leap to rank 16 in February and further improved to rank 9 by March 2025. This upward movement is indicative of a strong sales performance, particularly in March, where DEALR's sales closely rivaled those of Back Forty / Back 40 Cannabis, which also saw fluctuations in rank from 14 to 8 over the same period. Notably, Weed Me and Pure Sunfarms experienced more modest rank changes, with Weed Me improving to rank 7 and Pure Sunfarms maintaining a steady presence within the top 10. DEALR's strategic advancements in rank and sales suggest a growing consumer preference and market penetration, positioning it as a formidable contender in the British Columbia Flower market.

Notable Products

In March 2025, Sweet Jesus Pre-Roll 5-Pack (2.5g) maintained its position as the top-performing product for DEALR, boasting impressive sales of 5932 units. Private Party (3.5g) secured the second spot, consistent with its ranking from January, despite a slight dip in sales earlier. Candy Chrome Pre-Roll 5-Pack (2.5g) emerged as a new contender, achieving the third rank with notable performance. Blue Tartz Pre-Roll 3-Pack (3g) experienced a drop to fourth place after previously holding the second rank in February. Gastopia Pre-Roll 5-Pack (2.5g) remained steady in fifth place, showing consistent sales figures throughout the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.