Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

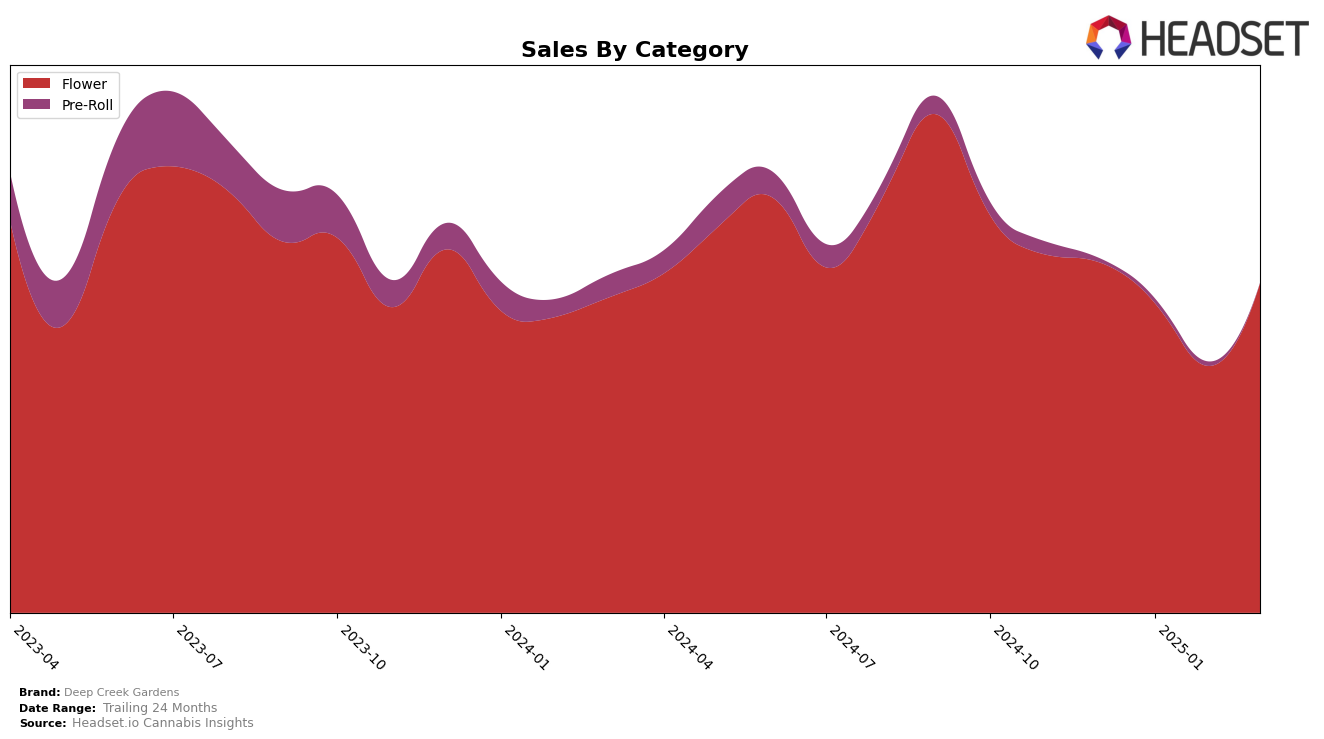

Deep Creek Gardens has shown varied performance across different product categories in Oregon. In the Flower category, the brand experienced fluctuations in its rankings, starting at 8th in December 2024, dropping to 16th by February 2025, and then improving slightly to 12th in March 2025. This movement indicates a competitive market environment, where Deep Creek Gardens has managed to maintain a presence within the top 20, despite some challenges. The sales figures reflect these changes, with a notable dip in February followed by a recovery in March. This suggests that while there might have been a temporary decline, the brand's strategies or market conditions likely improved towards the end of the period.

In contrast, the Pre-Roll category paints a different picture for Deep Creek Gardens in Oregon. The brand did not break into the top 30 rankings, remaining consistently outside this range, with ranks hovering in the 70s and 80s. This underperformance highlights potential areas for growth or reevaluation in their Pre-Roll offerings. Despite a slight increase in sales from December to January, the subsequent months saw a downward trend, culminating in a significant drop in March 2025. This suggests that while Deep Creek Gardens has a strong foothold in the Flower category, it faces challenges in gaining similar traction with Pre-Rolls, pointing to an opportunity for strategic adjustments.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Deep Creek Gardens experienced notable fluctuations in its market position from December 2024 to March 2025. Starting at rank 8 in December, Deep Creek Gardens saw a decline to rank 14 in January and further down to rank 16 in February, before recovering slightly to rank 12 in March. This period of volatility contrasts with the performance of competitors like Cannabis Nation INC, which maintained a relatively stable position, only dropping from rank 7 to 11 over the same period. Meanwhile, High Tech experienced a significant dip from rank 3 in December to rank 15 in January, but rebounded to rank 10 by March, indicating a more volatile but ultimately positive trajectory compared to Deep Creek Gardens. Additionally, PDX Organics showed a strong upward trend, moving from outside the top 20 in December to rank 13 by March, suggesting increasing competitive pressure. These dynamics highlight the competitive challenges Deep Creek Gardens faces in maintaining its market share amidst fluctuating ranks and the aggressive movements of its competitors.

Notable Products

In March 2025, the top-performing products for Deep Creek Gardens were Firebird Bulk and Runtz Bulk, both securing the first position with notable sales figures of 1194 units each. Grape Pie Bulk followed closely in second place with 799 units sold. Pineapple Fields Bulk and Super Boof Bulk ranked third and fourth, with 742 and 694 units sold respectively. Compared to previous months, Firebird Bulk and Runtz Bulk maintained their top positions, showing consistent demand. Grape Pie Bulk improved from its previous rankings, indicating a growing popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.